- Credit Cards

- Financial Services

- Investments

- Infographics

- Youtube Channel

Money Market Funds Explained

Table of contents

What Is a Money Market Fund?

How do money market funds work, prime money market fund, government and treasury funds, tax-exempt funds, who should consider investing in money market funds.

- Frequently Asked Questions

Money market funds, also known as money market mutual funds, are a type of low-risk, high liquidity investment. They comprise near-term, short-maturity securities, including cash, cash equivalents, Treasury funds, and certificates of deposit.

Money market funds are regulated by the US Securities and Exchange Commission . They are a popular investment option provided by mutual fund companies, banks, and brokerages.

The primary purpose of a money market fund is to offer investors flexible opportunities that carry a low level of risk. Money market mutual funds are among the least volatile and most liquid investment types.

In this guide to money market funds, we’ll explain what they are, how they work, what advantages and disadvantages they offer, and which types are available.

If you’re new to investing or you’re considering diversifying your investment portfolio to include low-risk investments, you may be wondering what a money market fund is.

A money market fund is a type of mutual fund that enables investors to invest in liquid securities with a maturity of 13 months or less (with the exception of government funds).

These debt securities are characterized by their maturity and very low credit risk. The type of money market fund will dictate the kind of instruments held. There are three main types of money market funds in the US:

- Prime funds (also known as general purpose)

- Tax-exempt funds (also known as municipal funds)

- Government and Treasury funds

It is important to note that money market funds are not the same as money market accounts.

A money market account is a type of savings account that earns interest on deposits. MMAs are available from banks and other financial institutions and are insured by the Federal Deposit Insurance Corporation. There are benefits to investing in top-rated money market accounts , but in most cases, there are limitations that make them less flexible than other types of savings accounts.

Money market funds work in a similar way to typical mutual funds. They issue shares or units to investors and operate according to guidelines set by the SEC.

There are various types of debt securities and instruments that funds can invest in. These include:

- Banker’s acceptance

- Certificate of deposit

- Commercial papers

- US Treasury bills

- Repurchase agreements

Money market mutual funds offer a selection of products to investors. The net asset value is designed to stay at $1 per share . There have only been a couple of situations where the value has dropped below $1, including the financial crisis of 2008 .

Excess earnings on money market funds are distributed among investors via dividends. The $1 NAV is one of the primary motivators for investors, as it facilitates regular payments from fund managers to fund holders.

The returns of the instruments contained within a money market fund are dependent on market interest rates. This means that the overall reward also fluctuates in line with changing interest rates.

Types of Money Market Funds

Funds are classified into several categories according to the maturity period and the type of investment assets.

Also known as general purpose funds, prime money market funds invest in floating-rate debt and commercial papers issued or assigned by non-Treasury entities, including US government agencies or organizations and enterprises sponsored by the government, known as GSEs.

Government and Treasury funds invest in cash and instruments backed by the US government, including Treasury bills, 100% collateralized repurchase agreements, Treasury bonds, and government securities.

Tax-exempt funds, also known as municipal funds, are exempt from federal taxes. In some cases, they may also be exempt from state taxes. Municipal funds can be classed as national municipal or state municipal.

Pros and Cons of Money Market Funds

Although generally safe, money market investments are not free from risk and disadvantages. If you are thinking about buying shares of money market funds, it’s wise to consider the pros and cons first.

The advantages of money market funds include:

- Very low risk: One of the main reasons money market funds are so popular. Beginners may not want to experiment with high-risk investments, while experienced investors may wish to consider money market funds as a means of diversifying their investment portfolio to manage risks.

- High liquidity: Money market funds offer high liquidity in comparison with other types of investments, which gives investors more freedom and flexibility. A liquid investment can easily be converted into cash without the investor losing money.

- Higher returns than bank accounts: Money market funds are considered a low-risk, low-return investment option, but they do offer superior returns to regular savings accounts.

- Stability: Money market funds are among the least volatile types of investment funds.

- Regulation of money market funds for added security: Money market funds are regulated by the SEC. Fund managers must comply with regulations, which enhances security and provides investors with peace of mind.

- Short-term investment options: If you’re looking for a short-term investment option that doesn’t carry a high level of risk or uncertainty, this could be an ideal solution.

- Tax benefits: In some cases, investors can benefit from tax exemption by investing in money market funds. Municipal money market funds offer a means of earning money without paying federal and/or state taxes.

The disadvantages of money market funds include:

- Not insured by the FDIC: Unlike other types of CDs and savings accounts, money market funds are not insured by the Federal Deposit Insurance Corporation. This means that there is a low risk of losing money.

- Low returns: Money market returns are usually lower than those of other investment types, as capital appreciation is limited and risks are low. More volatile investments, such as stocks and bond mutual funds, can be more profitable.

- Price fluctuation: There is a risk of price fluctuations due to changes in interest rates and other factors that influence share prices.

Money market funds are suitable for a wide range of investors, including:

- Beginners looking for safe ways to grow their money in the short term

- Investors who have a short-term investment goal

- Investors with a low risk tolerance

- Investors searching for opportunities with minimal volatility

- Experienced investors looking for low-risk strategies to diversify their portfolio

- Investors who want highly liquid instruments

- Investors who want to use the portfolio of a money market fund to offset the risks of more volatile investments, such as stocks

- Investors looking to hold their money in a relatively safe fund while they wait for other opportunities

The History of Money Market Funds

Launched in the US in the 1970s , money market funds were designed to provide a simple, safe way to invest money in securities that often offered better returns than savings accounts. Originally, these funds comprised only government bonds, but today, there is a much wider range of bonds and securities available.

Following the financial crash in 2008, the SEC introduced new measures to improve money market fund management.

In 2010 , the SEC made rules more robust to enhance stability. It enforced tougher restrictions on money market portfolio holdings. In 2016 , it announced further changes to regulations. Prime money market funds were required to float the NAV rather than maintain the stable value.

Today, money market funds are considered a safe investment option for beginners, as well as experienced investors who want to diversify their portfolios or hold their cash while they wait for new opportunities to come along.

How are money market funds taxed?

Money market funds are divided into two categories: taxable and tax-exempt. Municipal money market funds are exempt from federal and state taxes in some cases. Funds that are taxable are liable for regular federal and state taxes.

Are money market funds safe?

Money market funds are a low-risk investment opportunity. They are generally considered to be a safe option for investors. The target value per share is $1. The value has only dipped below this on a few occasions, and every time it has recovered quickly.

What is an example of a money market fund?

There are three types of money market funds: prime, municipal or tax-exempt, and government and Treasury. Money market funds invest in near-term debt-based securities with high liquidity and low volatility. Examples of money market fund securities and instruments include CDs, Treasury papers and bills, cash and commercial papers.

For years, the clients I worked for were banks. That gave me an insider’s view of how banks and other institutions create financial products and services. Then I entered the world of journalism. Fortunly is the result of our fantastic team’s hard work. I use the knowledge I acquired as a bank copywriter to create valuable content that will help you make the best possible financial decisions.

More from blog

- Share full article

Advertisement

Supported by

The Fabulous Yields, and Lurking Risks, of Money Market Funds

The funds are paying enticing interest rates right now. But the debt ceiling and signs of weakness in the banking system are worrisome, our columnist says.

