Essay on Share Market

Students are often asked to write an essay on Share Market in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Share Market

What is the share market.

The share market is a place where people buy and sell shares of ownership in companies. These shares are called stocks, and they give the owner a share of the company’s profits and losses. When a company does well, the value of its shares goes up. When a company does poorly, the value of its shares goes down.

Why Do People Buy and Sell Stocks?

People buy and sell stocks for a variety of reasons. Some people buy stocks because they want to make money by selling them at a higher price. Others buy stocks because they believe in the company and want to own a part of it. Still others buy stocks because they want to receive dividends, which are payments that companies make to their shareholders.

How Does the Share Market Work?

The share market is a complex system, but it can be simplified into a few basic steps. First, a company decides to sell shares of its ownership to the public. This is called an initial public offering (IPO). Once the IPO is complete, the company’s shares are traded on a stock exchange. A stock exchange is a marketplace where buyers and sellers of stocks come together to trade. The price of a stock is determined by supply and demand. When there are more buyers than sellers, the price of the stock goes up. When there are more sellers than buyers, the price of the stock goes down.

The share market is a complex and ever-changing system, but it can be a great way to make money if you understand how it works.

250 Words Essay on Share Market

What is a share market.

A share market is like a big marketplace where people can buy and sell pieces of companies called shares. When you buy a share, you’re basically becoming a part-owner of that company. Share markets are important because they allow companies to raise money by selling their shares, and they provide a way for people to invest their money and potentially earn profits.

How Do Share Markets Work?

Share markets are run by exchanges, which are organizations that set the rules and procedures for buying and selling shares. The prices of shares are determined by supply and demand. When more people want to buy a share than there are people selling it, the price goes up. When more people want to sell than buy, the price goes down.

Benefits of Share Markets

Share markets can be a great way to grow your money over time. When a company does well, the value of its shares can increase, and you can make a profit by selling your shares for more than you paid for them. However, it’s important to remember that share markets can also be risky. The value of shares can go down as well as up, and you could lose money if you sell your shares for less than you paid for them.

Risks of Share Markets

There are a few risks associated with investing in share markets. One risk is that the value of your shares could go down. This is called a “loss.” Another risk is that you might not be able to sell your shares when you want to, or you might have to sell them for less than you paid for them. This is called a “liquidity risk.”

500 Words Essay on Share Market

A share market, also known as a stock market, is a place where people buy and sell shares of companies. Shares are small pieces of ownership in a company. When you buy a share of a company, you become one of its owners.

How Does a Share Market Work?

Share markets are run by exchanges, which are organizations that set the rules for trading shares. Exchanges also provide a platform where buyers and sellers can meet to trade shares.

When you want to buy or sell shares of a company, you need to place an order with a broker. Brokers are people or companies that help you buy and sell shares. Once you place an order, the broker will find someone who wants to sell or buy the shares at the price you want.

Why Do People Buy and Sell Shares?

There are many reasons why people buy and sell shares. Some people buy shares because they believe the company’s value will increase, and they will be able to sell the shares for a profit later on. Others buy shares to earn dividends, which are payments that companies make to their shareholders.

Some people sell shares because they need the money. Others sell shares because they believe the company’s value will decrease, and they want to avoid losing money.

Risks of Investing in the Share Market

Investing in the share market carries some risks. The value of shares can go up or down, and you could lose money if you sell your shares for less than you paid for them. Some companies may even go bankrupt, and you could lose all of your investment.

How to Invest in the Share Market

If you are interested in investing in the share market, you should do your research first. Learn about the different types of shares available, and read the financial statements of the companies you are interested in. You should also talk to a financial advisor to get help making investment decisions.

The share market can be a great way to invest your money and potentially make a profit. However, it is important to understand the risks involved before you invest. By doing your research and seeking professional advice, you can help reduce your risk and increase your chances of success.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Why Should I Be Prom Queen

- Essay on Outdoor Activities

- Essay on Why Students Cheat

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is the Stock Market?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Stock market definition

The stock market is where investors buy and sell shares of companies. It’s a set of exchanges where companies issue shares and other securities for trading. It also includes over-the-counter (OTC) marketplaces where investors trade securities directly with each other (rather than through an exchange).

The stock market explained

In practice, the term "stock market" often refers to one of the major stock market indexes, such as the Dow Jones Industrial Average or the S&P 500 . These represent large sections of the stock market. Because it's hard to track every single company, the performance of the indexes is viewed as representative of the entire market.

You might see a news headline that says the stock market has moved lower or that the stock market has closed up or down for the day. This often means stock market indexes have moved up or down, and stocks within the index have gained or lost value. Investors who buy and sell stocks hope to profit through this movement in stock prices.

» Need to back up a bit? Read our explainer on stocks

How the market works

When you purchase a public company's stock, you're buying a small piece of that company.

The stock market works through a network of exchanges — you may have heard of the New York Stock Exchange or the Nasdaq. Companies list shares of their stock on an exchange through a process called an initial public offering, or IPO . Investors purchase those shares, which allows the company to raise money to grow its business. Investors can then buy and sell these stocks among themselves.

Buyers offer a “bid,” or the highest amount they’re willing to pay, usually lower than the amount sellers “ask” for in exchange. This difference is called the bid-ask spread. For a trade to occur, a buyer needs to increase his price, or a seller needs to decrease hers.

Computer algorithms generally do most price-setting calculations. You’ll see the bid, ask, and bid-ask spread on your broker's website when buying stock. In many cases, the difference will be pennies and not much concern for beginner and long-term investors.

The U.S. Securities and Exchange Commission regulates the stock market, and the SEC’s mission is to “protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation."

Historically, stock trades likely took place in a physical marketplace. These days, the stock market works electronically through online stockbrokers. Each trade happens on a stock-by-stock basis, but overall stock prices often move in tandem because of news, political events, economic reports and other factors.

» Learn more: How to invest in stocks

What is the point of the stock market?

The point of the stock market is to provide a place where anyone can buy and sell fractional ownership in a publicly traded company. It distributes control of some of the world’s largest companies among hundreds of millions of individual investors. And the buying and selling decisions of those investors determine the value of those companies.

The market lets buyers and sellers negotiate prices. This negotiation process maximizes fairness for both parties by providing both the highest possible selling price and the lowest possible buying price at a given time. Each exchange tracks the supply and demand of stocks listed there.

Supply and demand help determine the price for each security, or the levels at which stock market participants — investors and traders — are willing to buy or sell. This process is called price discovery, and it’s fundamental to how the market works. Price discovery plays an important role in determining how new information affects the value of a company.

For example, imagine a publicly traded company with a market capitalization (market value) of $1 billion and trades at a share price of $20.

Suppose a larger company announces a deal to acquire the smaller company for $2 billion, pending regulatory approval. If the deal goes through, it would represent a doubling of the company’s value. However, investors might want to prepare for regulators blocking the deal.

