Summary Administration Probate in Florida

Posted by Bishop L. Toups | In Estate Planning

A Summary Administration probate in Florida is a phenomenal way of cutting down on the expensive cost and time of a typical, Formal Administration probate. A Summary Administration can be used when the decedent has been deceased for more than two years or when the estate is less than $75,000. A Summary Administration is typically many thousands of dollar less than a Formal Administration, and a Summary Administration usually only takes one to two months. A Formal Administration can easily take a year or longer.

Table of Contents

Opening a Summary Administration

The initial step in opening a Summary Administration is the drafting and filing of the Petition for Summary Administration. The Petition for Summary Administration is the most essential document filed in the Summary Administration because the majority of the information the Court needs to enter a final order distributing the funds is contained within the Petition for Summary Administration.

The Petition for Summary Administration can be filed by any estate beneficiary or person nominated as a personal representative in the Decedent’s Last Will and Testament. The Petition can be filed at any time during the administration of the estate. The Petition contains some of the following information:

- Information about the petitioner. This is the person petitioning for the Summary Administration.

- Information about the decedent: name, last four of their social security number, last known address, date, and place of the decedent’s death, and where the decedent was domiciled.

- List of assets of the estate, beneficiaries, and how the assets are to be split either through the Last Will and Testament or through the laws of intestacy (when someone dies without a Will).

- List of any known creditors of the estate and the current status of the creditor claims.

Caution: the Petition for Summary Administration must list the assets in detail. For example, a bank account should be listed as: Bank of America Checking Account Ending in #2019, $200. If you do not have the details for the assets, like the amount or type of account, then you’re likely not going to be able to do a Summary Administration. Make sure to dig through the Decedent’s mail and emails to see if you can find statements showing the asset information.

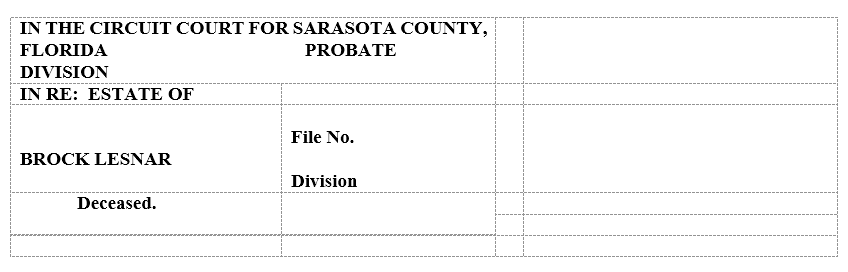

Here’s an example of a Petition for Summary Administration in Florida:

PETITION FOR SUMMARY ADMINISTRATION

(testate nonresident decedent – single petitioner)

Petitioner, Samantha Lesnar, alleges:

- Petitioner has an interest in the above estate as a beneficiary of the decedent and sole surviving daughter. The Petitioner’s address is set forth in paragraph 3 and the name and office address of the petitioner’s attorney are set forth at the end of this petition.

- Decedent, Brock Lesnar, whose last known address was 123 Fake Street, Sarasota, FL 34242, and the last four digits of whose social security number are 5555, died on September 13, 2021, at Sarasota Memorial Hospital, and on the date of death, decedent was domiciled in Sarasota County.

- So far as is known, the names of the beneficiaries of this estate and of decedent’s surviving spouse, if any, their addresses and relationships to decedent, and the years of birth of any who are minors, are:

- Venue of this proceeding is in this county because decedent owned property in this county at the time of death.

- Domiciliary or principal probate proceedings are not known to be pending in another state or country.

- An authenticated copy of the decedent’s last will, dated December 1, 2020, and an authenticated copy of so much of the domiciliary proceedings as is required by Florida Probate Rule. 5.470 accompany this petition. Petitioner is unaware of any unrevoked will or codicil of decedent other than as set forth in paragraph 6.

- Petitioner is entitled to summary administration because:

- Decedent’s will does not direct administration as required by Florida Statutes Chapter 733.

- To the best knowledge of the petitioner, the value of the entire estate subject to administration in this state does not exceed $75,000.

- The following is a complete list of the assets in this estate and their estimated values:

- With respect to claims of creditors:

- Petitioner has made a diligent search and reasonable inquiry for any known or reasonably ascertainable creditors and

- The estate is not indebted.

- All creditors ascertained to have claims and which have not joined in the petition or consented to entry of the order requested will be served by formal notice with a copy of this petition.

Petitioner acknowledges that any known or reasonably ascertainable creditor who did not receive timely notice of this petition and for whom provision for payment was not made may enforce a timely claim and, if the creditor prevails, shall be awarded reasonable attorney’s fees as an element of costs against those who joined in the petition.