By Jeff Sommer

Jeff Sommer is the author of Strategies , a weekly column on markets, finance and the economy.

The markets have been rocky ever since the Federal Reserve started raising interest rates to combat inflation last year.

Stocks and bonds have lost money. The costs of financing a car, a house or even a small credit-card purchase have risen. Two important regional U.S. banks failed and needed bailouts, and worries about a possible recession have spread.

But it’s been a glorious time for one part of the financial world: money market mutual funds. The biggest money funds tracked by Crane Data are paying more than 4.6 percent interest, and a handful have yields around 5 percent.

Their gaudy interest rates closely follow the Fed funds rate, set by the central bank. The effective Fed funds rate is now about 4.83 percent. That’s onerous for people who need to borrow money, and deliberately so: The Fed is raising rates because it is trying to squelch inflation by slowing the economy.

What’s painful for borrowers is great for people who need a place to park money they have put aside to pay the bills. In a bid to hold onto customers, some banks have begun raising rates in savings accounts and for certificates of deposit, though most bank deposits remain in accounts that pay close to nothing.

That’s given money market funds magnetic appeal. Their assets have swollen to more than $5.6 trillion , from $5.2 trillion in December 2021, when the Fed began talking about impending interest rate increases. Money market funds are likely to keep growing if the Fed holds rates at their current level, or raises them further.

I’ve used money market funds on and off for decades with no problems, and consider them to be fairly — though not entirely — safe. I think it’s reasonable to put some of your cash in them, as long as you are careful and keep your eyes wide open.

The Landscape Shifts

In June, when money market rates jumped from the near-zero level at which they had languished to as much as 0.7 percent, I pointed out that for the first time in ages, it made sense to start shopping around for places to park your cash.

The days of being consigned to receiving nothing for the privilege of keeping your money in a financial institution were over, if you were willing to make a move. When interest rates started to rise, money market rates started levitating immediately, opening up a wide gap with bank deposit rates.

By now, that gap has widened to its greatest level in decades. The advantages of money market funds are increasingly obvious, not just for the corporate financial officers who have always used them as an efficient and high-yielding place to hold money, but for thousands of ordinary people, who are at last receiving something for their cash.

Say you’ve got $10,000 to stash somewhere. Keep it in a checking account, and you will receive nothing, or close to it. Keep it in a money-market fund paying 5 percent for a year and you will receive $500.

That won’t make you rich. Depending on consumer prices, you could lose purchasing power in inflation-adjusted terms. Right now, money market yields are just beginning to approach the annual rate of the Consumer Price Index , which was 5 percent in March. But compared with nothing, $500 is wonderful.

Some banks are beginning to offer competitive rates with insurance from the Federal Deposit Insurance Corporation — Apple , for example, has partnered with Goldman Sachs, and is marketing a 4.15 percent interest account. Many other financial institutions are competing for attention, too, but they generally lag money market rates.

In short, if you are a money-market fund investor, rising interest rates can be delightful. But in finance, a benefit is rarely without cost.

Known Vulnerabilities

Investors have never had major losses in money market funds in the United States, and I find that record comforting.

But it doesn’t mean that the funds are without risk.

For one thing, there are already indications that their growing popularity comes partly at the expense of banks, especially smaller ones that have lost deposits. Such losses — which contributed to the collapses of Silicon Valley Bank and Signature Bank last month — have created stress in the entire financial system.

More than $560 billion in deposits exited the commercial banking system this year through April 5, according to government figures . At the same time, more than $442 billion flowed into money market funds, according to Crane Data. That’s been great for the income of the fund investors, but it’s not an unalloyed good for financial institutions.

You can see this in individual companies. At Charles Schwab , for example, which has just reported its quarterly earnings, the firm’s banking arm lost $41 billion in deposits in the first three months of the year. At the same time, Schwab’s money market funds gained $80 billion.

For Schwab customers, the shift has been a tremendous boon. It means a big surge in income for them. For the company’s shareholders, though, it means a crimp in profits. As a company, Schwab says, it is strong enough to handle the shift. That may be so, but not all financial institutions are in solid shape right now.

Financial regulators are monitoring these issues closely.

Money Market ‘Runs’

It’s not just banks that are vulnerable to “runs” — panics, in which people scramble to withdraw their money, spurring others to do the same, in a vicious cycle.Money market funds are periodically subject to runs, too.

There have been only two known incidents in which money market funds were unable to pay 100 cents on each dollar invested in them — they “broke the buck, ” in Wall Street jargon — and, despite headaches and long payment delays, no significant losses occurred in those cases.

But there have been many near misses. A 2012 report by the Federal Reserve Bank of Boston found more than 200 instances in which companies that ran money market funds quietly poured money into them to ensure that the funds could pay investors 100 percent of the money they expected.

Recall that the Fed had to restore calm during money market runs in 2008 and again in 2020, during a brief crisis at the start of the coronavirus pandemic. The Securities and Exchange Commission, which regulates money market funds, has already tightened its rules twice, and it is proposing additional changes .

Federal involvement in the money markets has become a constant thing. Since the 2020 crisis, money market funds have increasingly relied on a Fed backstop — the reverse repurchase agreement operations, or “reverse repo,” of the Federal Reserve Bank of New York. Most of the holdings of many money market funds are Treasury securities sold overnight by the Fed. In total, more than $2.2 trillion in securities are tied up in this market.

On March 30, in the midst of the latest banking crisis, Treasury Secretary Janet L. Yellen targeted money market funds as an area of special concern. “If there is any place where the vulnerabilities of the system to runs and fire sales have been clear-cut, it is money market funds,” she said. “These funds are widely used by retail and institutional investors for cash management; they provide a close substitute for bank deposits.”

While noting the regulatory tightening that had already occurred, Ms. Yellen said that much more needed to be done. “The financial stability risks posed by money market and open-end funds have not been sufficiently addressed,” she said.

How to Use Them

These days, I have a variety of places to stash the cash I’ll need to pay the bills.

These include accounts at a major global commercial bank, a credit union, an online high yield F.D.I.C.-insured savings bank and a low-fee money-market fund with a large, reputable asset management company. Over the past year or two, I’ve kept some money in all of these, though the money market fund has become my favorite lately, because it generates steady cash.

But when the Fed drives interest rates back down — that could happen soon if there’s a recession, or many months from now, if inflation is persistent — money-market fund rates will drop, too, and I’ll reduce my holdings in them.

I’m also aware of the potential perils associated with money market funds. To minimize risk, I use a so-called government fund — one that holds only Treasury bills, other securities of the U.S. government and of U.S. agencies, and reverse repo securities at the Fed. That eliminates the possibility that my fund will hold securities issued by a private company that goes belly up — as Lehman Brothers did in 2008, causing trouble for some money market funds.

Of course, Treasury bills aren’t 100 percent safe either, not with the federal debt ceiling looming. Mind-boggling as this may be, it is possible that the U.S. government could default on its debt. Many money market funds are avoiding Treasury bills that could come due during a debt ceiling stalemate.

Ultimately, I expect reason to prevail and the U.S. government to pay all its bills. Should it default on Treasury obligations, after all, no other financial security in the United States would be entirely safe.

Still, for the money I really need, I’ll be sure to have a higher proportion of my cash in F.D.I.C.-insured accounts when the climax of the debt ceiling fight seems to be upon us, possibly as soon as June.