If the deal seems like a sure thing, sellers might raise their asks to $40, and buyers might increase their bids to meet those asks. But if there’s a chance the deal won’t be approved, buyers might only be willing to offer bids of $30. If they’re very pessimistic about the deal’s chances, they might keep their bids at $20.

In this way, the market can determine how a complicated piece of new information — a takeover deal that might not go through — should affect the company’s market value.

» See NerdWallet's list of the best online stock brokers for beginners

What is the stock market doing today?

Investors often track the stock market's performance by looking at a broad market index like the S&P 500 or the DJIA. The chart below shows the current performance of the stock market — as measured by the S&P 500's closing price on the most recent trading day — and the S&P 500's historical performance since 1990.

Stock market data may be delayed up to 20 minutes, and is intended solely for informational purposes, not for trading purposes.

What is stock market volatility?

Investing in the stock market does come with risks, but with the right investment strategies, it can be done safely with minimal risk of long-term losses. Day trading, which requires rapidly buying and selling stocks based on price swings, is extremely risky. Conversely, investing in the stock market for the long term has proven to be an excellent way to build wealth over time.

For example, the S&P 500 has a historical average annualized total return of about 10% before adjusting for inflation. However, the market will rarely provide that return on a year-to-year basis. In some years, the stock market could end down significantly, while in others, it could go up tremendously. These large swings are due to market volatility or periods when stock prices rise and fall unexpectedly.

If you’re actively buying and selling stocks, there’s a good chance you’ll get it wrong at some point, buying or selling at the wrong time, resulting in a loss. The key to investing safely is to stay invested — through the ups and the downs — in low-cost index funds that track the whole market so that your returns might mirror the historical average.

How do you invest in the stock market?

You’ll usually buy stocks online between 9:30 AM and 4 PM ET through the stock market, which anyone can access with a brokerage account , robo-advisor or employee retirement plan. Investing outside of these hours is called premarket trading or after-hours trading and carries additional risks.

You don’t have to officially become an “investor” to invest in the stock market — for the most part, it’s open to anyone.

If you have a 401(k) through your workplace, you may already be invested in the stock market. Mutual funds, often composed of stocks from many different companies, are common in 401(k)s.

You can purchase individual stocks through a brokerage account or an individual retirement account like an IRA . Once you open and fund an account with an online broker, you can begin to buy and sell investments. The broker acts as the middleman between you and the stock exchanges.

Online brokerages have made the signup process simple, and once you fund the account, you can take your time selecting the right investments for you.

With any investment, there are risks. But stocks carry more risk — and more potential for reward — than some other securities. While the market's history of gains suggests that a diversified stock portfolio will increase in value over time, stocks also experience sudden dips.

To build a diversified portfolio without purchasing many individual stocks, you can invest in a type of mutual fund called an index fund or an exchange-traded fund. These funds aim to passively mirror the performance of an index by holding all of the stocks or investments in that index. For example, you can invest in the DJIA, the S&P 500 and other market indexes through index funds and ETFs.

Stocks and stock mutual funds are ideal for a long time horizon — like retirement — but unsuitable for a short-term investment (generally defined as money you need for an expense within five years). With a short-term investment and a hard deadline, there's a greater chance you'll need that money back before the market has had time to recover losses.

No brokerage account? Learn how to open one

See our top-rated online stock brokers

View the best brokers for investing in IPOs

On a similar note...

Find a better broker

View NerdWallet's picks for the best brokers.

on Robinhood's website

- Search Search Please fill out this field.

What Is a Stock?

Types of stock, what is a stock exchange, stock market indexes, why companies issue shares, how share prices are set.

- Benefits of an Exchange Listing

- Problems of an Exchange Listing

Investing in Stocks

- Stock Market FAQs

The Bottom Line

- Stock Markets

How Does the Stock Market Work?

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

The stock market provides a venue where companies raise capital by selling shares of stock, or equity, to investors. Stocks give shareholders voting rights as well as a residual claim on corporate earnings in the form of capital gains and dividends.

Individual and institutional investors come together on stock exchanges to buy and sell shares in a public market. When you buy a share of stock on the stock market, you are not buying it from the company, you are buying it from an existing shareholder.

What happens when you sell a stock? You do not sell your shares back to the company, but instead, sell them to another investor on the exchange.

Key Takeaways

- Stocks represent ownership equity in the firm and give shareholders voting rights as well as a residual claim on corporate earnings in the form of capital gains and dividends.

- Individual and institutional investors come together on stock exchanges to buy and sell shares in a public venue.

- Share prices are set by supply and demand as buyers and sellers place orders.

A stock is a financial instrument that represents ownership in a company or corporation and a proportionate claim on its assets and earnings . Stocks are also called shares or equity.

Owning stock means that a shareholder owns a slice of the company equal to the number of shares held as a proportion of the company's total outstanding shares .

An individual or entity that owns 100,000 shares of a company with one million outstanding shares would have a 10% ownership stake in it.

Stocks are also called shares or a company's equity.

There are two main types of stock: common shares and preferred shares. Equities are synonymous with common shares because their market value and trading volumes are many times larger than those of preferred shares.

Common shares usually carry voting rights that enable the common shareholder to have a voice in corporate meetings and elections, while preferred shares generally do not have voting rights. Preferred shareholders have priority over common shareholders to receive dividends as well as assets in the event of a liquidation .

Common stock can be further classified in terms of voting rights. Some companies have dual or multiple classes of stock with different voting rights attached to each class. In such a dual-class structure , Class A shares may have 10 votes per share, while Class B shares may only have one vote per share. Dual- or multiple-class share structures are designed to enable the founders of a company to control its fortunes, strategic direction, and ability to innovate.

Stock exchanges are secondary markets where existing shareholders can transact with potential buyers. Corporations listed on stock markets do not commonly buy and sell their shares but may engage in stock buybacks or issue new shares but these transactions occur outside of the framework of the exchange.

Largest Stock Exchanges

The first stock markets appeared in Europe in the 16th and 17th centuries, mainly in port cities or trading hubs such as Antwerp, Amsterdam, and London. In the late 18th century, stock markets began appearing in America, notably the New York Stock Exchange (NYSE), which allowed for equity shares to trade.

The first stock exchange in America was the Philadelphia Stock Exchange (PHLX), which still exists today. The NYSE was founded in 1792 with the signing of the Buttonwood Agreement by 24 New York City stockbrokers and merchants. Before this official incorporation, traders and brokers would meet unofficially under a buttonwood tree on Wall Street to buy and sell shares.

The advent of modern stock markets ushered in an age of regulation and professionalization that now ensures buyers and sellers of shares can trust that their transactions will go through at fair prices and within a reasonable period. Today, there are many stock exchanges in the U.S. and throughout the world, many of which are linked together electronically.

The NYSE and Nasdaq are the two largest exchanges in the world, based on the total market capitalization of all the companies listed on the exchange. The number of U.S. stock exchanges registered with the Securities and Exchange Commission has reached nearly two dozen, though most of these are owned by either Cboe Global Markets , Nasdaq, or NYSE-owner Intercontinental Exchange.

Source: Trading Hours.

