Chapter 1. The economic impacts of the COVID-19 crisis

The COVID-19 pandemic sent shock waves through the world economy and triggered the largest global economic crisis in more than a century. The crisis led to a dramatic increase in inequality within and across countries. Preliminary evidence suggests that the recovery from the crisis will be as uneven as its initial economic impacts, with emerging economies and economically disadvantaged groups needing much more time to recover pandemic-induced losses of income and livelihoods . 1

In contrast to many earlier crises, the onset of the pandemic was met with a large, decisive economic policy response that was generally successful in mitigating its worst human costs in the short run. However, the emergency response also created new risks—such as dramatically increased levels of private and public debt in the world economy—that may threaten an equitable recovery from the crisis if they are not addressed decisively.

Worsening inequality within and across countries

The economic impacts of the pandemic were especially severe in emerging economies where income losses caused by the pandemic revealed and worsened some preexisting economic fragilities. As the pandemic unfolded in 2020, it became clear that many households and firms were ill-prepared to withstand an income shock of that scale and duration. Studies based on precrisis data suggest, for example, that more than 50 percent of households in emerging and advanced economies were not able to sustain basic consumption for more than three months in the event of income losses . 2 Similarly, the average business could cover fewer than 55 days of expenses with cash reserves . 3 Many households and firms in emerging economies were already burdened with unsustainable debt levels prior to the crisis and struggled to service this debt once the pandemic and associated public health measures led to a sharp decline in income and business revenue.

The crisis had a dramatic impact on global poverty and inequality. Global poverty increased for the first time in a generation, and disproportionate income losses among disadvantaged populations led to a dramatic rise in inequality within and across countries. According to survey data, in 2020 temporary unemployment was higher in 70 percent of all countries for workers who had completed only a primary education. 4 Income losses were also larger among youth, women, the self-employed, and casual workers with lower levels of formal education . 5 Women, in particular, were affected by income and employment losses because they were likelier to be employed in sectors more affected by lockdown and social distancing measures . 6

Similar patterns emerge among businesses. Smaller firms, informal businesses, and enterprises with limited access to formal credit were hit more severely by income losses stemming from the pandemic. Larger firms entered the crisis with the ability to cover expenses for up to 65 days, compared with 59 days for medium-size firms and 53 and 50 days for small and microenterprises, respectively. Moreover, micro-, small, and medium enterprises are overrepresented in the sectors most severely affected by the crisis, such as accommodation and food services, retail, and personal services.

The short-term government responses to the crisis

The short-term government responses to the pandemic were extraordinarily swift and encompassing. Governments embraced many policy tools that were either entirely unprecedented or had never been used on this scale in emerging economies. Examples are large direct income support measures, debt moratoria, and asset purchase programs by central banks. These programs varied widely in size and scope (figure 1.1), in part because many low-income countries were struggling to mobilize resources given limited access to credit markets and high precrisis levels of government debt. As a result, the size of the fiscal response to the crisis as a share of the gross domestic product (GDP) was almost uniformly large in high-income countries and uniformly small or nonexistent in low-income countries. In middle-income countries, the fiscal response varied substantially, reflecting marked differences in the ability and willingness of governments to spend on support programs.

Figure 1.1 Fiscal response to the COVID-19 crisis, selected countries, by income group

Similarly, the combination of policies chosen to confront the short-term impacts differed significantly across countries, depending on the availability of resources and the specific nature of risks the countries faced (figure 1.2). In addition to direct income support programs, governments and central banks made unprecedented use of policies intended to provide temporary debt relief, including debt moratoria for households and businesses. Although these programs mitigated the short-term liquidity problems faced by households and businesses, they also had the unintended consequence of obscuring the true financial condition of borrowers, thereby creating a new problem: lack of transparency about the true extent of credit risk in the economy.