That’s why, even when it comes to safe places to keep your cash, the general rules of investing apply: Diversify your holdings, and try to understand how much risk you are taking with your money.

I worry about money market funds. They aren’t 100 percent safe. But I’m grateful to have them.

Jeff Sommer writes Strategies , a column on markets, finance and the economy. He also edits business news. Previously, he was a national editor. At Newsday, he was the foreign editor and a correspondent in Asia and Eastern Europe. More about Jeff Sommer

- Publications

- Peer Review Reports

Thematic Review on Money Market Fund Reforms: Peer review report

Addressing vulnerabilities in money market funds is a key element of the FSB’s work programme to enhance the resilience of the non-bank financial intermediation sector.

Money market funds (MMFs) are important providers of short-term financing for financial institutions, corporations, and governments. MMFs are also used by retail and institutional investors to invest excess cash and manage their liquidity.

MMFs are subject to two broad types of vulnerabilities that can be mutually reinforcing: they are susceptible to sudden and disruptive redemptions, and they may face challenges in selling assets, particularly under stressed conditions. The prevalence of this liquidity mismatch, which crystallised during the March 2020 market turmoil, may depend in individual jurisdictions on market structures, use, and characteristics of MMFs.

In 2021, the FSB published a report with policy options to address MMF vulnerabilities by imposing on redeeming investors the cost of their redemptions; enhancing the ability to absorb credit losses; addressing regulatory thresholds that may give rise to cliff effects; and reducing liquidity transformation. This peer review takes stock of the measures adopted or planned by FSB member jurisdictions in response to that report, including those jurisdictions’ evidence-based explanation of relevant MMF vulnerabilities and policy choices made. The review does not assess the effectiveness of those policy measures, as this will be the focus of separate follow-up work by the FSB in 2026.

Press Release

27 february 2024 fsb review finds uneven implementation of money market fund reforms, related information, 16 august 2023 thematic peer review on money market fund reforms: summary terms of reference and request for public feedback, 11 october 2021 policy proposals to enhance money market fund resilience: final report.

- Terms and Conditions

- Privacy Notice

- Cookie Notice

FinancialResearch.gov

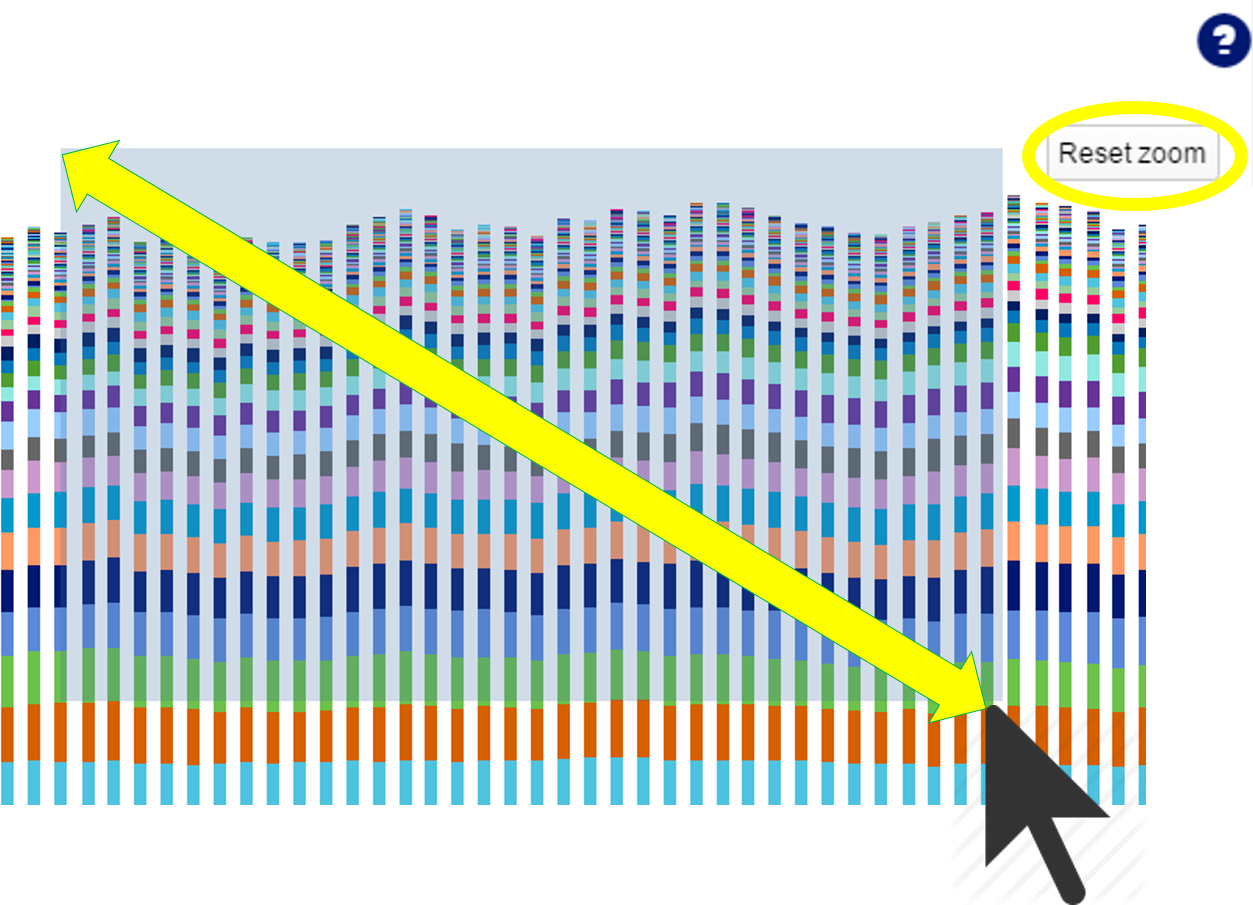

U.s. money market fund monitor, how to use the ofr's money market fund monitor, how to zoom in on chart, click and drag in chart to zoom..

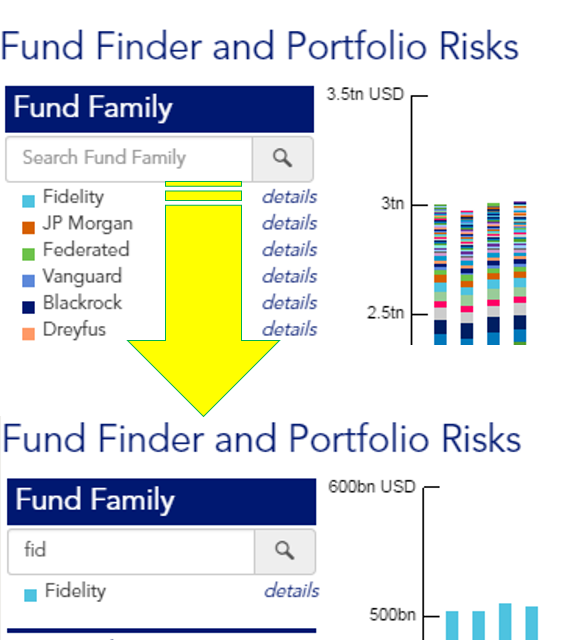

How to filter chart?

Type in search box for partial matching..