Over-the-Counter Exchanges

There also exist several loosely regulated over-the-counter (OTC) exchanges, which may also be referred to as bulletin boards (OTCBB). These shares tend to be riskier since they list companies that fail to meet the more strict listing criteria of bigger exchanges. Larger exchanges may require that a company has been in operation for a certain amount of time before being listed and that it meets certain conditions regarding company value and profitability.

In most developed countries, stock exchanges are self-regulatory organizations (SROs), non-governmental organizations that have the power to create and enforce industry regulations and standards.

The priority for stock exchanges is to protect investors through the establishment of rules that promote ethics and equality. Examples of such SROs in the U.S. include individual stock exchanges, as well as the National Association of Securities Dealers (NASD) and the Financial Industry Regulatory Authority (FINRA).

Indices represent aggregated prices of several different stocks, and the movement of an index is the net effect of the movements of each component. Major stock market indexes include the Dow Jones Industrial Average (DJIA) and the S&P 500 .

The DJIA is a price-weighted index of 30 large American corporations. Because of its weighting scheme and the fact that it only consists of 30 stocks (when there are many thousands to choose from), it is not a good indicator of how the stock market is doing. The S&P 500 is a market-cap-weighted index of the 500 largest companies in the U.S. and is a much more valid indicator.

Indices can be broad such as the Dow Jones or S&P 500, or they can be specific to a certain industry or market sector. Investors can trade indices indirectly via futures markets, or via exchange-traded funds (ETFs), which act just like stocks on stock exchanges.

A market index is a popular measure of stock market performance. Most market indices are market-cap weighted , which means that the weight of each index constituent is proportional to its market capitalization. Keep in mind, though, that a few of them are price-weighted , such as the DJIA. In addition to the DJIA, other widely watched indices in the U.S. and internationally include the:

S&P 500

Nasdaq Composite

Russell Indices ( Russell 1000 , Russell 2000 )

TSX Composite (Canada)

FTSE Index (UK)

Nikkei 225 (Japan)

Dax Index (Germany)

CAC 40 Index (France)

CSI 300 Index (China)

Sensex (India)

To make the transition from an idea germinating in an entrepreneur's brain to an operating company, they need to lease an office or factory, hire employees, buy equipment and raw materials, and put in place a sales and distribution network , among other things. These resources require significant amounts of capital, depending on the scale and scope of the business.

Raising Capital

Many corporate giants started as small private entities launched by visionary founders like Jack Ma of Alibaba ( BABA ) or Mark Zuckerberg of Meta.

A startup can raise capital either by selling shares through equity financing or borrowing money through debt financing . Debt financing can be a problem for a startup because it may have few assets to pledge for a loan.

Equity financing is the preferred route for most startups that need capital. The entrepreneur may initially source funds from personal savings, as well as friends and family, to get the business off the ground. As the business expands and its capital requirements become more substantial, the entrepreneur may turn to angel investors and venture capital firms.

Listing Shares

Companies can access larger amounts of capital than they can get from ongoing operations or a traditional bank loan by selling shares to the public through an initial public offering (IPO).

This changes the status of the company from a private firm whose shares are held by a few shareholders to a publicly-traded company whose shares will be held by numerous members of the general public. The IPO also offers early investors in the company an opportunity to cash out part of their stake, often reaping very handsome rewards in the process.

Once the company's shares are listed on a stock exchange and trading on the market, the price of these shares fluctuates as investors and traders assess and reassess their intrinsic value. There are many different ratios and metrics that can be used to value stocks, of which the single-most popular measure is probably the price-to-earnings (PE) ratio. Stock analysis tends to fall into one of two camps— fundamental analysis , or technical analysis .

The prices of shares on a stock market can be set in several ways. The most common way is through an auction process where buyers and sellers place bids and offer to buy or sell. A bid is a price at which somebody wishes to buy, and an offer, or ask , is the price at which somebody wishes to sell. When the bid and ask coincide, a trade is made.

Stock Market Supply and Demand

The stock market also offers a fascinating example of the laws of supply and demand at work in real time. For every stock transaction, there must be a buyer and a seller. Because of the immutable laws of supply and demand, if there are more buyers for a specific stock than there are sellers of it, the stock price will trend up. Conversely, if there are more sellers of the stock than buyers, the price will trend down.

The bid-ask or bid-offer spread, the difference between the bid price for a stock and its ask or offer price, represents the difference between the highest price that a buyer is willing to pay or bid for a stock and the lowest price at which a seller is offering the stock.

A trade transaction occurs either when a buyer accepts the asking price or a seller takes the bid price. If buyers outnumber sellers, they may be willing to raise their bids to acquire the stock. Sellers will, therefore, ask higher prices for it, ratcheting the price up. If sellers outnumber buyers, they may be willing to accept lower offers for the stock, while buyers will also lower their bids, effectively forcing the price down.

Matching Buyers to Sellers

Some stock markets rely on professional traders to maintain continuous bids and offers since a motivated buyer or seller may not find each other at any given moment. These are known as specialists or market makers .

A two-sided market consists of the bid and the offer, and the spread is the difference in price between the bid and the offer. The more narrow the price spread and the larger size of the bids and offers, the greater the liquidity of the stock. If there are many buyers and sellers at sequentially higher and lower prices, the market is said to have good depth .

The original manual method of trading was based on a system known as the open outcry system, where traders used verbal and hand signal communications to buy and sell large blocks of stocks in the trading pit or the exchange floor.

However, the open outcry system has been superseded by electronic trading systems at most exchanges. These systems can match buyers and sellers far more efficiently and rapidly, resulting in significant benefits such as lower trading costs and faster trade execution .

High-quality stock markets tend to have small bid-ask spreads, high liquidity, and good depth, which means that individual stocks of high quality, large companies tend to have the same characteristics.

Advantages of Stock Exchange Listing

- An exchange listing means ready liquidity for shares held by the company's shareholders.

- It enables the company to raise additional funds by issuing more shares.

- Having publicly tradable shares makes it easier to set up stock options plans that can attract talented employees.

- Listed companies have greater visibility in the marketplace; analyst coverage and demand from institutional investors can drive up the share price.

- Listed shares can be used as currency by the company to make acquisitions in which part or all of the consideration is paid in stock.

Disadvantages of Stock Exchange Listing

- Significant costs associated with listing on an exchange, such as listing fees and higher costs associated with compliance and reporting.

- Burdensome regulations may constrict a company's ability to do business.

- The short-term focus of most investors forces companies to try and beat their quarterly earnings estimates than take a long-term approach to their corporate strategy.

Many giant startups choose to get listed on an exchange at a much later stage than startups from a decade or two ago.

While this delayed listing may partly be attributable to the drawbacks listed above, the main reason could be that well-managed startups with a compelling business proposition have access to unprecedented amounts of capital from sovereign wealth funds , private equity, and venture capitalists. Such access to seemingly unlimited amounts of capital would make an IPO and exchange listing much less of a pressing issue for a startup.

Numerous studies have shown that, over long periods, stocks generate investment returns that are superior to those from every other asset class. Stock returns arise from capital gains and dividends.

