Covering a story? Visit our page for journalists or call (773) 702-8360.

UChicago Class Visits

Top stories, national study finds in-school, high-dosage tutoring can reverse pandemic-era learning loss, ethan bueno de mesquita appointed dean of the harris school of public policy, course on afrofuturism brings together uchicago students and community members, behavioral economics, explained.

Behavioral economics combines elements of economics and psychology to understand how and why people behave the way they do in the real world. It differs from neoclassical economics, which assumes that most people have well-defined preferences and make well-informed, self-interested decisions based on those preferences.

Shaped by the field-defining work of University of Chicago scholar and Nobel laureate Richard Thaler, behavioral economics examines the differences between what people “should” do and what they actually do and the consequences of those actions.

Jump to a section:

What is behavioral economics, what are the origins of behavioral economics research, and who are tversky and kahneman.

- What role have Richard Thaler and University of Chicago economists played in the development of the field?

What is a “nudge” in behavioral economics?

Guide to behavioral economics terms.

Behavioral economics is grounded in empirical observations of human behavior, which have demonstrated that people do not always make what neoclassical economists consider the “rational” or “optimal” decision, even if they have the information and the tools available to do so.

For example, why do people often avoid or delay investing in 401ks or exercising, even if they know that doing those things would benefit them? And why do gamblers often risk more after both winning and losing, even though the odds remain the same, regardless of “streaks”?

By asking questions like these and identifying answers through experiments, the field of behavioral economics considers people as human beings who are subject to emotion and impulsivity, and who are influenced by their environments and circumstances.

This characterization draws a contrast to traditional economic models that have treated people as purely rational actors—who have perfect self-control and never lose sight of their long-term goals—or as people who occasionally make random errors that cancel out in the long run.

Several principles have emerged from behavioral economics research that have helped economists better understand human economic behavior. From these principles, governments and businesses have developed policy frameworks to encourage people to make particular choices.

Behavioral economics has expanded since the 1980s, but it has a long history: According to Thaler, some important ideas in the field can be traced back to 18th-century Scottish economist Adam Smith.

Smith is often remembered for the concept of an “invisible hand” that guides an overall economy to prosperity if each individual makes their own self-interested decisions—a key concept in classical and neoclassical economics. But he also recognized that people are often overconfident in their own abilities, more afraid of losing than they are eager to win and more likely to pursue short-term than long-term benefits. These ideas (overconfidence, loss aversion and self-control) are foundational concepts in behavioral economics today.

More recently, behavioral economics has early roots in the work of Israeli psychologists Amos Tversky and Daniel Kahneman on uncertainty and risk. In the 1970s and ’80s, Tversky and Kahneman identified several consistent biases in the way people make judgments, finding that people often rely on easily recalled information, rather than actual data, when evaluating the likelihood of a particular outcome, a concept known as the “availability heuristic.” For example, people may think shark or bear attacks are a common cause of death if they’ve read about one such attack, but the incidents are actually very rare.

With “prospect theory,” Tversky and Kahneman also demonstrated that framing and loss aversion influence the choices people make. For example, if presented with an opportunity to win $250 guaranteed or gamble on a 25% chance of winning $1,000 and a 75% chance of winning nothing, most people will choose the sure win. But if presented with the chance to lose $750 guaranteed or a 75% chance to lose $1,000 and a 25% chance to lose nothing, most people will risk losing $1,000, hoping for the slim chance that they will lose nothing at all.

This classic example demonstrates that people are more willing to take a greater statistical risk if it means avoiding a $1,000 loss versus obtaining a $1,000 win, which contradicts expected utility theory. Prospect theory and other work by Tversky and Kahneman continues to inform many areas of behavioral economics research today.

What role have Richard Thaler and behavioral economists at the University of Chicago played in the development of the field?

In the 1980s, Richard Thaler began to build on the work of Tversky and Kahneman, with whom he collaborated extensively. Now the Charles R. Walgreen Distinguished Service Professor of Behavioral Science and Economics at the Booth School of Business, he is today considered a founder of the field of behavioral economics.