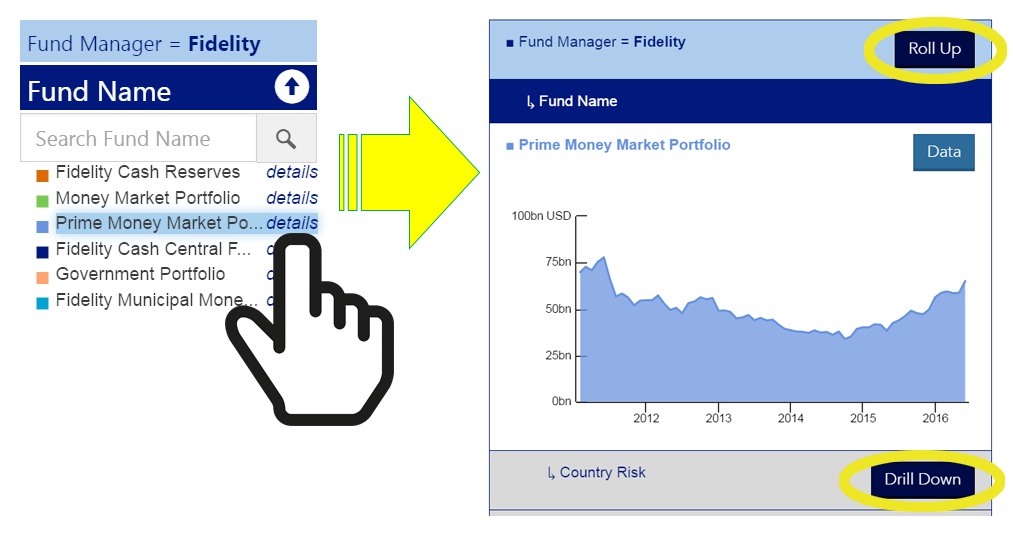

How to drill through data?

Click on details of legend item to see data drill down options..

How to download data?

Click "data" button to download the current view as csv file.

What if I find an error?

Thank you please click the feedback icon on the right to send an email and describe the error..

This monitor is designed to track the investment portfolios of money market funds by funds' asset types, investments in different countries, counterparties, and other characteristics. Users can view trends and developments across the MMF industry. Data are downloadable and displayed in six interactive charts. The reference guide contains examples of how to use the monitor and additional information.

- Investments by any U.S. MMF

- U.S. MMFs’ investments by fund category

- Investments by U.S. prime MMFs

- U.S. MMFs’ investments in the repo market

- U.S. MMFs’ repos with the Federal Reserve

- Federal Reserve repo facility total utilization and MMFs’ participation

What is a Repurchase Agreement - Repo

How are mmfs categorized.

- Government/Agency

- Exempt Government

- Single State

- Other Tax Exempt

What are repos with the Federal Reserve

What are money market funds and fund managers, what is a prime fund, what is a government fund, what is a tax exempt fund, and what are retail and institutional funds.

Last updated:

You are now leaving the OFR’s website.

You will be redirected to:

You are now leaving the OFR Website. The website associated with the link you have selected is located on another server and is not subject to Federal information quality, privacy, security, and related guidelines. To remain on the OFR Website, click 'Cancel'. To continue to the other website you selected, click 'Proceed'. The OFR does not endorse this other website, its sponsor, or any of the views, activities, products, or services offered on the website or by any advertiser on the website.

Thank you for visiting www.financialresearch.gov.

- Performance & Yields

- Ultra-Short

- Short Duration

- Empower Share Class

- Academy Securities

- Cash Segmentation

- Separately Managed Accounts

- Managed Reserves Strategy

- Capitalizing on Prime Money Market Funds

Liquidity Insights

- Liquidity Insights Overview

- Audio Commentaries

- Case Studies

- Leveraging the Power of Cash Segmentation

- Cash Investment Policy Statement

- China Money Market Resource Centre

Market Insights

- Market Insights Overview

- Eye on the Market

- Guide to the Markets

- Market Updates

- 7 Essentials of ESG

Portfolio Insights

- Portfolio Insights Overview

- Fixed Income

- Long-Term Capital Market Assumptions

- Sustainable investing

- Strategic Investment Advisory Group

- MORGAN MONEY

- Global Liquidity Investment Academy

- Account Management & Trading

- Announcements

- Navigating market volatility

- Diversity, Equity & Inclusion

- How we invest

- Sustainable and social investing

- LinkedIn Twitter Facebook

Money market fund risks

- Investment Academy Hub

- 1. Choosing a liquidity investment

- 2. Evaluating and managing risks

- 3. Regulation and liquidity fund due diligence

Assessing risk in money market funds

Because they invest in fixed income securities, money market funds and ultra-short duration funds are subject to three main risks: interest rate risk, liquidity risk and credit risk.

Interest rate risk

Interest rate risk measures the impact of changes in rates on the securities held by money market funds.

If interest rates increase, the value of a money market fund’s investments generally declines, and vice versa. Securities with longer maturities typically offer higher yields, but have greater interest rate sensitivity.

Usually, changes in the value of fixed income securities will not affect cash income but may affect the value of an investment in the fund.

Weighted average maturity (WAM) and duration measure the sensitivity of a bond’s price to changes in interest rates. The interest rate risk of a fund can be mitigated by limiting the maximum WAM or duration of the product.

Liquidity risk

Liquidity risk can result from market volatility or from a lack of liquidity in underlying securities held by a fund.

Mitigating liquidity risk is most important for money market funds because they are meant to be used for daily cash needs.

There are two main types of liquidity risks faced by money market funds: funding liquidity risk (if the fund’s liquidity is insufficient to meet redemptions) and market liquidity risk (if market volatility forces funds to sell securities below the mark-to-market price in order to meet large redemptions or maintain regulatory limits).

To minimise funding liquidity risk, funds can maintain high overnight cash balances, build a strong ladder of maturities and institute cautious concentration limits to create a diversified investor base.

The latest regulations and rating requirements typically specify minimum requirements for daily liquid assets (DLA) and weekly liquid assets (WLA). Fund managers will typically hold higher DLA and WLA to provide an additional cushion against unexpected outflows.

Market liquidity risk can be mitigated by holding smaller concentrations of each issue with diversified maturities — particularly for less liquid securities — which can help minimise the impact of security price volatility. Money market funds typically pursue a buy-and-hold investment strategy, which can help them weather market liquidity risk, as securities mature at par. Maintaining strong broker relationships can also help ensure liquidity is maintained.

Credit risk

Credit risk measures the likelihood that issuers or counterparties will default or be downgraded.

Default risk is the failure to repay on securities, time deposits or repurchase agreements. Downgrade risk is the risk that the credit rating of a security or issuer may be reduced by a credit rating agency.

An increase in credit risk can lead to greater volatility in the price of the security, thereby impacting the value of the fund. A money market fund may also become a forced seller, because the security no longer meets regulatory or rating agency rules — while at the same time, the reduced rating may affect the security’s liquidity, making it more difficult for the fund to sell it.

Credit risk can be mitigated through the use of external or internal credit research, designed to monitor the credit quality of the issuer or counterparty. Credit rating agencies, either international or domestic, publish credit ratings that are an opinion on the default risk of a particular bond or issuer. Rating agencies also signal the likely future path of credit ratings with a “rating outlook” for the next six to 24 months and a “rating watch” for a three-month time horizon.