A capital gain occurs when you sell a stock at a higher price than the price at which you purchased it. A dividend is the share of profit that a company distributes to its shareholders. Dividends are an important component of stock returns. They have contributed nearly one-third of total equity return since 1956, while capital gains have contributed two-thirds.

While the allure of buying a stock similar to one of the fabled FAANG quintet—Meta, Apple ( AAPL ), Amazon ( AMZN ), Netflix ( NFLX ), and Google parent Alphabet ( GOOGL )—at a very early stage is one of the more tantalizing prospects of stock investing, in reality, such home runs are few and far between.

Investment often depends on an individual's tolerance for risk . Risky investors may generate most of their returns from capital gains rather than dividends. On the other hand, investors who are conservative and require income from their portfolios may opt for stocks that have a long history of paying substantial dividends.

Market Cap and Sector

While stocks can be classified in several ways, two of the most common are by market capitalization and by sector . Market cap refers to the total market value of a company's outstanding shares and is calculated by multiplying these shares by the current market price of one share.

Large-cap companies are generally regarded as those with a market capitalization of $10 billion or more, while mid-cap companies are those with a market capitalization of between $2 billion and $10 billion, and small-cap companies fall between $250 million and $2 billion.

The industry standard for stock classification by sector is the Global Industry Classification Standard (GICS), which was developed by MSCI and S&P Dow Jones Indices in 1999 as an efficient tool to capture the breadth, depth, and evolution of industry sectors. GICS is a four-tiered industry classification system that consists of 11 sectors and 24 industry groups. The 11 sectors are:

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Information Technology

- Communication Services

- Real Estate

This sector classification makes it easy for investors to tailor their portfolios according to their risk tolerance and investment preference. Conservative investors with income needs may weigh their portfolios toward sectors whose constituent stocks have better price stability and offer attractive dividends through so-called defensive sectors such as consumer staples, health care, and utilities. Aggressive investors may prefer more volatile sectors such as information technology, financials, and energy.

How Does Inflation Affect the Stock Market?

Inflation refers to an increase in consumer prices, either due to an oversupply of money or a shortage of consumer goods. The effects of inflation on the stock market are unpredictable: in some cases, it can lead to higher share prices, due to more money entering the market and increased job growth. However, higher input prices can also restrict corporate earnings, causing profits to fall. Overall, value stocks tend to perform better than growth stocks in times of high inflation.

How Much Does the Stock Market Grow Every Year?

The S&P 500 has grown about 10.5% per year since it was established in the 1920s. Using this as a barometer for market growth, one can estimate that the stock market grows in value by about the same amount each year. However, there is an element of probability: in some years the stock market sees greater growth, and in some years it grows less. In addition, some stocks grow faster than others.

How Do People Lose Money in the Stock Market?

Most people who lose money in the stock market do so through reckless investments in high-risk securities. Although these can score high returns if they are successful, they are just as likely to lose money. There is also an element of psychology: an investor who sells during a crash will lock in their losses, while those who hold their stock have a chance of seeing their patience rewarded. Finally, margin trading can make the stock market even riskier, by magnifying one's potential gains or losses.

Stock markets represent the heartbeat of the market , and experts often use stock prices as a barometer of economic health. But the importance of stock markets goes beyond mere speculation. By allowing companies to sell their shares to thousands or millions of retail investors, stock markets also represent an important source of capital for public companies.

U.S. Securities and Exchange Commission. " What Kinds of Stocks Are There? "

U.S. Securities and Exchange Commission. " Description of Capital Stock ."

The Historical Society of Pennsylvania. " Philadelphia Stock Exchange Papers ," Page 1.

U.S. Securities and Exchange Commission. " National Securities Exchanges ."

Trading Hours. " List of Stock Markets ."

U.S. Securities and Exchange Commission. " Over-the-Counter Market ."

S&P Global Indices. " Dow Jones Industrial Average ."

S&P Dow Jones Indices. " S&P 500 ."

Alibaba Group. " History and Milestones ."

Facebook. " Harvard University ."

S&P Dow Jones Indices. " The Importance of Dividends ," Page 1.

Financial Industry Regulatory Authority. " Market Cap, Explained ."

Morgan Stanley Capital International. " The Global Industry Classification Standard (GICS) ."

:max_bytes(150000):strip_icc():format(webp)/etfs-lrg-3-5bfc2b2346e0fb00265bd786.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Stock Market Prices Essay

Supply and demand, share prices and their effects on businesses, textbook questions, list of references.

The prices of stocks which are purchased and sold in the secondary market are mostly influenced by demand and supply. Typically, the price of stocks depends on the number of shares that are offered in relation to the demand of the stocks.

The price of the shares are often high when there are few shares in the market and if the demand of these shares is high. On the other hand, the prices of shares are low if the shares offered in the market are many. Similarly, the price of the shares becomes significantly low when demand of the shares in the market goes down. Thus, the price of shares is determined by the demand and supply of shares in the market.

The demand of shares in the stock market is determined by various factors. Sloman (2008) posits that, income, wealth, expectations, divided yield, price and returns of substitutes are the factors that influence the demand of the stocks. Sloman (2008) considers the dividend yield as the money received back by investors and is expressed as a given percentage of its price.

Many investors are attracted to purchase those stocks whose dividends are high. Equally, the prices and returns of substitutes relate to dividends as well as the market price for other corresponding stocks. Since the demand of such stocks is often high, their supply often goes down.

Subsequently, this makes the price of the stocks to increase. According to Sloman (2008), the most prevalent substitutes for investing in shares include investing in properties such as real estates. Investors are always looking for the ways to make extra money. Therefore, many investors opt to invest in properties or any other forms of investments if they consider them to be more profitable than investing in shares.

According to Boyce (2011), between 1960 and 2009 the profits for equities was higher than the profits gained from investment in property for the most part of the 20-year investment period. It was also observed that even over shorter time spans, equities have been the top-most performing asset, in 64% of five year periods, between 1960 and 2006.

Wealth represents the accrued savings and assets. Wealth that is in form of assets is easily converted into cash and invested in shares. It is important to note that houses do not have a high rate of return as compared to investments in shares. Therefore, high-rise owners often opt to sell their houses and invest that money in shares. When this occurs, it increases the demands of shares.

People’s expectations is another factor that determines the demand and prices of shares. Investors tend to buy more of those shares that they are optimistic about their future value. However, this kind of buying poses a great risk. This is because these prospects are not always true.

Sometimes, other factors which may be beyond the investors’ expectations could crop up and affect the current outstanding performances of such companies. Such issues may lessen the value of the shares (Bacchetta, Tille & Wincoop , 2010)

The prices of shares in companies are imperative. This is because the prices of these shares are often used to depict the performance of a given company in the market. When the price of a company’s share increases, it primarily indicates that that company is performing well. Conversely, when the price of the share in a company decreases, it indicates poor performances.

If the rate of economic growth is 3% in a particular year, why are share prices likely to rise by more than 3% that year?