- It is proposed that all assets of the decedent be distributed to the following:

Petitioner waives notice of hearing on this petition and requests that the decedent’s last will be admitted to probate and an order of summary administration be entered directing distribution of the assets in the estate in accordance with the schedule set forth in paragraph 11 of this petition.

Under penalties of perjury, I declare that I have read the foregoing, and the facts alleged are true, to the best of my knowledge and belief.

Signed on this day of ______________, 2023.

____(Signature here)_____

Samantha Lesnar , Petitioner

Bishop L. Toups Attorney for Samantha Lesnar Florida Bar Number: 120525 249 Nokomis Ave. S. Venice, FL 34285 Telephone: (941) 882-0731 E-Mail: [email protected]

Self-Proving Wills in Florida

If the Decedent had a Last Will and Testament, the Petitioner must prove that the Will is valid. Most Wills drafted here in Florida are self-proving, meaning that the Will is automatically treated as valid by the court without any further steps to try and prove the Will. Many out of state Wills are not self-proving and will require the Petitioner to prove the Will either through an affidavit signed by a witness or an oath of someone who had personal knowledge of the Will and that the Will is the decedent’s Will.

Here’s an example of what a Self-Proving Will looks like here in Florida:

SELF-PROVING AFFIDAVIT

I, _______________, declare to the officer taking my acknowledgment of this instrument, and to the subscribing witnesses, that I signed this instrument as my will.

_______________, Testatrix

We, _______________________________ and _______________________________, have been sworn by the officer signing below, and declare to that officer on our oaths that the Testatrix declared the instrument to be the Testatrix’s will and signed it in our presence and that we each signed the instrument as a witness in the presence of the Testatrix and of each other.

_____(Witness 1 Signature Here)_____

Witness Signature

_____(Witness 2 Signature Here)_____

Acknowledged and subscribed before me by means of ☐ physical presence or ☐ online notarization by the Testatrix, _______________, who ☐ is personally known to me or ☐ has produced ____________________________ (type of identification) as identification, and sworn to and subscribed before me by each of the following witnesses: ________________________________________, who ☐ is personally known to me or ☐ has produced ____________________________ (type of identification) as identification, by means of ☐ physical presence or ☐ online notarization; and ________________________________________, who ☐ is personally known to me or ☐ has produced ____________________________ (type of identification) as identification, by means of ☐ physical presence or ☐ online notarization. Subscribed by me in the presence of the Testatrix and the subscribing witnesses, by the means specified herein, all on January ______________, 2023.

______(Notary Public Signature Here)______

Notary Public

Creditors in a Florida Summary Administration

A Summary Administration is really for small estates that do not have any creditors, and for estates that are less than $75,000. If the decedent has existing creditors or is likely to have creditors, then the Summary Administration will likely not be the best probate option. However, suppose the creditors are known and the amounts owed are known. In that case, you can either pay the creditor claims before filing the Summary Administration, or you can provide for payment of the creditor claim within the Petition for Summary Administration.

One common issue during a Summary Administration is when an unknown creditor files a claim against the Estate after the Summary Administration is opened. If this happens and there are sufficient assets to pay the creditor, then the Petition for Summary Administration must be amended to provide for payment for the creditor claim. Or the creditor claim needs to be paid by the beneficiaries directly so the creditor will release its claim.

Example: Delilah passed away with only a bank account worth $50,000 solely in her name. Her beneficiaries did not expect any creditor claims and filed a Summary Administration Probate. As soon as the Summary Administration probate was opened, a creditor filed a claim on behalf of a hospital for an ambulance ride for $1,200 when Delilah was rushed to the emergency room before she passed.

Result: The bank account is not an exempt asset for creditor claims here in Florida. Her beneficiaries will have to pay for the $1,200 creditor bill either out of pocket or they’ll have to amend the Petition for Summary Administration to include a payment of the $1,200 creditor bill.

If the only asset in the Summary Administration is protected homestead and the homestead is transferred to qualified heirs, then a Summary Administration can be used even when there are creditors. This is because the homestead is given a value of $0 in Florida Probate since it is automatically exempt from the vast majority of creditor claims.

Example: Jorge died with a homestead worth 1.5 million dollars in Sarasota, FL. Jorge was involved in a major accident before he died, where he was at fault and severely injured another driver. Jorge had a judgment against him from the car accident worth $750,000. Jorge’s sole beneficiary was his daughter, Delilah.

Result: Delilah can open a Summary Administration since Jorge’s property was protected homestead and is his only probate asset. Jorge’s creditors will be unable to collect on the $750,000 because the only probate asset is protected homestead and all of Jorge’s beneficiaries are qualified heirs.