Rating agencies generally need to consider multiple factors and parties before taking rating action, which may limit their effectiveness. Therefore, a comprehensive, internal credit analysis process and credit risk management framework, that is integrated with a money market fund’s portfolio management, can minimise the risk of suffering unanticipated downgrades or defaults.

Stress testing to measure risk

Stress tests are the best method of risk analysis for money market funds and ultra-short duration funds, and are required by several regulators. Risk managers can use stress tests to ensure funds are conservatively managed with sufficient capacity to avoid a significant decline in the value of an investment in the fund.

Here is an example of a stress test that considers a money market funds’ sensitivity to changes in interest rates (x-axis), credit spreads (y-axis) and liquidity flows.

Credit risk management

Having an experienced and independent internal credit research team is increasingly critical to avoiding downside credit risks. Liquidity investors should therefore carefully review a fund manager’s credit research and credit risk management team and process when selecting a fund.

The credit risk management team’s primary function is establishing appropriate concentration and tenor limits based on the assigned internal credit rating to properly manage credit risks. Better-rated issuers generally receive higher concentration and tenor allocations

Securities with higher credit ratings are lower less risk than lower-rated securities. A strong internal credit analysis process will use independent internal ratings, in addition to considering those of the external rating agencies. These internal ratings are often more conservative than the external ones.

Concentration

Credit risk can be managed by reducing the concentration of lower-rated securities in the fund. Each issuer is assigned a portfolio concentration limit corresponding to its internal rating, which is lower than the regulatory or rating agency limit and represents the ceiling.

Tenor is the length of time a security has until maturity. Each issuer is assigned a tenor limit corresponding to its internal rating that is lower than the regulatory or rating agency limit, which represents the ceiling. A shorter tenor minimises the risk that a security will be downgraded or default before maturity.

Five key fundamental credit considerations

1. Capital should be tangible and appropriate relative to earnings volatility.

2. Asset quality is assessed through the underlying credit quality and inherent liquidity of underlying assets.

3. Management should be consistent and operate with integrity.

4. Earnings are reviewed for consistency and quality over prolonged time periods.

5. Liquidity is assessed through matched funding, backup credit lines or a stable retail funding base (for banks).

Other factors to be considered in robust credit analysis

- Industry and operating trends, including cash flows, industry or product dominance and relative performance compared with peer groups, can be insightful in analyzing credit risk.

- Alternative repayment options, such as providing collateral, usually offer better recovery value in a credit event

Fund ratings

When selecting a liquidity product, money market fund ratings given by independent credit rating agencies can be a good starting point for assessing a fund’s security and creditworthiness.

- Back to Evaluating Risks

- Back to the hub homepage

- Choosing a liquidity product

- Download the brochure

- Further reading

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Welcome USAA members.

Welcome USAA members. Take the next step toward your tomorrow with Schwab.

Schwab Money Funds

Designed to offer stability of capital, liquidity, and income.

- A convenient way to access potentially higher yields on cash

- Access to a range of taxable and tax-exempt money funds 1

- No transaction fees to buy or sell 2

- Minimum investment as low as $0*

What is a money market fund?

A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk, stability of capital and typically higher yields than some other cash products.

Compare these money fund types

Ready to get started, prime money funds3 (taxable), prime money funds 3 (taxable).

These funds invest in high-quality, short-term money market securities issued by U.S. and foreign entities, including corporations, financial institutions, and the U.S. government.

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4

- Minimum Initial Investment

- Eligible Investors 3

- Schwab Value Advantage Money Fund® – Investor Shares ( SWVXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4 5.18%

- Minimum Initial Investment $0*

- Eligible Investors 3 Retail

- Next Step Buy

- Schwab Value Advantage Money Fund® – Ultra Shares ( SNAXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4 5.33%

- Minimum Initial Investment $1,000,000

Government and Treasury Money Funds (Taxable)

These funds invest in short-term U.S. government debt securities with holdings in U.S. Treasury obligations or repurchase agreements.

- Eligible Investors 3

- Schwab Government Money Fund – Investor Shares ( SNVXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4 5.03%

- Eligible Investors 3 Retail/Institutional

- Next Step Buy

- Schwab Government Money Fund – Ultra Shares ( SGUXX )

- Schwab Treasury Obligations Money Fund – Investor Shares ( SNOXX )

- Schwab Treasury Obligations Money Fund – Ultra Shares ( SCOXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4 5.17%

- Schwab U.S. Treasury Money Fund – Investor Shares ( SNSXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4 5.02%

- Schwab U.S. Treasury Money Fund – Ultra Shares ( SUTXX )

Municipal Money Funds³ (Tax-Exempt)

Municipal money funds 3 (tax-exempt).

These funds invest in short-term municipal money market securities issued by states, local governments, and other municipal agencies.

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5

- Schwab Municipal Money Fund - Investor Shares ( SWTXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5 3.44%

- Schwab Municipal Money Fund - Ultra Shares ( SWOXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5 3.59%

- Schwab California Municipal Money Fund – Investor Shares ( SWKXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5 3.08%

- Schwab California Municipal Money Fund – Ultra Shares ( SCAXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5 3.22%

- Schwab New York Municipal Money Fund – Investor Shares ( SWYXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5 3.40%

- Schwab New York Municipal Money Fund – Ultra Shares ( SNYXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5 3.55%

- Schwab AMT Tax-Free Money Fund – Investor Shares ( SWWXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5 3.42%

- Schwab AMT Tax-Free Money Fund – Ultra Shares ( SCTXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4, 5 3.57%

Variable Share Price Money Funds (Taxable)

Designed primarily for institutional investors. This fund invests in taxable short-term obligations issued by corporations and banks, as well as repurchase agreements and asset-backed commercial paper.

- Schwab Variable Share Price Money Fund™ – Ultra Shares ( SVUXX )

- 7-day yield (with waivers) as of 12:00 AM EDT 04/02/2024 4 5.31%

- Eligible Investors 3 Retail/Institutional

The Variable Share Price Money Fund is a prime taxable money fund intended for institutional accounts.

Want to learn more?

Distributions

Schwab Money Funds pay dividends on the 15th of each month (or on the next business day, if the 15th is not a business day), except that in December dividends are paid on the last business day of the month.

Schwab Funds ® Monthly Distribution Schedule

Explore the details of Schwab Money Funds and Schwab Money Funds Commentary

Schwab Sweep Money Funds

Schwab has eliminated sweep money market funds as a cash feature for most new and existing accounts. Limited accounts and account types may be eligible to have a money market fund as the designated cash feature. More complete information about all of Schwab’s available cash features can be found in the Cash Features Disclosure Statement .

Who can buy what funds?

- Retail Investors can invest in retail money market funds, which are defined as funds with policies and procedures that limit beneficial ownership to those investors deemed as "natural persons."

- Institutional Investors are eligible to invest in institutional money market funds with a variable net asset value (VNAV). Retail Investors may also choose to invest in these funds.

- Both Retail and Institutional Investors are eligible to invest in government money market funds.

- Designed to provide a convenient way to access potentially higher yields on cash

- Most have no investment minimums

- No transaction fees

- Solutions for both retail and institutional account types

- Extensive credit research and professional money management

Money market funds can be bought and sold in most brokerage and retirement accounts and are treated similarly to how other mutual funds are traded.