Strong economies have been noted to be characterized by an increase in the household income which is reflected in increased spending and investments. An economic growth of about 3% in a particular year is likely to translate to increased share prices by more than 3%. This is because a growth in the economy signifies increased per capita income.

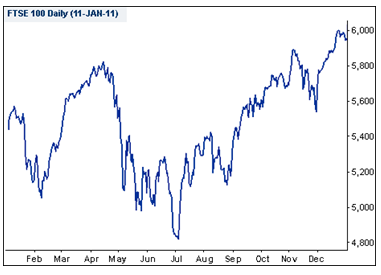

What happened to the FTSE 100 in 2010, why?

The figure above illustrates how the FTSE 100 index initially performed poorly after suffering major setbacks due to the economic recession witnessed in the year 2008-2009. According to Scott (2010), investors were reluctant to invest in shares since they could not project what would follow the financial crisis.

The financial crises of the year 2008-09 lead to the failing of many banks which impacted negatively on the value of the FTSE 100 stock market. Fletcher (2010) noted that, even by mid 2010, the performance of the FTSE 100 stock had not appreciated considerably since most investors were still under uncertainty of investing in shares. This is clearly noted by the great decrease in share prices that occurred in July.

Similarly, the value of the shares depreciated significantly in September and November. These drops were linked to large amounts of money that were given to other European countries as bail-outs (Kollewe & McDonald, 2010).

At the end of the year 2010, the value of the shares had appreciated greatly since more investors had became more optimistic about the future of shares as indicated by the raising of the overall value of the index (Scott, 2010).

Find another application of the same idea and explain why the concept is useful in the context you have chosen

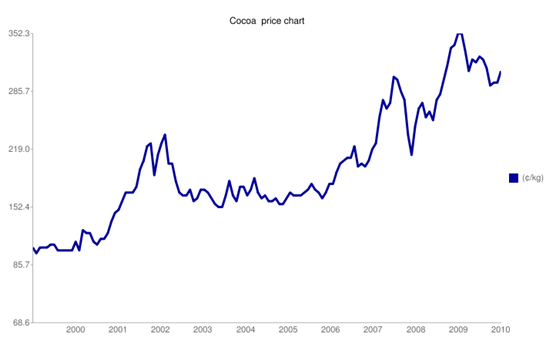

Supply and demand also determines the prices of commodities globally. For example, currently the prices of Cocoa have greatly increased due to the shortage of Cocoa which is associated with the recent civil unrest in Ivory Coast (AFN, 2011).

‘Côte d’Ivoire is among the leading producers of Cocoa in the world. Being a major supplier of the commodity, the country plays a central role in influencing the world cocoa prices. Similar concerns about the disruption of cocoa production and export during the civil war also caused New York prices to soar to a high of $2,335/tonne in October 2002.

It is observed that when cocoa is in short supply and also in high demand, its prices are often artificially inflated in a similar way to the share prices. This principle is very similar to what happens on stock markets, although the causes are usually much different.

The supply and demand of shares are known to be the natural determiners of the prices of shares. Nevertheless, there is a danger in that; the process is often manipulated where the prices of shares ends up being artificially inflated. This inflation is dangerous because it leads to considerable loss of investors’ money when the bubble occurs.

AAP., 2010. Wattyl accepts takeover bid from Valspar. Web.

AFN., 2011. Cote D’Ivoire and cocoa: The facts . Web.

Baccheta, P., Tille, C., & Wincoop, E., 2010. Risk panics: When markets crash for no apparent reason . Web.

Boyce, L., 2011. Investors’ love for property starts to dim . Web.

Fletcher, N., 2010. FTSE 100 dips ahead of bank stress test results . Web.

Kollewe, A., & McDonald., P. 2010. Anglo Irish Bank bailout could total €34bn . Web.

Scott, P., 2010. Where will the FTSE 100 end 2010? Web.

Sloman, J., 2008. Economics and the Business Environment , 2 nd edition. New York: McGraw Hill.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, January 10). Stock Market Prices. https://ivypanda.com/essays/stock-market-prices-essay/

"Stock Market Prices." IvyPanda , 10 Jan. 2024, ivypanda.com/essays/stock-market-prices-essay/.

IvyPanda . (2024) 'Stock Market Prices'. 10 January.

IvyPanda . 2024. "Stock Market Prices." January 10, 2024. https://ivypanda.com/essays/stock-market-prices-essay/.

1. IvyPanda . "Stock Market Prices." January 10, 2024. https://ivypanda.com/essays/stock-market-prices-essay/.

Bibliography

IvyPanda . "Stock Market Prices." January 10, 2024. https://ivypanda.com/essays/stock-market-prices-essay/.

- World Cocoa Market: Past and Present

- Analysis of BlackRock World Mining Trust

- Health Benefits of Cocoa

- Cocoa Production and Its Environmental Performance

- The UK Collective Investments and Fund Performance

- The Stock Companies' Return-Risk Analysis

- Hedgers and Speculators Role in Derivates Markets

- Cocoa Production: Analysis and Traceability

- External Influences Affecting the Tesco Company and Its Activities

- Starting Cocoa Production in Ghana

- Understanding of the Economics and Politics of Latin America

- Colombia's Demo and Eco Transitions

- Eurozone Economic Crisis and Global Business

- Review of revenue estimates in Federal, State and Local Budgets

- Economic Analysis of Lord Brownie’s Proposed Review

Essay: WHAT MAKES THE STOCK MARKET GO UP--AND DOWN

- StumbleUpon

- Del.i.cious

FROM its inception, the stock market was meant to be a place where businessmen could raise capital by selling shares in their enterprises, and where investors could turn a profit when those enterprises prospered. The market still serves both purposes, but today it is judged less by what it does for businessmen seeking capital than by what it accomplishes for investors seeking gain.

Want the full story?

Learn more about the benefits of being a TIME subscriber

If you are already a subscriber sign up — registration is free!

Sign In adFactory.getCmAd(142, 70, "upgradetop", "text").write();

If you check the "Remember me" box, you will be automatically signed in for 30 days to TIME.com when you visit in the future.

If you are accessing TIME.com on a public computer, you are advised not to click on the "Remember me" option.

For more information, please visit TIME's Privacy Policy

ESSAY SAUCE

FOR STUDENTS : ALL THE INGREDIENTS OF A GOOD ESSAY

Essay: Stock markets

Essay details and download:.

- Subject area(s): Finance essays

- Reading time: 2 minutes

- Price: Free download

- Published: 18 September 2015*

- File format: Text

- Words: 572 (approx)

- Number of pages: 3 (approx)

Text preview of this essay:

This page of the essay has 572 words. Download the full version above.