Caution: Any time there is a large creditor or a potential large creditor, we highly recommend you consult with a Probate Attorney pro here in FL before moving forward with the probate. There are a few options to overcome large creditor claims, which should be discussed before the Probate is filed.

Closing Out a Summary Administration in Florida

Once the Petition for Summary Administration has been filed, the Last Will and Testament has been proved (if there is a Will), and all creditor claims have been dealt with, the Petitioner can petition the Court to file a final Order of Summary Administration. The Order of Summary Administration lists all of the assets, the beneficiaries, and how the assets are to be distributed based on the Decedent’s Will. If there was no Will, the assets will be distributed based on the intestacy laws of Florida.

Once the Judge signs the Order of Summary Administration, the probate is closed. The Petitioner or the beneficiaries can take this order to all the financial institutions to have the assets transferred. The financial institutions will transfer the funds to the beneficiaries based on the court order. Some out-of-state institutions might give you a hard time since the Order of Summary Administration will likely look different than their small estate affidavit. If you receive pushback, ask that they send the Order to their legal team for review.

Tip: If there’s protected homestead within the Summary Administration, it is vital that you also file a Petition to Determine Homestead and an Order to Determine Homestead. The Petition and Order to Determine Homestead protects the decedent’s homestead from most creditor claims. Consult with a Probate Attorney pro so you do not mess up the Homestead creditor protections.

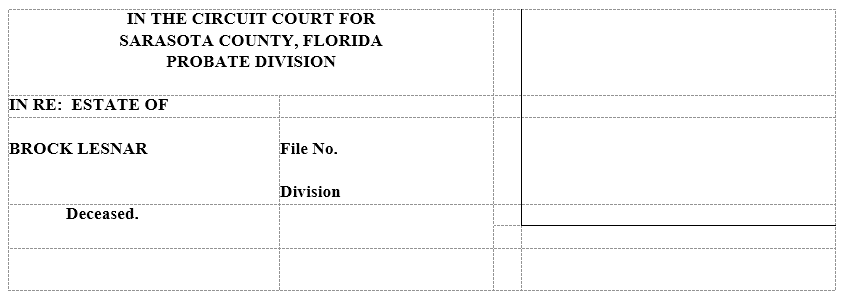

Here’s an example of what an Order of Summary Administration looks like:

ORDER OF SUMMARY ADMINISTRATION

On the petition of Samantha Lesnar for summary administration of the estate of Brock Lesnar, deceased, the court finding that the decedent died on September 13, 2021, that all interested persons have been served proper notice of the petition and hearing or have waived notice thereof; that the material allegations of the petition are true; that the will dated December 1, 2020, has been admitted to probate by order of this court as and for the last will of the decedent; and that the decedent’s estate qualifies for summary administration and an Order of Summary Administration should be entered, it is

ADJUDGED that:

- There be immediate distribution of the assets of the decedent as follows:

- Homestead real property located at 123 Fake St., Sarasota, FL 34232:

- Bank of America Checking Account Ending in #1234:

- Those to whom specified parts of the decedent’s estate are assigned by this order shall be entitled to receive and collect the same, and to maintain actions to enforce the right.

- Debtors of the decedent, those holding property of the decedent, and those with whom securities or other property of decedent are registered, are authorized and directed to comply with this order by paying, delivering, or transferring to the beneficiaries specified above the parts of the decedent’s estate distributed to them by this order, and the persons so paying, delivering, or transferring shall not be accountable to anyone else for the property.

ORDERED on _________________________, 2022.

_______________________________

Circuit Judge

Bishop L. Toups

Bishop L. Toups is an estate planning, elder law, and tax attorney in Southwest Florida.

Stand Up To The IRS

IRS Bills? The Internal Revenue Service can wreak havoc on your life. This book has the information and strategies you need to confront America’s most intimidating agency.

Tax Savvy For Small Business

Create a business tax strategy that will save you time, energy and money. Getting your tax on track will free time to do what really counts - running a profitable business.

Surviving An IRS Tax Audit

Worried about escaping an audit intact? Then you need Surviving an IRS Tax Audit. This book explains what to say, what to do, even what to wear, so that a visit from the auditor doesn't turn into a disaster.

Contact Daily, Montfort & Toups

Any information sent to us is bound by attorney-client privilege and will remain confidential.

You can call us at 1-800-291-4881 .

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Florida Document Specialists

Leaders in Document Preparation, Online Notarization, and Apostille Services

Probate Orders – Petition for Summary Administration

Filing proposed orders of summary administration and homestead with the court.

There are many challenges that pro se parties face in filing a petition for summary administration in Florida. One such challenge is how to actually get proposed summary administration probate orders in front of a judge to be reviewed and signed.