Prime Money Market Funds primarily invest in taxable short-term obligations issued by corporations and banks, as well as repurchase agreements and asset-backed commercial paper. Prime MMFs are considered retail money funds and are only available to natural persons.

Government and Treasury Money Market Funds primarily invest in short-term U.S. government debt securities. Treasury money market funds typically limit their holdings to only U.S. Treasury obligations or repurchase agreements collateralized by U.S. Treasury securities. Government and Treasury MMFs are available to all investors.

Municipal Money Market Funds primarily invest in short-term municipal money market securities issued by states, local governments, and other municipal agencies. Municipal MMFs pay interest that is generally exempt from federal income tax. Municipal MMFs are considered retail money funds and are only available to natural persons.

Variable Share Price Prime Money Market Funds are designed for institutional investors but are available to all investors. These funds invest in taxable short-term obligations issued by corporations and banks, as well as repurchase agreements and asset-backed commercial paper. Daily share price (net asset value, NAV) will fluctuate.

The main differences between the types of money market funds are what each fund is allowed to invest in (i.e., the investible universe), and the corresponding regulatory rules applicable to each sector, which can affect the yield the portfolio generates. A prime money fund invests primarily in taxable short-term obligations issued by corporations and banks, as well as repurchase agreements and asset-backed commercial paper. Government and Treasury funds invest primarily in short-term U.S. government debt securities. Treasury money market funds typically limit their holdings to only U.S. Treasury obligations or repurchase agreements collateralized by U.S. Treasury securities. Municipal money market funds invest primarily in short-term, municipal money market securities issued by states, local governments, and other municipal agencies. They pay interest that is generally exempt from federal income tax. Go here for a list of current money market fund options and yields.

Accounts of Charles Schwab & Co., Inc. are insured by SIPC for securities and cash in the event of broker-dealer failure. The Schwab Money Funds are protected as securities by SIPC. Below is a link to information that can be shared with the client at schwab.com.

Additional information on SIPC: SIPC ® Account Protection: Charles Schwab: Asset Protection

Schwab Money Funds are quoted with a 7-day yield. A money fund's 7-day yield fluctuates based on several factors, including the current interest rate environment. Go here for a list of current money market fund options and 7-day yields.

Money market fund yields can be affected by multiple variables that may be sector-specific, including supply/demand dynamics, regulatory requirements, and eligibility rules. For more information, go here to see Schwab's current money market fund options and yields.

Yes. Yields often fluctuate based on several factors, including the current interest rate environment and the fund's underlying holdings. Go here for a list of current money market fund options and yields.

The 7-Day Yield represents the annualized fund yield based on the average income paid out over the previous seven days assuming interest income is not reinvested and it reflects the effect of all applicable waivers. Absent such waivers, the fund's yield would have been lower.

Take the next step.

Call 800-435-4000 or

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Best money market funds in April 2024

Farran Powell

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Stephanie Steinberg

Updated 5:49 p.m. UTC April 2, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Investments like certificates of deposit and high-yield savings accounts are garnering attention as a way for investors to keep cash safe while earning consistent income.

But money market funds are a viable alternative to CDs and savings accounts. Known for their stability and modest yet steady income streams, money market funds can serve as a haven during economic uncertainty.

To help investors identify the best money market funds in 2024, our team ranked the universe of options based on stringent criteria, including but not limited to the fund’s assets under management, expense ratios, minimum required investment and track record.

Best money market funds

Vanguard federal money market fund (vmfxx), vanguard treasury money market fund (vusxx), schwab value advantage money fund – investor shares (swvxx), schwab treasury obligations money fund – investor shares (snoxx), fidelity money market fund (sprxx), fidelity government money market fund (spaxx).

Expense ratio

Total assets, what you should know.

VMFXX is a straightforward example of a money market fund. Considered one of the most conservative funds in Vanguard’s lineup, VMFXX’s portfolio is almost entirely invested in cash, U.S. government bonds or repurchase agreements collateralized by U.S. government bonds, all of which have short-term maturities. The fund’s yield fluctuates with prevailing interest rates. Like most money market funds, VMFXX seeks to maintain a stable net asset value per share of $1.

Pros and cons

- No purchase, redemption or 12b-1 fee.

- A low expense ratio of 0.11%.

- A high AUM and a long track record dating back to July 1981.

- Requires a $3,000 minimum investment.

- Yields will fluctuate with interest rate changes.

- Historically lower returns compared to stocks and bonds.

More details

- Minimum investment: $3,000.

- Fund 10-year annualized return as of April 1: 1.34%.

VUSXX is an example of a Treasury money market fund. Currently, at least 80% of this fund is required to be held in Treasury bills or repurchase agreements fully collateralized by Treasury securities. Compared to other assets, Treasurys are considered very low-risk due to their excellent credit quality and short maturity, which virtually immunizes them from default and interest rate risk.

- A low expense ratio of 0.09%.

- A high AUM and a long track record dating back to December 1992.

- Fund 10-year annualized return as of April 1: 1.33%.

SWVXX provides the usual combination of stability and consistent income by tracking a portfolio of high-quality, short-term investments from both U.S. and foreign issuers. As a prime money market fund, SWVXX has the ability to hold corporate fixed-income securities, such as commercial papers, in addition to the usual Treasury repurchase agreements and CDs.

- No sales loads or 12b-1 fees.

- No minimum required investment.

- High total assets and a long track record dating back to April 1992.

- Charges a higher 0.34% expense ratio.

- Minimum investment: $0.

- Fund 10-year annualized return as of April 1: 1.32%.

As a government money market fund, SNOXX only invests in securities issued by the U.S. government or repurchase agreements collateralized by such investments. As a result, the fund has a slightly lower default risk than a prime money market fund like SWVXX. The downside is a lower seven-day yield in exchange for this reduced risk. Once again, as the federal fund rate changes, this yield will also change in lockstep.

- Better credit quality compared to prime money market funds.

- Yields fluctuate with interest rate changes and are lower than prime money market funds.

- Fund 10-year annualized return as of April 1: 1.18%.

The fund’s overall portfolio total assets, which includes all other share classes of the fund — such as institutional shares — sits at $107.5 billion, having accrued steadily since the fund’s debut in January 1989. The fund’s portfolio is typical of a prime money market fund, split between U.S. Treasury and government agency repurchase agreements, commercial papers from financial sector companies and CDs.

- No transaction fees or 12b-1 fees.

- High AUM and a long track record dating back to January 1989.

- Charges a higher 0.42% expense ratio.

- Fund 10-year annualized return as of April 1: 1.30%.

Investors looking to avoid commercial paper from corporations in their money market fund can consider SPAXX, which has been around since February 1990. As a government money market fund, SPAXX’s portfolio consists mostly of U.S. government repurchase agreements, agency-issued floating rate and fixed-rate securities with a short maturity and high credit quality. It also has a small allocation to U.S. Treasury bills and Treasury coupons.

- No transaction fees or 12b-1 fee.

- Yields will fluctuate with interest rate changes and are lower compared to prime money market funds.

- Fund 10-year annualized return as of April 1: 1.14%.

Compare the best money market funds

Methodology

Our ranking of the top money market funds was created by applying a screen of several “must-have” metrics:

- AUM: All money market funds on this list have accrued a minimum AUM of at least $5 billion for their respective share class.