Stock markets play a vital part towards the economy of a country. The stock market most important role is supporting the growth of the industry and commerce in the country eventually affects the economy of the country to a great extent. That is the reason that a rising stock market is the sign of a developing industrial sector and a growing economy of the country. Thus, the government, industry and even the central banks of the country must keep a close watch on the happenings of the stock market. The stock market is important from both the industry’s point of view as well as the investor’s point of view. History has shown that the price of shares and other assets is an important part of the dynamics of economic activity, and can influence or be an indicator of social mood. Rising share prices, for instance, tend to be associated with increased business investment and vice versa. Share prices also affect the wealth of households and their consumption. Therefore, central banks tend to keep an eye on the control and behavior of the stock market and, in general, on the smooth operation of financial system functions. Financial stability is the raison d’??tre of central banks. History has shown that the price of shares and other assets is an important part of the dynamics of economic activity, and can influence or be an indicator of social mood. In the stock market, investor objective is to maximize the portfolio’s expected return and minimize the risk. Return is an amount of revenue an investment generates over a given period of time as percentage of the amount of capital invested. The stock market plays a play a pivotal role in the growth of the industry and commerce of the country that eventually affects the economy of the country to a great extent. That is reason that the government, industry and even the central banks of the country keep a close watch on the happenings of the stock market. The stock market is important from both the industry’s point of view as well as the investor’s point of view. In prospects of overall economy, stock market makes it possible for the economy to ensure long-term commitments in real capital. For that reason, level of efficiency measurement of the stock market is very important to the markets players, who ensure long-term real capital in an economy. Since stock market returns are subject to fluctuations, it is essential to determine the forces influencing the stock returns for efficient functioning and development of the stock market and Country. Over the past few decades, numerous studies have been done to find out the relationships between conventional stock returns and macroeconomic variables especially for developed markets. However, regional Islamic stock markets such as Malaysia and Indonesia have not been fully explored because of their small sizes and geographic locations. Therefore, this study attempts to fill this gap by exploring the effect of macroeconomic variables toward the Islamic stock returns in Malaysia and Indonesia. Therefore, the researcher have chosen five macroeconomic variables including gross domestic products, money supply, exchange rate, interest rate and industrial production index to examine the variables with the stock prices. Indeed, there are other variables that affect stock prices but the researcher limit the discussion on these variables because of efficiency in modelling as incorporating many variables result in loss of degree of freedom.

...(download the rest of the essay above)

About this essay:

If you use part of this page in your own work, you need to provide a citation, as follows:

Essay Sauce, Stock markets . Available from:<https://www.essaysauce.com/finance-essays/essay-stock-markets/> [Accessed 06-04-24].

These Finance essays have been submitted to us by students in order to help you with your studies.

* This essay may have been previously published on Essay.uk.com at an earlier date.

Essay Categories:

- Accounting essays

- Architecture essays

- Business essays

- Computer science essays

- Criminology essays

- Economics essays

- Education essays

- Engineering essays

- English language essays

- Environmental studies essays

- Essay examples

- Finance essays

- Geography essays

- Health essays

- History essays

- Hospitality and tourism essays

- Human rights essays

- Information technology essays

- International relations

- Leadership essays

- Linguistics essays

- Literature essays

- Management essays

- Marketing essays

- Mathematics essays

- Media essays

- Medicine essays

- Military essays

- Miscellaneous essays

- Music Essays

- Nursing essays

- Philosophy essays

- Photography and arts essays

- Politics essays

- Project management essays

- Psychology essays

- Religious studies and theology essays

- Sample essays

- Science essays

- Social work essays

- Sociology essays

- Sports essays

- Types of essay

- Zoology essays

The Economic Times daily newspaper is available online now.

What is share market.

The stock market is a share market, however besides shares of companies, other instruments are traded too. The share market is a source for companies to raise funds and for investors to buy part-ownership in growing businesses and grow their wealth. On becoming a shareholder, an investor earns a part of the profits earned by the company by way of dividend. At the same time, the investor also undertakes the risk to bear loses, should the business fail to perform well. Market participants need to get registered with the stock exchange and market regulator Sebi to be able to trade in the stock market.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today .

Top Trending Stocks: SBI Share Price , Axis Bank Share Price , HDFC Bank Share Price , Infosys Share Price , Wipro Share Price , NTPC Share Price

- View More Stories

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essays Examples >

- Essay Topics

Essays on Share Market

2 samples on this topic

On this page, we've put together a database of free paper samples regarding Share Market. The intention is to provide you with a sample close to your Share Market essay topic so that you could have a closer look at it in order to get a clear idea of what a top-notch academic work should look like. You are also suggested to employ the best Share Market writing practices showcased by competent authors and, eventually, craft a top-notch paper of your own.

However, if crafting Share Market papers entirely by yourself is not an option at this point, WowEssays.com essay writer service might still be able to help you out. For instance, our writers can craft a unique Share Market essay sample solely for you. This model paper on Share Market will be written from scratch and tailored to your individual requirements, reasonably priced, and delivered to you within the pre-set deadline. Choose your writer and buy custom essay now!

Accounting & Financial Literacy : Buss401 Reports Examples

Business Report

The A2 Milk Company Statement of Academic Honesty This assessment has been written by me and represents my own work. This work has not been previously submitted. All sourced information has been appropriately acknowledged and ARA referenced. I permit this assessment to be copied for academic processes (such as moderation). I have retained a copy of this assessment electronically.

Part 1 – Introduction

1.1 What is the name of the Entities Reporting (Quote the page number from the Annual Report)

Content Search

Market analysis unit: rapid market assessment - karen/kayin state (april 5, 2024), attachments.

This Rapid Market Assessment (RMA) is a suppliment to the MAU Market Price Report in Southeast Myanmar. It provides township-level data on market functionality, activity, supply, and logistics. Data were collected through observation and KIIs with retailers during Mar. 11-18, 2024. Reports available at www.themimu.info/market-analysis-unit .

KEY FINDINGS

Town markets were functional and well-supplied, but the village market differed significantly;

Activity declined in the Kawkareik village market due to conflict, and retail challenges mounted;

Fuel and medicines remained scarce in the region, and many goods were undersupplied in Kawkareik;

Formal inter-townships shipping continued, but informal shipping costs climbed in Kawkareik;

Poor security and weak demand were challenges for retailers in all markets in March;

Some retailers were reticent to boost inventory due to weak inventory, such as those in Myawaddy.

Regional Overview

Market Functionality - Town markets were operational, but Kawakreik village conditions were worse. Markets remained open, but retailers described safety in Kawkareik and Myawaddy markets as poor. That said, there were no reports of recent damage or closures.

Market Activity - Market activity declined in Kawkareik in March, but it was little changed in towns. Conflict muted marked activity in the Kawkareik village market, and a difficult operating environment limited retailer activity in Myawaddy where route closures and high shipping costs pushed some retailers out of the market.

Availability of Goods - Goods were fairly well sup-plied in towns, but fuel and medicines were scarce. Town markets generally offered a range of foods and NFIs, and only fuel and medicines stood out as particularly understocked. Supply was unsurprisingly poorer in the Kawkareik village market than in the town markets.