One would think that after taking the time to gather and prepare the proper probate forms for summary administration of a small estate, i.e. a Petition for Summary Administration, Petition to Determine Homestead Status of Real Property, Affidavit of Heirs, etc., getting the court to act on your probate petition would be the easy part. More often than not, that isn’t so.

Most pro se summary administration petitioners don’t realize that once the various probate petitions and supporting documents (certificate of death, etc.) are filed with the court to open a small estate with a summary administration, a set of proposed orders must still be prepared. Our customers are often surprised to learn that the court, much less the actual judge assigned to the case, does not type the orders that will be signed. Proposed probate orders must be typed and presented to the probate judge utilizing the specific methods that the judge has mandated. If you don’t follow the judge’s procedure, your case will sit in purgatory until the proverbial cows come home.

Using the Correct Summary Administration Forms

Before we get back to examples of procedures for getting proposed probate orders before the judge, I want to again stress the importance of having the proper forms and proposed orders for your summary administration case.

Although it may sound counter-intuitive, one of the worst mistakes you can make is depending on the “law library”, even the one in the court you are filing in, to have proper probate forms. There is a project that I recently worked on for a customer who actually had the judge tell her, “I’ve never seen these types of probate forms before, where did you get them?” The petitioner told the judge that she had purchased them from the law library. The judge replied that she could not make sense of the petition (it was a rambling 28 pages long) and told the petitioner that an order would be forthcoming. Soon after, the judge issued an order directing the petitioner to file a, “Second Amended Petition for Summary Administration”, and to make sure that it addressed at least a dozen issues that were not addressed within the 28-page packet that was previously submitted. Yes, the petitioner is now on her third try at a petition for summary administration, but since we are typing her forms, she is not going to have that issue this time.

Now, back to the subject of this blog, which is the process of submitting proposed probate orders to the judge for signature. Here is the bad news: There are 67 counties in Florida, and most of them have a different procedure on how they want it done.

I can’t list probate procedures for all 67 Florida counties, but I will give four basic examples of how widely procedures can vary. We’ll use the “Small Friendly County”, Miami-Dade County, Broward County, and the county from the bowels of hell that shall remain nameless .

It’s Time to Prepare and Submit Proposed Orders of Summary Administration

So, you’ve studied the Florida Statutes concerning probate and have read the Florida Probate Code . You’ve drafted your petition for summary administration, homestead petition, and supporting documents, and you’re ready to draft proposed summary administration and probate orders for the judge’s signature.

A typical bundle of proposed Florida pro se probate orders may consist of:

- Order of Summary Administration (Testate)

- Order of Summary Administration (Intestate)

- Order Admitting Will to Probate (Either Self-Proved or with an Oath of Witness)

- Order Determining Status of Homestead Property

The Small, Friendly County

With some small, friendly Florida counties, getting your orders before the judge can be as simple as calling up the clerk of court, (a real human will answer on the first or second ring) and asking the clerk what their local procedures are for accepting proposed orders of summary administration. Most likely you will be told to simply make two or three copies of the proposed orders and mail them to the court along with self-addressed stamped envelopes. They will even give you the address to use and ask you about your grandchildren. A week or two later, your probate case is done.

Miami-Dade County

Despite its enormous size, the Miami-Dade County probate system works very efficiently if you know the secret handshake. The eleventh judicial circuit, which encompasses Miami-Dade County, uses an electronic system known as “Probate E-Courtesy” to handle the task of getting proposed probate orders, like summary administration and homestead determination, before their judges. You must first register for an E-Courtesy account, and then have your proposed orders ready to upload in Microsoft Word format. You must also upload a courtesy copy of the corresponding petitions in .pdf format. Once you have done this properly, you’ll get an email from the system letting you know that the proposed probate orders have been accepted and are on their way to a judge. My favorite story about judges and probate orders actually comes from Miami-Dade County. Once, I helped a customer create and upload proposed orders to his E-Courtesy account on a Sunday afternoon . Twenty-seven minutes later, the orders were signed by the judge and uploaded to the Florida e-portal for docketing with the clerk of court! In contrast, if you send paper orders to Miami-Dade, they will sit there until the cows come home, leave, and come home again.