Thaler’s research in identifying the factors that guide individuals’ economic decision-making earned him the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel in 2017. His ideas stem in part from a series of observations he made in graduate school that led him to believe that people’s behavior deviated from traditional economic models in predictable ways.

For example, Thaler observed that he and a friend were willing to forgo a drive to a sporting event due to a snowstorm because they had been given free tickets. But had they purchased the tickets themselves, they would have been more inclined to go, even though the tickets would have been valued at the same price regardless, and the danger of driving in the snowstorm unchanged. This is an example of the “sunk cost fallacy”—the idea that people are less willing to give up on projects they have personally invested in, even if it means more risk.

Thaler is also known for popularizing the concept of the “nudge,” a conceptual device for leading people to make better decisions. A “nudge” takes advantage of human psychology and a number of other concepts in behavioral economics, including mental accounting—the idea that people treat money differently based on context. For example, people are more willing to drive across town to save $10 on a $20 purchase than $10 on a $1,000 purchase, even though the effort expended and the amount of money saved would be the same.

Thaler and other UChicago economists—including Leonardo Bursztyn, Josh Dean, Nicholas Epley, Austan Goolsbee, Alex Imas, John List, Susan Mayer, Sendhil Mullainathan, Devin Pope, Rebecca Dizon Ross and Heather Sarsons—continue to conduct empirical research, including field experiments, that explore behavioral economics from multiple angles.

In behavioral economics, a “nudge” is a way to manipulate people’s choices to lead them to make specific decisions: For example, putting fruit at eye level or near the cash register at a high school cafeteria is an example of a “nudge” to get students to choose healthier options. An essential aspect of nudges is that they are not coercive: Banning junk food is not a nudge, nor is punishing people for choosing unhealthy options.

Thaler’s ideas about nudges were popularized in Nudge: Improving Decisions about Health, Wealth, and Happiness , his 2008 book with former UChicago legal scholar Cass Sunstein, now of Harvard University. Businesses and governments, including the U.S. government under President Barack Obama, have adapted Thaler and Sunstein’s ideas about nudges into policy.

For example, automatically enrolling employees in 401k plans—and asking them to opt out rather than offering them the chance to opt in—is an example of a nudge to encourage better and more consistent saving for retirement. Another seeks to make organ donation standard practice, by requiring people registering for drivers’ licenses to indicate whether or not they are willing to donate.

The formal term Thaler and Sunstein use to describe a situation designed around nudges is “libertarian paternalism”—libertarian because it preserves choice, but paternalistic because it encourages certain behavior. In Thaler’s words: “If you want people to do something, make it easy.”

The availability heuristic refers to the idea that people often rely on easily recalled information, rather than actual data, when evaluating the likelihood of a particular outcome. For example, people may think shark or bear attacks are a common cause of death if they’ve read about one such attack, but the incidents are actually very rare.

Bounded rationality refers to the fact that people have limited cognitive ability, information and time, and do not always make the “correct” choice from an economist’s point of view, even if information is available that would point them toward a particular course of action.

This might be because they cannot synthesize new information quickly; because they ignore it and instead choose to “go with their gut”; or because they don’t have the time to fully research all options. The term was coined in 1955 by Nobel laureate and UChicago alum Herbert A. Simon, AB’36, PhD’43.

Bounded self-interest is the idea that people are often willing to choose a less-optimal outcome for themselves if it means they can support others. Giving to charity is an example of bounded self-interest, as is volunteering. While these are common activities, they are not captured by traditional economic models, which predict that people act mostly to further their own goals and those of their immediate family and friends, rather than strangers.

Bounded willpower captures the idea that even given an understanding of the optimal choice, people will often still preferentially choose whatever brings the most short-term benefit over incremental progress toward a long-term goal. For example, even if we know that exercising may help us obtain our fitness goals, we may put it off indefinitely, saying we will “start tomorrow.”