Transport & Logistics - Inter-township shipping was possible, but rice shipments were limited. Shipping costs were rising in Kawkareik—where retailers relied on informal shipping—and in Hlaingbwe. Hpa-An retailers said regulation of rice shipments limited supply. Most retailers sourced supply from nearby townships

Retailer Challenges - Retailers faced challenges related to poor supply, poor security, and weak demand. Weak demand was a concern for retailers in town markets, but retailers also reported challenges accessing supply. Security was a concern across markets, but only retailers in the Kawkareik village market cited market- or infrastructure-related damage as a large concern. Poor cash access was a growing concern in March.

Possible Interventions - Some retailers were unlikely to increase supply amid high fuel costs and flagging demand. Retailers in Kawkareik and Myawaddy said they were unlikely to increase inventory as long as fuel costs stayed high and demand remained poor. Retailers in Hpa-An and particularly Hlaingbwe were more keen to increase inventory provided assistance such as fuel subsidies or assurances of safe travel.

Related Content

Market analysis unit: rapid market assessment - southern shan state (april 5, 2024).

Myanmar + 3 more

Myanmar Emergency Update (as of 4 March 2024)

Myanmar red cross society have provided humanitarian assistance to most needed communities in mindut township [en/my], market analysis unit: market price report - southeast myanmar (february 2024).

Essay on Markets: Top 4 Essays | Economics

In this essay we will discuss about:- 1. Meaning of Markets 2. Features of the Markets 3. Elements 4. Performance.

Essay on Markets

Essay # 1. meaning of markets :.

The term market structure refers to the type constituents and nature of an industry. It includes the relative and absolute size of firms, active in industry, easiness in the entry into business, the demand curve of the firm products etc.

There are two extremities of the market structure on this basis, on one end there is a market of perfect competition and on the other perfect monopoly market. In between these two extremities there are monopolistic competition, oligopoly, duopoly etc.

ADVERTISEMENTS:

In common usage the word market designates a place where certain things are bought and sold. But when we talk about the word market in economics, we extend our concept of market well beyond the idea of single place to which the householder goes to buy something. For our present purpose, we define a market as an area over which buyers and sellers negotiate the exchange of a well- defined commodity. For a single market to exist, it must be possible for buyers and sellers to communicate with each other and to make meaningful deals over the whole market.

Several economists have attempted to define the term market as used in economics.

Some of them are as under:

According to Curnot, “Economists understand by the term market not any particular market-place in which things are bought and sold, but the whole of any region in which buyers and sellers are in such free intercourse with one another that the price of the same goods tends to equality easily and quickly.”

In the eyes of Prof. Chapman, “The term market refers not necessarily to a place but always to a commodity and the buyers and sellers who are to direct competition with one another”.

In simple words, the term market refers to a structure in which the buyers and sellers of the commodity remain in close contact.

Essay # 2. Features of the Markets:

On the basis above-mentioned definitions we can mention following main features of the market:

(i) Commodity:

For the existence of market, a commodity- essential this is to be bought and sold. There cannot be a market without commodity.

(ii) Buyers and Sellers:

Buyers and sellers are also essential for market. Without buyers and sellers the sale-purchase activity cannot be conducted which is essential part of a market.

(iii) Area:

There should be an area in which buyers and sellers of the commodity live in. It is not essential that the buyers and sellers should come to a particular place to transact the business.

(iv) Close Contact:

There should be close contact and communication between, buyers and sellers. This communication may be established by any method. For example, in olden days this contact and communication was possible only when the buyers and sellers of a particular commodity could come at a particular place.

But now with the developed means of communication physical presence of buyers and sellers at one particular place is not essential. They can contact with, each other through letters, telegrams, telephones, etc. In the boundary of a market we include only those buyers and sellers who can maintain regular close contacts.

For instance, India’s farmers (or sellers of grains) have no close contacts with the consumers (or buyers) of England, hence though they are the buyers and sellers of grains yet do not come under the purview of a market.

(v) Competition:

There should be some competition among buyers and sellers of the commodity in a market.

Essay # 3. Elements of Market Conduct:

(a) seller and buyer concentration:.

Here, seller concentration means in certain industry the number of active firms is very limited and these few firms produce a large part of the total supply. In other words, there firms possess the market power in a sense that any one of these firms can affect the market price by making change in the quantity of its product.

In full competition, each firm produces a very small part of the total production. Hence, it cannot affect the market price. In this type of market, the seller concentration is zero. So, as we move from the perfect competitive market towards pure monopolist market, the quantity of seller concentration increases.

(b) Market Power:

Every competitive firm attempts to get market power by making difference in the product. From economic point of view difference in the product or product heterogeneousness affects the market, structure significantly. In the position of homogeneous product when a seller makes even a slight change in the price of product the consumers begin to purchase the product sold by other producers.

In other words the firm producing homogeneous product has to face the perfectly elastic demand curve. On the contrary in the position of heterogeneous products any single firm can increase some price without being affected due to the preferences of the consumer.

(c) Product Differentiation:

In the perfect competition market all firms sell the same or homogeneous product. But in the market, in reality a single product is sold by the different producers, claiming that all products (such as toothpaste) are not same. The producers bring variety by means of brand name, packaging, size, colour, taste, weight etc. In spite of no locational differences, variety is seen by means of retailer service, home delivery, credit facility etc.

(d) Barriers in Entry:

Seller’s concentration indicates that how some firms acquire dominance in an industry, consequently the real competition between the firms is lessened or limited. If there are some barriers in the entry of new firms, then the prospective competition is also limited.

The types of such barriers are as follows:

(i) Cost profit to the present firm which is not available to the new firms.

(ii) Legal barriers in entry.

(iii) Product difference and advertisement etc. cause the presence of strong preference among consumers for the products sold by the established firms.

(e) Other Elements:

Apart from these main elements, there are some other elements to be considered. One of them is the growth rate of market demand. In this situation the firms are somewhat idle. On the contrary in a rapidly growing industry the firms also become more competitive. In the growing market every firm is struggling and striving for more demand.

If there is more elasticity of the price demand of a product, the firm will be motivated to lessen the price in order to increase ones portion in the total sale. In the condition of oligopoly when a firm decreases price other firms also do the same. Then all firms derive benefit in the condition of more elastic demand. If the product demand is inelastic no firm will tend to change price.

Essay # 4. Market Performance:

Market performance means the evaluation of the derivation of the behaviour of any industry when it behaves differently than the established superior laws of the market. It is assumed that in the position of the perfect competition only an industry can perform well. But when the market is derivated from the condition of perfect competition, then the market behaviour also changes. Now the question arises, as to how a market performance can be evaluated in any industry?

Certain acceptable indicators are as follows:

1. Profitability:

All firms have an objective like profitability, profit maximisation or satisfactory level of profit. But profitability in any industry does not depend only upon the performance of the firm. It also depends upon monopolist power, product diversity, or inefficient use of resources etc. Economists have used the hypothesis of normal profit. It is the rate of profit which makes the firm not to leave the industry. The performance level affects the quantity of profit significantly.

2. Productivity:

It is an index of production of per unit input used, if more production is possible by the same units then there is growth in productivity. Growth in production is an indicator of efficient performance of an industry.