Broward County

Broward is another huge South Florida county in the seventeenth judicial circuit. Broward County also uses an electronic system for in-taking proposed orders, but it’s slightly more complicated. First, you must download and complete court mandated checklists for every petition that you have filed. Most counties have their staff complete these checklists as part of the intake process, because, presumably, the court employee knows what to look for. Broward has out-sourced that step to you! They are very serious about their checklists. Also make sure you’ve filed your criminal history affidavit! Once you’ve prepared your proposed orders, convert them to .pdf format. You must have a Florida E-Portal Account opened, which means that you better have filed your Notice of Designated Address and Email Address, but I digress. Broward wants you to e-file (as opposed to e-courtesy) a cover letter (some courts yell at you if you send a cover letter) attached to the proposed orders along with the court mandated checklists. If you do something wrong in Broward, don’t wait by the phone. Even when you do everything right, it may take a while or even some prompting to get your orders moving towards the judge. This, of course, refers only to pro se petitioners. Families who can afford an attorney undoubtedly have a smoother process or are at least isolated from the stress. All this being said, I like Broward County. They do a good job for having to deal with such a huge workload on a limited budget.

The County that Shall Remain Nameless

I have no desire to further infuriate the spiny creature who answers the phone at the probate clerk’s office in this god-forsaken county, because I still have to interact with it.

In this county, they are very serious about their customer-completed checklists too, but they make a little game of it. They tell you where to go to download the checklist. Part of the checklist asks you to refer to the Docket Numbers and Docket Line Number that corresponds to the items on the checklist. No problem I thought, I’ll just hop over to the Clerk of Court’s website and print a copy of the docket. Not in this county . Forty-five minutes later, I’m still on their website refusing to believe that the public can’t access a probate docket (all the other counties allow this). So, in desperation, I called the creature:

Me: I’m having a problem with your website. I can’t access a docket on a probate case.

Clerk: Are you a party to the probate?

Me: No.

Clerk: I’m sorry sir, that information is confidential.

Me: So, if a “party” is trying to fill out your court mandated probate checklist, how does that person get to look at the docket?

Clerk: Well, they’ll have to request access.

Me: How do they do that?

Clerk: They’ll have to submit a SIGNED AND NOTARIZED FORM to the County Who Shall Remain Nameless’ IT department requesting a username and password for the website.

Me: No other county does that.

Clerk: Well we do.

Me: So, a serious question here ma’am. What if a probate petitioner doesn’t have a computer, doesn’t have an attorney, and just wants to get a copy of THEIR OWN docket so they can fill out your mandated checklist?

Clerk: Well, I’d guess they should find someone with a car to drive them to the library to use a computer.

Me: Well ok then! Thank you.

So, downloaded the super-secret form, had it notarized, and emailed it to their IT department. A few days later I received my username and password in the mail. Of course, none of the information is confidential, any member of the public could do just what I did. But at least I had access to the docket. Smooth sailing, right? No.

The Real Misery Begins

Then, I had to download a (I believe it was an 18-page file) which describes how to send an email with the proposed orders to the judge. The subject line of the email has to contain specific information in a specific order. Then, the manual goes into a chapter about how to get into the Microsoft Word advanced features to “strip” your files of extraneous, hidden coded characters, and anoint and bless the file prior to sending it. And for heaven’s sake, make sure you use the right font and pitch. Also, they make it clear that they want the customary lines for the judge’s signature and date removed from the proposed orders, or they will be rejected with an error code. A what? They also want courtesy copies of the petitions attached to the same email. Just when you thought it couldn’t get any worse, you’re introduced to their “error code” system. For example, if you submit your proposed orders, and something is wrong, don’t expect anyone to take a moment to reply and tell you what the issue is. They will respond with something like “ERROR CODE R-4” – which you have to then look up in their error manual (which you have to download), for an explanation of the deficiency.

The only good thing I can say about this miserable county, is that after completing this multi-day task, the result was a signed Order of Summary Administration from a judge in the county that shall remain nameless.

Hiring a Document Preparation Service

When considering hiring a document preparation company to prepare and file your Florida Summary Administration probate forms, you may want to think of the value added service s they provide such as decoding and dealing with the numerous probate filing procedures in place across Florida.

Florida Document Specialists provides a flat-fee service for the preparation and filing of your Florida Summary Administration forms. Visit our page on Summary Administration to lean more about the process and the services we offer.

We’d love to hear about any experiences you’ve had while interacting with probate clerks as a pro se litigant. Feel free to leave comments below.

Download our free probate checklist. Download now

Settle an estate, without the guesswork.

Join the 100,000+ executors that have settled an estate sooner - using our step-by-step probate checklist

- U.S. (English)

- Canada (English)

- Canada (Français)

Everything You Need to Know About Summary Administration in Florida

Understanding what summary administration is, and if you are eligible for it, can be complex. here is a brief review of summary admin to make your next steps clearer..

- Written by Brett Surbey

- Posted on November 4, 2022

Fact Checked

The content on this page has been reviewed by qualified CFP's, TEP's, Tax accountants & Practicing and past lawyers to ensure it is factually accurate, meets current industry standards and helps readers achieve a better understanding of probate, estate planning, and estate taxes for your loved one.