Figure 1.2 Fiscal, monetary, and financial sector policy responses to the COVID-19 crisis, by country income group

The large crisis response, while necessary and effective in mitigating the worst impacts of the crisis, led to a global increase in government debt that gave rise to renewed concerns about debt sustainability and added to the widening disparity between emerging and advanced economies. In 2020, 51 countries—including 44 emerging economies—experienced a downgrade in their government debt risk rating (that is, the assessment of a country’s creditworthiness) . 7

Emerging threats to an equitable recovery

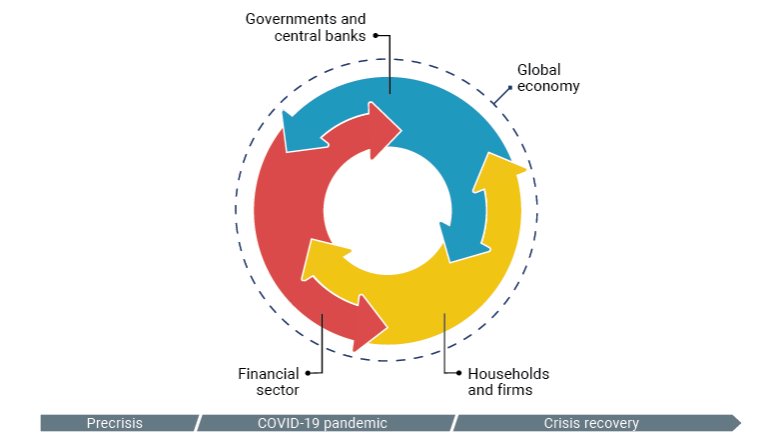

Although households and businesses have been most directly affected by income losses stemming from the pandemic, the resulting financial risks have repercussions for the wider economy through mutually reinforcing channels that connect the financial health of households, firms, financial institutions, and governments (figure 1.3). Because of this interconnection, elevated financial risk in one sector can spill over and destabilize the economy as a whole. For example, if households and firms are under financial stress, the financial sector faces a higher risk of loan defaults and is less able to provide credit. Similarly, if the financial position of the public sector deteriorates (for example, as a result of higher government debt and lower tax revenue), the ability of the public sector to support the rest of the economy is weakened.

Figure 1.3 Conceptual framework: Interconnected balance sheet risks

This relationship is, however, not predetermined. Well-designed fiscal, monetary, and financial sector policies can counteract and reduce these intertwined risks and can help transform the links between sectors of the economy from a vicious doom loop into a virtuous cycle.

One example of policies that can make a critical difference are those targeting the links between the financial health of households, businesses, and the financial sector. In response to the first lockdowns and mobility restrictions, for example, many governments supported households and businesses using cash transfers and financial policy tools such as debt moratoria. These programs provided much-needed support to households and small businesses and helped avert a wave of insolvencies that could have threatened the stability of the financial sector.

Similarly, governments, central banks, and regulators used various policy tools to assist financial institutions and prevent risks from spilling over from the financial sector to other parts of the economy. Central banks lowered interest rates and eased liquidity conditions, making it easier for commercial banks and nonbank financial institutions such as microfinance lenders to refinance themselves, thereby allowing them to continue to supply credit to households and businesses.

The crisis response will also need to include policies that address the risks arising from high levels of government debt to ensure that governments preserve their ability to effectively support the recovery. This is an important policy priority because high levels of government debt reduce the government’s ability to invest in social safety nets that can counteract the impact of the crisis on poverty and inequality and provide support to households and firms in the event of setbacks during the recovery.

➜ Read the Full Chapter (.pdf) : English ➜ Read the Full Report (.pdf) : English ➜ WDR 2022 Home

CHAPTER SUMMARIES

➜ Chapter 1 ➜ Chapter 2 ➜ Chapter 3 ➜ Chapter 4 ➜ Chapter 5 ➜ Chapter 6

RELATED LINKS

➜ Blog Posts ➜ Press and Media ➜ Consultations ➜ WDR 2022 Core Team

WDR 2022 Video | Michael Schlein: President & CEO of Accion

Wdr 2022 video | chatib basri: former minister of finance of indonesia.

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

- Arts & Culture

Get Involved

Autumn 2023

Annual Gala Dinner

Internships

Lebanon’s economic crisis: A tragedy in the making

Amer Bisat , Marcel Cassard , Ishac Diwan

For the past 18 months, Lebanon has been reeling from a wrenching economic crisis. This essay deciphers the crisis’s origin, describes the current juncture, and reflects on the likely outcomes in the proximate future.

How did we get here?