But this index is also not without practical shortcomings. Till we cannot keep the other factors stable, it is difficult to measure productivity of certain means/ inputs, like labour on capital. Besides this the units of labour, capital, or land are heterogeneous, so when a change occurs in the quantity of an input, there is also a change in its quality. For example when we recruit more workers, first we recruit more skilled ones and then the less skilled.

Information about the performance of an industry can be derived from its growth rate also. The measure of growth rate of an industry can be known from the product, employment and wealth creation. But every index creates problems in measuring the performance.

For example, it is possible that in an industry more and more people get employment, or there is a rapid rate of wealth accumulation. But it is also possible that the resources are not efficiently used. Likewise when the growth rate is high we do not have information of production cost, whether it is more or less.

4. Effect on Index:

Now the question arises whether the market structure affects the indexes of market performance. Profitability is one of the many indicators of performance. For example in perfect competition, a firm earns normal profit in long term while in monopoly or market having monopolist power, the firm earns extra-normal profit in long term also.

Excessive seller concentration, barriers in entry and product difference can make firm earn more profit in long term also. Likewise we take growth index. Both in monopoly and oligopoly markets firm produces less than its capacity or there is a position of extra capacity.

5. Ill Effects on Firm Growth:

Thus, the growth of the firm is affected adversely. Productivity and efficiency are associated with each other. In the position of monopoly and oligopoly a firm has extra capacity which means inefficient use of resources and low level of productivity. Lastly, the social performance of a firm is also affected by market structure. In monopoly and perfect competition, consumer and labour, both are exploited. Growth in competition decreases the power of exploitation of the producers.

6. Social Performance:

The performance level of an industry can be evaluated in the item of many social bases. These social bases can be income redistribution or other indicators of social welfare. For example the social performance of the medicine industry can be measured by the decrease in the illness period or death rate.

If the expansion/growth of any industry results in decrease of present inequalities of income in society, or it helps in reducing poverty or unemployment then the performance level of the industry can be called high.

Market Structure Conduct Performance Interrelations:

In micro economics the equilibrium of the firm and industry is studied. On the contrary industrial economics is more related to change in market structure, resulting in the changes of market behaviour or firm’s behaviour, which ultimately affect their market performance. So, industrial economics can be studied with the help of structure conduct performance approach or model.

Complexity of Interrelations:

According to the economists, the interrelations between the structures, conduct performance are sufficiently complex. To conclude it can be said that market structure affects the behaviour of a firm and behaviour of a firm affects its performance (profitability) in the market.

Related Articles:

- Markets under Monopolistic Competition | Markets

- Monopoly and Perfect Competition | Markets | Economics

- Characteristics of a Perfect Competition | Market | Economics

- Aspects of Monopolistic Competition | Markets

- Free Samples

- Premium Essays

- Editing Services Editing Proofreading Rewriting

- Extra Tools Essay Topic Generator Thesis Generator Citation Generator GPA Calculator Study Guides Donate Paper

- Essay Writing Help

- About Us About Us Testimonials FAQ

- Studentshare

- The Share Market

The Share Market - Essay Example

- Subject: Business

- Type: Essay

- Level: Masters

- Pages: 5 (1250 words)

- Downloads: 0

Extract of sample "The Share Market"

Check these samples of the share market, the mechanisms used by investors in the share market, ethical investment portfolios issues, auditing and fraud at cendant corporation, the changing slope of the yield curve, three strongest components of each plan, the australian securities exchange and interest rates, establishment of an alpha response technology solutions venture in the rwandan special economic zone.

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY

IMAGES

VIDEO

COMMENTS

New Issues Market (NIM) 4. Secondary Market in Old Issues Market 5. The Gilt-Edged Market. Essay # Definition of Stock Market: The Capital market or the stock market normally deals with long term securities, including both private and government securities. The securities market is considered as the most important component of the capital market.

A second advantage of investing in the stock market is that, through owning stocks, individuals are guaranteed a direct means of participating in the building of their nation's economy. This can be very beneficial to an individual and, because of the numerous gains associated with being key investors in a nation's economy.

It is an absolutely interesting that the top biggest companies in the world, (by top 100 companies) are all listed on the Stock Market, such as Wal-mart stores the biggest companies by 2010 (Fortune global 500, 2010) Free Essays from Bartleby | There are thousands of stocks on the stock market. It can be a daunting task deciding which stocks to ...

The share market is a place where people buy and sell shares of ownership in companies. These shares are called stocks, and they give the owner a share of the company's profits and losses. When a company does well, the value of its shares goes up. When a company does poorly, the value of its shares goes down.

Stock Market: The stock market refers to the collection of markets and exchanges where the issuing and trading of equities ( stocks of publicly held companies) , bonds and other sorts of ...

A stock market can be defined as a "public entity for trading of company stock and derivatives at an agreed price; these are securities listed on stock exchange as well as those traded privately" (Anonymous: "Capital and derivatives Market" Para 2).

Types Of Share Market. The stock market is of 2 types: #1 - Primary Market. The firm enters the primary stock market following its first-time enrollment at the stock exchange Stock Exchange Stock exchange refers to a market that facilitates the buying and selling of listed securities such as public company stocks, exchange-traded funds, debt instruments, options, etc., as per the standard ...

In practice, the term "stock market" often refers to one of the major stock market indexes, such as the Dow Jones Industrial Average or the S&P 500. These represent large sections of the stock ...

Reviewed by Julius Mansa. Fact checked by Kirsten Rohrs Schmitt. The stock market provides a venue where companies raise capital by selling shares of stock, or equity, to investors. Stocks give ...

The demand of shares in the stock market is determined by various factors. Sloman (2008) posits that, income, wealth, expectations, divided yield, price and returns of substitutes are the factors that influence the demand of the stocks. Sloman (2008) considers the dividend yield as the money received back by investors and is expressed as a ...

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks ... Non-organized markets denominated in English (" Over The Counter "). According to the negotiation phase of financial assets. Primary market : Financial assets are created. In this market, assets are transmitted directly by their issuer.

April 1, 2024 at 6:00 PM EDT. Stocks finished mostly lower Monday to start the second quarter, after the S&P 500 clinched a 10% gain for the first three months of the year. Read the day's full ...

Follow @TIME. FROM its inception, the stock market was meant to be a place where businessmen could raise capital by selling shares in their enterprises, and where investors could turn a profit when those enterprises prospered. The market still serves both purposes, but today it is judged less by what it does for businessmen seeking capital than ...

Paper Type: 300 Word Essay Examples. The stock market is perfectly competitive because there are a very large number of groups in the market. The stock market, as we know it, is a global community that consists of four different groups: public corporations; market makers; buyers; and sellers.

April 2, 2024 at 6:02 PM EDT. Stocks slid Tuesday, with the S&P 500 retreating under pressure from rising oil prices and bond yields that tapped multimonth highs. Read the day's full markets ...

What is Share Market? The share market is a platform where buyers and sellers come together to trade on publicly listed shares during specific hours of the day. People often use the terms 'share ...