- Share class: All money market funds on this list represent share classes open to retail investors, not institutional investors.

- Minimum investment: To qualify for this ranking, a money market fund must have a minimum investment requirement of $3,000 or less.

- Type: This list only ranks government, prime and Treasury money market funds, with municipal money market funds excluded.

- Expense ratios: All money market funds on this list must have a 0.5% or less net expense ratio.

- Track record: A money market fund must have at least a 10-year performance history to be eligible for this list.

An experienced fund analyst selected the funds above, but they may not be right for your portfolio. Before purchasing any of these funds, do plenty of research to ensure they align with your financial goals and risk tolerance.

Why other funds didn’t make the cut

We began by filtering out money market funds that charge an expense ratio of 0.5% or higher. Given the long-term expected return of these funds tends to be low, minimizing fees can help investors keep more money in their pockets.

Next, we filtered out funds with less than a 10-year performance history and lower than $5 billion in AUM. This helped us identify established funds from large providers with economies of scale and a long track record of performance.

We also restricted our rankings to government, Treasury and prime money market funds. This meant excluding municipal money market funds. While these tax-exempt funds may be advantageous for investors in a higher income tax bracket, their yields tend to be lower, making them less suitable for the average investor.

We also filtered out money market funds only accessible to institutional investors and the institutional share classes of some money market funds. These usually require a large minimum investment, which makes them far less accessible to retail investors.

Finally, to ensure accessibility, we set a limit of $3,000 for the minimum investment a money market fund can initially require. This filtered out money market funds with high minimum investment requirements, making the rankings more accessible to beginner investors with smaller accounts.

Final verdict

The options for money market funds are vast. Still, most investors would do well sticking to funds from established providers with high AUM, low expense ratios, small or no minimum investments, and a long track record of stable performance.

Our pick for the best money market fund overall is Vanguard Federal Money Market Fund (VMFXX), thanks to a combination of historically consistent performance, excellent current yields, low expense ratios and the backing of a reputable, established firm in the form of Vanguard .

What is a money market mutual fund?

Money market mutual funds are designed to provide greater safety of principal while paying out consistent income at prevailing interest rates. They can come in four types: government, prime, Treasury or municipal, also known as tax-exempt.

They primarily invest in short-term, high-quality fixed-income securities such as Treasury bills, commercial paper, CDs and repurchase agreements. These instruments tend to have a low risk of default and low-interest rate sensitivity, which allows the money market fund to maintain a stable net asset value of $1 per share.

The interest paid out by these underlying instruments is collected by the money market fund and distributed periodically to investors as income. Many investors use money market funds as a way to park cash in a portfolio for safety and some income potential.

How do money market funds work

Money market funds work by pooling the capital of numerous investors together and investing it in a portfolio of fixed-income securities selected for three traits: high credit quality, short maturity, and good liquidity. This usually includes Treasury bills, commercial paper, CDs and repurchase agreements, but the exact composition of a money market fund will depend on its type.

The underlying portfolio of securities in a money market fund helps it achieve a dual objective. The first is maintaining a stable net asset value per share of a dollar, regardless of market conditions. This eliminates volatility for the money market fund and makes it attractive to investors looking for safety.

The second objective is regular income. Distributions come from the interest income generated by the money market fund’s underlying portfolio. In general, the level of income will fluctuate in lockstep with prevailing interest rates. Investors will receive income distributions periodically, usually monthly.

Frequently asked questions (FAQs)

Money market funds are not insured by the Federal Deposit Insurance Corp. The FDIC only insures certain types of bank accounts and products — such as checking and savings accounts, money market accounts and CDs — up to a certain limit.

The FDIC does not insure investment products, which includes money market funds. Therefore, it is possible to lose money when investing in a money market fund, though it is generally considered a very low-risk investment.

All investments carry risks, but some are safer than others regarding the risk of principal loss. In general, money market funds are considered safer investments than other types of funds, such as stock or bond funds , thanks to their holdings, which tend to be high-quality, short-term fixed-income investments with excellent liquidity.

This makes money market funds more suitable for investors looking to preserve capital since they don’t incur the same volatility as stock and bond funds. However, “safe” does not mean “risk-free.”

There is always a degree of risk involved with any investment, including money market funds. As noted, money market funds are not FDIC insured, which makes them less safe than a savings account or certificate of deposit.

Recessions tend to affect investments negatively, but money market funds are usually resilient due to the short-term and high-quality nature of the securities they hold and the regulatory reforms implemented in 2016 to further improve their safety.

While they are not entirely immune to the effects of a recession, they are designed to maintain a stable net asset value of $1 per share, even during economic downturns. Historically, there have been a few instances when a money market fund “broke the buck,” with its net asset value per share plunging below $1.

The most notable instance of this was during the 2008 financial crisis when the Reserve Primary Fund “broke the buck” after the failure of Lehman Brothers. But even then, stock market investors experienced more substantial losses in comparison.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Tony Dong is a freelance financial writer with bylines in U.S. News and World Report, the NYSE, the Nasdaq, The Motley Fool and Benzinga. He lives in Vancouver, Canada and is an avid watch collector.

Farran Powell is the lead editor of investing at USA TODAY Blueprint. She was previously the assistant managing editor of investing at U.S. News and World Report. Her work has appeared in numerous publications including TheStreet, Mansion Global, CNN, CNN Money, DNAInfo, Yahoo! Finance, MSN Money and the New York Daily News. She holds a BSc from the London School of Economics and an MA from the University of Texas at Austin. You can follow her on Twitter at @farranpowell.

Stephanie Steinberg has been a journalist for over a decade. She has served as a health and money editor at U.S. News and World Report, covering personal finance, financial advisors, credit cards, retirement, investing, health and wellness and more. She founded The Detroit Writing Room and New York Writing Room to offer writing coaching and workshops for entrepreneurs, professionals and writers of all experience levels. Her work has been published in The New York Times, USA TODAY, Boston Globe, CNN.com, Huffington Post, and Detroit publications.

S&P 500 (SPX) today: Arista Networks Inc is a top mover, up 2.65%

Investing Tony Dong

Copper prices today: April 3, 2024

Crude oil prices today: WTI prices are up 17.16% YTD

Investing Wayne Duggan

Gold price today: Gold is up 0.78%

Silver price today: April 3, 2024

Palladium price today: April 3, 2024

Investing Coryanne Hicks

Platinum price today: April 3, 2024

Nasdaq composite today: The index is down by 0.95%

S&P 500 (SPX) today: Ameren Corp is a top mover, up 1.24%

Crude oil prices today: WTI prices are up 16.26% YTD

Gold price today: Gold is up 0.21%

Silver price today: April 2, 2024

Platinum price today: April 2, 2024

Palladium price today: April 2, 2024

Nasdaq composite today: The index is up 0.11%

- Search Search Please fill out this field.

What Is a Money Market Mutual Fund?

Understanding money market mutual funds.

- Operational Details of MMFs

- Guide to Mutual Funds

Introduction To Money Market Mutual Funds

:max_bytes(150000):strip_icc():format(webp)/rbaldridge__rebecca_baldridge-5bfc2619c9e77c00517ed58c.jpg)

Investors interested in the money market can access it most easily through money market mutual funds. However, smaller investors still need a rudimentary understanding of the Treasury bills , commercial paper, bankers' acceptances, repurchase agreements, and certificates of deposit (CDs) that make up the bulk of money market mutual fund portfolios. In this article, we show you how money market funds work and how they can benefit you.