With hindsight, Lebanon’s economic crisis was predictable . By the time the crisis erupted in October 2019, the economy was facing four extraordinary challenges. First, public sector debt had reached such elevated levels that a default had become a question of when, not if. Second, the banking sector, having lent three-quarters of deposits to the government, had become functionally bankrupt and increasingly illiquid. Third, the productive economy had experienced virtually no growth for an entire decade — a development with acute socio-political implications. Finally, and perhaps most importantly, the country was politically rudderless: there was no president between 2014 and 2016, there were multiple and lengthy delays in cabinet formation, and the 2018 parliamentary elections took place but only after a five-year delay. The Hariri government that was in place when the crisis hit in 2019 became impotent to such an extent that it lacked power to deliver on any of the reforms required as a condition for foreign support.

By October 2019, the citizenry had had enough. Sensing a looming crisis and frustrated by the utter lack of action by the political class, hundreds of thousands of people took to the streets demanding radical political change. The cabinet resigned, throwing the country into a political crisis. Unsurprisingly, capital inflows came to a sudden halt. Banks, already insolvent, experienced a sharp liquidity crunch, forcing them to declare a “bank holiday” and institute severe restrictions on bank withdrawals. A foreign exchange black market emerged and the national currency, the lira, sharply depreciated. In turn, inflation soared and people’s real wages and purchasing power collapsed. In addition, as if all these woes were not sufficient, a severe COVID-19 crisis hit the country and, most tragically, a devastating explosion took place on Aug. 4, leveling a third of downtown Beirut.

The confluence of these large negative shocks led to the implosion of the economy: GDP is estimated to have contracted by 25% in 2020, with an additional 10-15% decline forecast for 2021. When measured in USD, the Lebanese economy may end up shrinking from $60bn in 2018 to $15bn in 2021. An extreme form of wealth destruction is taking place with the Lebanese de facto losing the majority of their bank savings. Meanwhile, four out of every ten Lebanese are out of work, and half the population is under the poverty line.

But what these numbers do not reveal are the structural scars. Human capital is fast eroding due to a massive brain drain of the young and skilled. Equally worrying is the loss of physical productive capacity resulting from widespread business closures. Much more alarming are the security consequences of the economic implosion. Lebanon’s sectarian history is rife with conflict. An economic collapse provides a perfect habitat for a return of violence.

What is being done?

Confronted with these traumatic shocks, the Lebanese political class has been appallingly missing in action. A new government was formed in January 2020 and, to its credit, worked with an international consultant on an emergency economic program and initiated IMF negotiations. The program spelled out the size of the financial losses and called on all stakeholders to share in the burden, starting with creditors and bank shareholders. Unfortunately, the effort quickly proved quixotic. Under concerted attack from a wide-ranging coalition of political and vested interests, the government balked at the required economic and financial measures, which in turn led to a halt in IMF negotiations. In the event, the government became ineffectual and, following the Aug. 4 explosion, tendered its resignation, creating another political vacuum.

What explains the political class’s inaction?

There are three likely explanations. First, an intractable political environment that makes collective decision-making difficult, especially given the size of the losses that need apportioning. Second, Lebanese political parties are “agents and not principals,” effectively acting as messengers of regional and international players who are currently not incentivized to solve the Lebanese crisis. Third, paralysis reflects an active decision by the political class to do nothing: high inflation, exchange rate depreciation, and deposit “lirafication” shift the burden onto the population at large and away from the interests of the oligarchy. Regardless of which of these reasons dominates, policy neglect is creating seismic political shifts that will eventually threaten the survival of the current political class.

Where do we go from here?

Predicting how the crisis evolves from here is difficult, but we can frame the contours of the likely outcomes around three different scenarios.

The worst-case scenario is a continuation of the path of “ malign neglect .” While not our baseline, we see the probability of this scenario playing out as reasonably high. This scenario allows for a continuation of the ongoing but extremely insidious process of “auto-adjustment” of macroeconomic imbalances, albeit in a very sub-optimal and regressive manner, and with a long-term negative impact on growth and the social fabric of the country. Left to its own devices, the economy will generate an alarming acceleration of youth and skilled labor emigration, and enterprise closures. The currency will become further un-anchored, hyperinflation will wipe out incomes and wealth, and food and medical shortages will escalate, requiring rising levels of humanitarian support. The security situation will inevitably deteriorate into, at best, a state of lawlessness and, at worst, organized armed conflict of the kind the country has experienced in the past.