Article Contents

What is Summary Administration in Florida?

What are florida’s requirements for filing for summary administration, the effect of florida’s homestead law on summary administration, how long does a summary administration take in florida, how much does summary administration cost in florida.

Similar to standard probate proceedings, summary administration is a simplified version of probate that involves more efficient proceedings for eligible estates. To be able to file for summary administration two of three conditions need to be met according to Section 735.201 of the Florida Statutes:

- The decedent’s will does not specifically state that it is to be probated formally as per Chapter 733.

- The entire value of the estate’s assets that are non-exempt (more on this below) is $75,000 or less. OR

- The deceased has been deceased for two years or more.

Quick Note:

The reason for the two-year limitation date is that any person owed money from the estate has two years to bring their claim forward. Once this period has passed, all claims will be barred, assuming no proceedings have been taken.

If the above criteria have been met, you will be eligible for summary administration in Florida assuming there are no unforeseen complications. As we noted earlier, the value of the estate only includes non-exempt assets as part of the valuation. To make this as straightforward as possible, here is an outline of what kinds of assets count as exempt or non-exempt.

Assets that do count towards estate value:

- Accounts such as banking or investment accounts were solely owned by the decedent with no designated beneficiaries.

- Individual Retirement Accounts (IRA), life insurance policies, or annuities that contain no designated beneficiaries.

- Property owned solely by the decedent (they are the only person on title), or property that is held by them and a tenant in common without any right of survivorship.

Assets exempt from estate value:

- Trusts - Any valid, living, revocable, or irrevocable trusts are official assets of the trust and its beneficiaries, thus they are not part of the probate process.

- Accounts containing designated beneficiaries - Retirement funds, life insurance policies, investments, and other accounts that contain a designated beneficiary upon the owner’s death are exempt from probate.

- Jointly owned property with survivorship rights - Any property that is owned equally by two or more persons with the ownership rights passing onto the other in the event of death, is considered exempt.

- Life estate deeds - Any type of real estate which passes to another owner (also called a remainderman) under a life estate deed or enhanced life estate deed–such as a Florida lady bird deed –is exempt from the valuation process.

Although the summary administration process may seem quite efficient, there are some legal circumstances to be aware of. One of these is Florida’s Homestead Law.

Roughly defined, a Florida homestead is any primary place of residence located in Florida. In estate administration situations, this relates to the type of real property owned by the decedent. If the decedent did own a Florida homestead, this special type of asset is automatically passed on to their heirs according to Florida’s Constitution. However, this does not imply that the heirs have a clear title (have the ability to sell the property).

Often the heirs will require an Order Determining Homestead before issuing a title change. Additionally, a separate proceeding to determine that the decedent did own a homestead will need to be processed along with the summary administration.

This added step can prolong the entire process, but typically both Orders are completed within four to eight weeks.

Wrapping Up:

If the deceased owned a home in Florida that was their primary residence, their property will automatically pass on to their heirs without counting towards the total value of the estate.

However, if the property is to be sold, an Order Determining Homestead will need to be completed alongside the Order of Summary Administration. This process typically does not increase the timeline of the summary administration, but be aware that some judges may require a three-month waiting period .

Generally speaking, summary administration can be completed within 2-4 months, whereas formal administration will take at least 1 year to close . This timeline may be shorter or longer depending on factors such as:

- Whether the deceased owed money (had creditors)

- If the estate contains no non-exempt assets

- If the deceased has been dead for two years or more

Most attorneys will charge a flat fee for summary administration, which can range from $1,500 to $3,500 depending on the nature of the assets within the estate, outstanding creditor claims, and the number of beneficiaries listed.

If you choose to file the summary administration yourself , the Court costs alone range from $300 to $500.

Looking for Expert Advice Without the Cost?

If summary administration sounds like a viable option, but the high attorney costs don’t consider getting in touch with one of ClearEstate’s estate administration professionals .

Whether you only need a quick Zoom call, or a long meeting to determine the value of the estate, we can help.

Contact us today with any questions you may have about summary administration - we're happy to help :)

Brett is a Corporate Paralegal and Published Writer. He’s written for accounting and law firms, tech companies, and academic journals. He empathetically guides executors, administrators, and personal representatives throughout the entire estate settlement process.

Join the 100,000+ executors who have downloaded our free step-by-step blueprint to probate.

Related articles

Estate Settlement

Dec 19, 2023

How long does probate take in New York? (hint: up to 2 years)

Generally, most estates can take between 8 to 12 months to complete probate in New York. However, some cases can even take up to 2 years. Read on to find out more.