Key Takeaways

- A money market mutual fund is a type of mutual fund that invests in high-quality, short-term debt instruments, cash, and cash equivalents.

- Though not exactly as safe as cash, money market funds are considered extremely low risk on the investment spectrum and thus carry close to the risk-free rate of return.

- A money market fund generates income (taxable or tax-free, depending on its portfolio) but little capital appreciation.

- Money market funds invest in a variety of similar instruments, while money market accounts exist in a single offering held at a bank or credit union and insured by the FDIC.

An important delineation to understand is the difference between money market funds and money market accounts.

Money Market Funds vs. Money Market Accounts

Unlike cash and even typical CDs , money market mutual funds are not insured by the Federal Deposit Insurance Corporation (FDIC). There is always a risk, though extremely small, that the investor could lose money. Put another way, the crucial difference between money market funds and money market accounts is that the former is sponsored by fund companies and carry no guarantee of principal. Money market accounts, on the other hand, are interest-earning savings accounts that offer limited transaction privileges and are offered by financial institutions insured up to a certain limit.

Money market accounts usually pay a higher interest rate than a passbook savings account but generally a slightly lower interest rate than a CD or the total return of a money market fund. Money market accounts also tend to restrict the accessibility of account balances through check writing while money market fund withdrawals are typically available on demand.

Money market funds are often called "money funds" or "money market mutual funds " and should, therefore, not be confused with the similar-sounding money market deposit accounts offered by banks in the United States. The major difference is that money market funds are assets held by a brokerage , or possibly a bank, whereas money market deposit accounts are liabilities for a bank. The bank can invest the money at its discretion and potentially in (riskier) investments other than money market securities. In a money market fund, investors are buying securities, and the brokerage is holding them. In a money market deposit account, investors are depositing money in the bank, and the bank is investing that money for itself and paying the investor the agreed-upon return.

The Purpose of Money Market Mutual Funds for Investors

There are three instances when money market mutual funds, because of their liquidity , are particularly suitable investments.

- Money market mutual funds offer a convenient parking place for cash reserves when an investor is not quite ready to invest or is anticipating a near-term cash outlay for a non-investment purpose. Money market mutual funds offer ultimate safety and liquidity. This means that investors will have an expected sum of cash at the very moment that they need it.

- An investor holding a basket of mutual funds from a single fund company may occasionally want to transfer assets from one fund to another. If, however, the investor wants to sell a fund before deciding on another fund to purchase, a money market mutual fund offered by the same fund company may be a wise place to park the sale proceeds. Then, at the appropriate time, the investor may exchange their money market mutual fund holdings for shares of the other funds in the fund family.

- To benefit their clients, brokerage firms regularly use money market mutual funds to provide cash management services. Putting a client's dormant cash into money market mutual funds will earn the client an extra percentage point (or two) in annual returns above those earned by other possible investments.

Operational Details of Money Market Mutual Funds

Money market mutual funds are designed to offer features suited to the needs of small investors. Minimum initial investments generally range from $500 to $5,000.

Investors can purchase shares in money market mutual funds directly from brokerage companies or mutual fund firms, just as they would purchase shares in a stock or equity mutual fund . As investment advisors, some banks also sell money market funds, and some even have their own proprietary funds that offer money market investment opportunities.

Money market mutual funds also offer some simplified withdrawal features that are more generally associated with bank or trust accounts. For example, money market funds allow investors to withdraw assets by writing checks, with a typical minimum amount of $500 per check. If the investor does not want to write a check as a means of withdrawing funds, they can easily redeem shares by requesting payment by mail or by remittance via wire transfer to their bank account.

Categories of Money Market Mutual Funds

Money market mutual funds may contain a specific type of money market security or a combination of securities across a wide spectrum:

- One particular type of fund limits its asset purchases to U.S. Treasury securities.

- Another class of money market funds purchases both U.S. government securities and investments in various government-sponsored enterprises (GSEs).

- The third and largest class of money market mutual funds invests in a variety of money market instruments that offer the highest degree of security.

Another important categorization for money market mutual funds relates to their taxable or tax-exempt status. Taxable funds invest in securities such as Treasury bills and commercial paper , the interest income on which is subject to federal taxation. Tax-exempt funds invest exclusively in securities issued by state and local governments and, therefore, are exempt from federal taxation. Tax-exempt funds appeal to investors in higher federal tax brackets who seek tax savings on the interest income generated by their portfolios.

Tax-exempt money market mutual funds can offer a triple-whammy tax reprieve for some investors. Some tax-exempt funds purchase only securities issued by governments within a particular state. If an investor can find such a fund for their home state, their interest income may be exempt from federal, state, and perhaps even local income taxes.

Cash vs. Money Market Funds

Most analysts treat money market accounts like cash. When calculating financial ratios , money market securities and fund balances are added to cash balances. This is because the financial instruments that make up money market funds are considered highly liquid, meaning that they can be converted into cash quickly. In addition to being highly liquid, money market funds exhibit less volatility and are less prone to market fluctuations and interest rate risk than other investments.

The target par value of a share of most money market mutual funds.

Money market funds seek stability and security with the goal of never losing money and keeping net asset value (NAV) at $1. This one-buck NAV baseline gives rise to the phrase break the buck , meaning that if the value falls below the $1 NAV level, some of the original investment is gone, and investors will lose money.

This only happens very rarely, but because money market funds are not FDIC-insured, they can lose money. For instance, at the height of the 2008 market crash, several money market funds traded for less than $1 per share. The day after Lehman Brothers filed for bankruptcy, one money market fund fell to 97 cents after writing off the debt it owned that was issued by Lehman. This created the potential for a bank run in money markets as there was fear that more funds would break the buck.

Special Considerations: Money Market Funds

Just as equity and fixed-income mutual funds have greatly simplified the world of investing, money market mutual funds have made money market investing accessible to individual retail investors. Money market mutual funds are among the safest and most liquid generally available financial instruments . Moreover, money market funds offer modest initial investment requirements and provide simple procedures for withdrawing funds by check or transfer to a bank account. Finally, if they choose carefully , purchasers of certain tax-exempt money market funds may also enjoy relief from federal, state, and even local taxes.

Federal Deposit Insurance Corporation. " Insured or Not Insured? "

Ozgur Akaya, Mark D. Griffiths, Drew B. Winters. " Reserve Primary: Fools Rush In Where Wise Men Fear to Tread ," Page 15. Journal of Investment Management, 2015.

:max_bytes(150000):strip_icc():format(webp)/Moneymarket1-4be549284d2a4fc3804797292e8e1238.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

ESSAY SAUCE

FOR STUDENTS : ALL THE INGREDIENTS OF A GOOD ESSAY

Essay: Money markets

Essay details and download:.

- Subject area(s): Business essays

- Reading time: 6 minutes

- Price: Free download

- Published: 8 September 2015*

- File format: Text

- Words: 1,748 (approx)

- Number of pages: 7 (approx)

Text preview of this essay:

This page of the essay has 1,748 words. Download the full version above.