The best-case scenario involves a political consensus around a comprehensive economic program, on which basis a credible and independent government with emergency legislative powers is formed. Such a cabinet would start with a short-term stabilization program involving tightening of liquidity, arresting the fiscal implosion, officializing capital controls, and obtaining an urgent bridge loan under the umbrella of an IMF Stand-By agreement. The cabinet would also commit to a three-year program that would restructure the debt, recapitalize the banking sector, streamline the public sector, and enact “real economy” reforms that would put the country on a recovery path.

At this juncture, we assign to this positive scenario a very low probability of coming to fruition. Indeed, such an ambitious program, albeit essential for the long-term survival of the country, will almost certainly be rejected by an entrenched political class and vested interests, who would see it as political suicide.

The most likely scenario lies somewhere in the middle and involves the formation of a “traditional” (as opposed to independent) government, with the backing of all political parties. A shift in regional dynamics (with the promise of an Iran/U.S. rapprochement) may open a space for domestic compromise. Furthermore, the magnitude of the recent economic collapse may have created enough fear among local players regarding their political survival, that they may be willing to implement some difficult measures.

Under this middle scenario, the government would only have limited room for maneuver and will remain hostage to the political class and associated vested interests. It would not have the political muscle (or willingness) to put in place the structural transformation required by the country and would be unlikely to adhere (on an ongoing basis) to the conditions of an IMF program . With elections planned in 2022, political parties would block measures required to put the economy on a sustainable path, including reducing subsidies, restructuring the banking sector with an even distribution of the massive losses across the various segments of the economy and population, and cutting government spending and raising taxes. As such, although this middle-of-the-road scenario may stabilize the situation in the short run (and may even mobilize some limited foreign funding), it has little chance of allowing the country to genuinely turn the corner.

Lebanon is facing an existential moment. Over the short term, the best one can hope for is a “muddle through” scenario (with limited foreign financial support) that arrests the economic collapse. In the medium term, the 2022 parliamentary elections, if they are held on time, and the hoped-for resolution of regional crises may open up a window for the emergence of a new leadership that can finally put the country on the trajectory of prosperity it so deserves.

Amer Bisat is Head of Sovereign and Emerging Markets (alpha) at BlackRock and a former IMF economist. Marcel Cassard was the global head of Fixed Income and Economics Research at Deutsche Bank and a former IMF economist. He is a member of LIFE's Advocacy Committee. Ishac Diwan is professor of economics at the École Normale Supérieure in Paris and a former Director at the World Bank. The views expressed in this piece are their own.

Photo by JOSEPH EID/AFP via Getty Images

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click her e .

World Economic Situation and Prospects 2022

LDC resources

- List of LDCs

- Reports and Resolutions

- Analytical documents

- Impact Assessments

- Vulnerability Profiles

- Monitoring Reports

- Country Snapshots

Committee for Development Policy

- CDP Members

- CDP Resources

- News & Events

- Least Developed Countries (LDCs)

CDP Documents by Type

- Reports & Resolutions

- Policy Notes

- LDC Handbook

- Background Papers

- CDP Policy Review Series

CDP Documents by Theme

- Sustainable Development Goals

- Financing For Development

- Productive Capacity

- Social Issues

- Science & Technology

- Small Island Developing States

- Fraud Alert

- Privacy Notice

- Terms of Use

Presentations made painless

- Get Premium

114 Economic Crisis Essay Topic Ideas & Examples

Inside This Article

The global economy has faced numerous challenges throughout history, with economic crises being a recurring theme. From the Great Depression of the 1930s to the more recent financial crisis of 2008, these events have had far-reaching impacts on societies around the world. If you are studying economics or simply interested in learning more about this topic, here are 114 economic crisis essay topic ideas and examples to consider:

- The causes and consequences of the Great Depression

- The role of government intervention in economic crises

- The impact of the 2008 financial crisis on the global economy

- The role of the International Monetary Fund in responding to economic crises

- The effects of inflation on an economy

- The relationship between unemployment and economic crises

- The impact of technological advancements on economic stability

- The role of trade policies in preventing economic crises

- The effects of income inequality on economic growth

- The impact of climate change on economic stability

- The role of central banks in managing economic crises

- The effects of government debt on economic stability

- The impact of globalization on economic crises

- The role of consumer spending in economic recovery

- The effects of currency devaluation on an economy

- The relationship between political instability and economic crises

- The impact of natural disasters on economic growth

- The role of education in preventing economic crises

- The effects of corruption on economic development

- The impact of population growth on economic stability

- The relationship between health outcomes and economic crises

- The effects of technological unemployment on economic growth

- The role of entrepreneurship in economic recovery

- The impact of government regulation on economic stability

- The effects of income tax policies on economic growth

- The relationship between housing markets and economic crises

- The impact of energy prices on economic stability

- The role of infrastructure investment in preventing economic crises

- The effects of financial market speculation on economic growth

- The impact of trade wars on global economic stability

- The relationship between education levels and economic crises

- The effects of demographic shifts on economic growth

- The role of healthcare costs in economic stability

- The impact of automation on job markets and economic growth

- The effects of government subsidies on economic development

- The relationship between social welfare programs and economic crises

- The impact of government corruption on economic stability

- The role of corporate governance in preventing economic crises

- The effects of natural resource depletion on economic growth

- The impact of foreign aid on economic stability

- The relationship between income inequality and economic crises

- The effects of currency manipulation on economic growth

- The role of financial regulations in preventing economic crises

- The impact of sovereign debt crises on global economic stability

- The effects of tax evasion on economic development

- The relationship between climate change policies and economic crises

- The impact of fiscal stimulus on economic growth

- The role of monetary policy in preventing economic crises

- The effects of trade imbalances on economic stability

- The impact of income tax cuts on economic growth

- The relationship between government spending and economic crises

- The effects of austerity measures on economic development

- The role of economic sanctions in preventing economic crises

- The impact of income redistribution on economic stability

- The effects of financial deregulation on economic growth

- The relationship between consumer confidence and economic crises

- The impact of technological disruptions on job markets and economic stability

- The effects of social unrest on economic development

- The role of economic forecasting in preventing economic crises

- The impact of demographic changes on economic growth

- The relationship between healthcare costs and economic crises

- The effects of government debt levels on economic stability

- The impact of trade agreements on economic growth

- The role of financial market volatility in preventing economic crises

- The effects of income tax reform on economic development

- The relationship between energy prices and economic crises

- The impact of government subsidies on economic stability

- The effects of labor market regulations on economic growth

- The role of income inequality in preventing economic crises

- The impact of technological advancements on job markets and economic stability

- The effects of government corruption on economic development

- The relationship between infrastructure investment and economic crises

- The impact of healthcare reform on economic growth

- The role of social welfare programs in preventing economic crises

- The effects of climate change on economic stability

- The relationship between financial market speculation and economic crises

- The impact of government regulations on economic growth

- The effects of currency devaluations on job markets and economic stability

Want to create a presentation now?

Instantly Create A Deck

Let PitchGrade do this for me

Hassle Free

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2023 Pitchgrade

Home / Essay Samples / Economics / Economic Crisis

Essays on Economic Crisis

The global economic crisis: ripples and repercussions.

A global economic crisis is a daunting and far-reaching event that brings severe downturns in the world's economic activity, affecting numerous countries and industries simultaneously. In this essay, we will delve into the defining features of a global economic crisis, its underlying causes, and the...

Philippine Economic Crisis: Unveiling Realities

The Philippines has faced several economic crises throughout its history, each presenting unique challenges and implications for the nation's growth and development. This essay will explore the causes of economic crises in the Philippines, their impact on various sectors, and the measures taken to address...

Understanding the Dynamics of an Economic Crisis

An economic crisis is a severe and prolonged downturn in the economy of a country or region, characterized by a sharp decline in economic activity, widespread unemployment, and financial instability. It is a situation that disrupts the normal functioning of an economy and can have...

Trying to find an excellent essay sample but no results?

Don’t waste your time and get a professional writer to help!

You may also like

- Consumerism

- Cosmetology

- Enron Scandal

- Socioeconomic Status

- Cultural Capital

- Capitalism Essays

- Materialism Essays

- Income Inequality Essays

- Nafta Essays

- Brexit Essays

- Microeconomics Essays

- Economic Inequality Essays

- Supply and Demand Essays

- Comparative Advantage Essays

- Economic Development Essays

samplius.com uses cookies to offer you the best service possible.By continuing we’ll assume you board with our cookie policy .--> -->