Nov 29, 2023

Here's What Happens If You Don't File Probate in California

Failing to file for probate in California can cause frozen assets, prolonged creditor claims, and possibly legal issues for an Executor. read on to learn more.

Oct 12, 2023

The Probate Timeline in Texas: How Long Does Probate Take?

Discover how long probate takes in Texas. Get insights into the process, factors affecting duration, and what to expect during probate.

Florida Probate Attorney

Florida Estate and Probate Law

Florida Probate | Summary Administration in Florida

Summary administration is a shortened form of Florida probate that does not require the appointment of a Florida personal representative . Florida summary administration usually requires less time, effort, and expense than formal administration .

There are two ways in which an estate can qualify for summary administration in Florida. For summary administration to be available:

- The decedent must have been dead for more than two years, or

- The value of the entire estate subject to administration in Florida, less the value of property exempt from the claims of creditors, must not exceed $75,000.

How Summary Administration Works

Like a formal administration, a Florida summary administration starts with filing a petition in court. The petition for summary administration may be filed by any beneficiary or by a person nominated as a personal representative by the decedent’s will, but must be signed and verified by the surviving spouse (if any).

The probate rules require that the petition include facts showing that the estate is eligible for summary administration, a list of assets and their values, certain information about the estate’s debt, and a plan for distributing the assets. Once the court receives the petition and is satisfied that the estate qualifies, the court issues an order distributing the assets. Unlike a formal administration, a personal representative is not appointed.

The assets of the estate are immediately distributed to beneficiaries and creditors upon the entry of the order admitting the estate to probate.

Effect of Creditor Claims on Summary Administration

If the decedent has been dead for more than two years, creditor claims are not an issue. Florida has a two year nonclaim provision that effectively bars any creditor claims that are not brought within two years of the decedent’s death. Because of the nonclaim provision, creditor claims do not need to be addressed as part of the summary administration process if the decedent has been dead for more than two years.

If the decedent has not been dead for two years, creditor claims must be dealt with before an order of summary administration can be issued. Florida law requires the petitioner in a summary administration proceeding to “make a diligent search and reasonable inquiry for any known or reasonably ascertainable creditors, serve a copy of the petition on those creditors, and make provision for payment for those creditors to the extent that assets are available.”

Effect of Florida Homestead on Summary Administration

If the decedent owned a home in Florida that was used as a primary residence, Florida homestead law must be considered. A Florida homestead is a special type of asset. It passes automatically to a deceased person’s heirs pursuant to the Florida Constitution. But that doesn’t mean that the heirs have clear title (title that can be sold) . Many title underwriters will require an Order Determining Homestead before issuing a title policy. Until then, the heirs will not have clear title.

If the decedent owned a Florida homestead, a separate proceeding to determine homestead must be brought along with a Florida summary administration. This can affect the timeline in some Florida counties. Most Florida probate judges will enter the Order Determining Homestead at the same time as the Order of Summary Administration. This allows the summary administration to be completed in the usual timeline, usually within four to eight weeks. A few judges, though, will require a three month waiting period before issuing the Order Determining Homestead, extending the summary administration by three months.

Florida homestead is not counted for purposes of determining whether the estate meets the $75,000.00 limitation. If the Florida homestead is the only asset of the estate, it will qualify for summary administration regardless of the value of the homestead.

Related Resources

- Florida Probate: What is Probate?

- Formal Administration in Florida

- Other Florida Probate Alternatives

- Florida Intestate Law and Intestate Succession

IMAGES

VIDEO

COMMENTS

In a testate estate, on the filing of the petition for summary administration, the decedent's will must be proved and admitted to probate. (d) Order. If the court determines that the decedent's estate qualifies for summary administration, it must enter an order distributing the probate

true; and that the decedent's estate qualifies for summary administration and an Order of Summary Administration should be entered; ORDERED and ADJUDGED that: 1. There be immediate distribution to _____ of the Decedent's Real Property located in Bay County, Florida described as:

Summary administration; nature of proceedings - 735.201 May be administered in the same manner as other estates - 735.202 Petition for summary administration - 735.203 Filing of petition - 735.2055 Summary administration distribution - 735.206 Notice to creditors - 735.2063 Disposition without administration - 735.301

Summary Administration Testate ... Florida Statutes; o Statement that the value of the entire estate subject to administration is less the value of property exempt from the claims of creditors, does not exceed $75,000.00 or that the ... Order of Summary Administration o Use the approved Probate Division Form, ...

IN AND FOR BROWARD COUNTY, FLORIDA . PROBATE DIVISION . PETITION FOR SUMMARY ADMINISTRATION OF TESTATE ESTATE. 1. This Checklist must be completed and -filed with your Pe etition. Review and sign the applicable certification clause at the end of the checklist prior to submitting it with your Petition.

PETITION FOR SUMMARY ADMINISTRATION- Probate Rule 5.530 Intestate (No Will) _____ or Testate (Will) _____ ... Decedent's will does not direct administration as required by Florida Statute Ch. 733 _____b. The value of the entire estate, less exempt property, does not exceed $75,000. ... be admitted to probate and an order of summary ...

732.502, §732.503, §733.201. 5.530(c), 5.230. 2. Order of Summary Administration. If the court determines that the decedent's estate qualifies for summary administration, it must enter an order distributing the probate assets and specifically designating the person to whom each asset is to be distributed. 735.206.

Checklist and Certification - Summary Administration - Testate I, _____, as the attorney of record, have reviewed the applicable checklist(s) on the 11 ... ☐ Petition for Summary Administration - Fla. Prob. R. 5.530 ... _____ ☐ Order of Summary Administration - Fla. Stat. § 735.206 _____ ☐ Order Admitting Will to Probate (Form E-1) I ...

735.206 Summary administration distribution.—. (1) Upon the filing of the petition for summary administration, the will, if any, shall be proved in accordance with chapter 733 and be admitted to probate. (2) Prior to entry of the order of summary administration, the petitioner shall make a diligent search and reasonable inquiry for any known ...

It is important to determine if the decedent's estate is eligible before filing a Florida Petition for Summary Administration. To qualify for a Florida summary administration, the following criteria must be met: The total value of the estate subject to administration in Florida, excluding any exempt property, should not exceed $75,000, or

A Summary Administration probate in Florida is a phenomenal way of cutting down on the expensive cost and time of a typical, Formal Administration probate. A Summary Administration can be used when the decedent has been deceased for more than two years or when the estate is less than $75,000. A Summary Administration is typically many thousands ...

5. In a testate estate, that the decedent's will does not direct administration as required by 5.530(a)(6) / 733 and 735.201(1) 5. That the value of the entire estate subject to administration in this state, less the value of property exempt from claims of creditors: Does not exceed $75,000 5.530(a)(7) / 735.201(2) or.

served with a copy of the petition for summary administration. See, Florida Statute §735.206(2) 3. Effect of Order of Summary Administration. Armed with an order of summary administration, a beneficiary can use such order to collect his or her share of the decedent's property. Notwithstanding, beneficiaries generally remain liable

administration as required by chapter 733, Florida Statutes; o Statement that the value of the entire estate subject to administration is less the value of property exempt from the claims of creditors, does not exceed $75,000.00 or that the ... entry of an Order of Summary Administration. Please refer to the

Order Of Summary Administration Intestate. Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form. Loading PDF... Tags: Justia - Order Of Summary Administration Intestate - Florida - - - - Free Legal Forms - Justia Forms.

A typical bundle of proposed Florida pro se probate orders may consist of: Order of Summary Administration (Testate) Order of Summary Administration (Intestate) Order Admitting Will to Probate (Either Self-Proved or with an Oath of Witness) Order Determining Status of Homestead Property.

Open the downloaded checklist with Adobe Acrobat Reader or Acrobat Pro. Download latest version. Fill out the fields as required. Print, save, or email the completed checklist as needed. If there is no applicable checklist, one is not required for submission of proposed orders through Court Map. All proposed orders and notices of hearing ...

A summary administration is a type of probate administration available in Florida: 1) When the value of decedent's probate estate subject to administration does not exceed $75,000, OR, 2) The decedent has been dead for over 2 years. See Fla. Stat. § 735.201.

IN AND FOR BROWARD COUNTY, FLORIDA . PROBATE DIVISION. CHECKLIST FOR PETITION FOR SUMMARY ADMINISTRATION OF INTESTATE ESTATE1 This Checklist must be completed and -filed with your Pe etition. Review and sign the applicable certification clause at the end of the checklist prior to submitting it with your Petition.

To be able to file for summary administration two of three conditions need to be met according to Section 735.201 of the Florida Statutes: The decedent's will does not specifically state that it is to be probated formally as per Chapter 733. The entire value of the estate's assets that are non-exempt (more on this below) is $75,000 or less.

For summary administration to be available: The value of the entire estate subject to administration in Florida, less the value of property exempt from the claims of creditors, must not exceed $75,000. Probate Note: Even if the estate meets one or both of these requirements, summary administration is unavailable if the decedent had a last will ...

Residential Foreclosure Order Setting Non-Jury Trial and Directing Pre-Trial Procedures. Uniform Final Judgment of Foreclosure. Notice of Cancellation of Foreclosure Sale [ WORD doc] [ pdf] - For this form only, please fax to Clerk of the Circuit Court at (813) 272-5508.