Loss aversion is the idea that people are more averse to losses than they are eager to make gains. For example, losing a $100 bill might be more painful than finding a $100 bill would be positive.

Prospect theory refers to a series of empirical observations made by Kahneman and Tversky (1979) in which they asked people about how they would respond to certain hypothetical situations involving wins and losses, allowing them to characterize human economic behavior. Loss aversion is key to prospect theory.

The sunk-cost fallacy is the idea that people will continue to invest in a losing project simply because they are already heavily invested, even if it means risking more losses.

Mental accounting is the idea that people think about money differently depending on the circumstances. For example, if the price of gas goes down, they may begin to buy premium gas, leading them to ultimately spend the same amount, rather than taking advantage of the savings offered by the lower price.

Related Experts

Richard Thaler

Sendhil Mullainathan

Nicholas Epley

More Explainers

Improv, Explained

Cosmic rays, explained

Thaler’s Nudge gets global attention— The University of Chicago

The Two Friends Who Changed How We Think About How We Think— The New Yorker

Richard H. Thaler Facts— The Nobel Prize

7 Richard Thaler Columns That Explain How Human Behavior Affects Economics— The New York Times

NBER Working Paper on Behavioral Economics

Behavioral economics from nuts to ‘nudges’— Chicago Booth Review

Related Topics

Latest news, big brains podcast: what dogs are teaching us about aging.

Department of Race, Diaspora, and Indigeneity

Eclipse 2024

What eclipses have meant to people across the ages

Dark matter

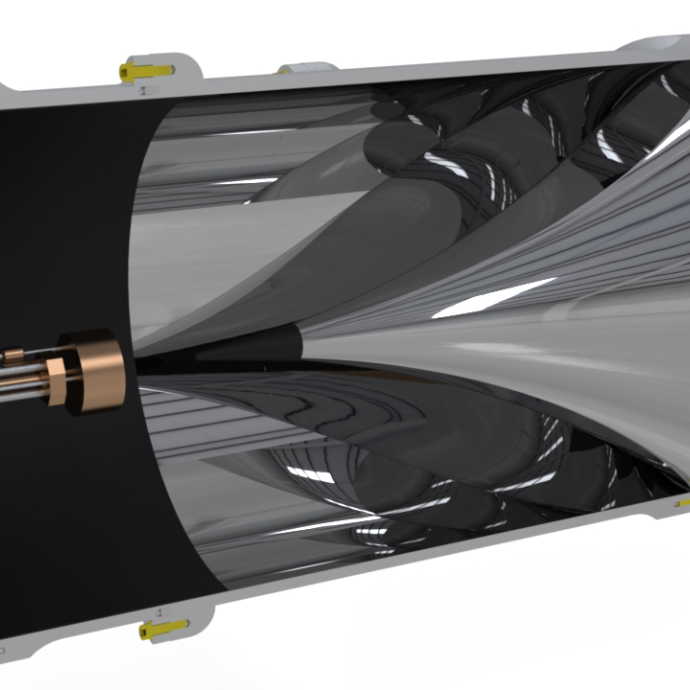

First results from BREAD experiment demonstrate a new approach to searching for dark matter

Where do breakthrough discoveries and ideas come from?

Explore The Day Tomorrow Began

Study finds increase in suicides among Black and Latino Chicagoans

Education Lab

Around UChicago

It’s in our core

New initiative highlights UChicago’s unique undergraduate experience

Alumni Awards

Two Nobel laureates among recipients of UChicago’s 2024 Alumni Awards

Faculty Awards

Profs. John MacAloon and Martha Nussbaum to receive 2024 Norman Maclean Faculty…

Sloan Research Fellowships

Five UChicago scholars awarded prestigious Sloan Fellowships in 2024

Convocation

Prof. John List named speaker for UChicago’s 2024 Convocation ceremony

The College

Anna Chlumsky, AB’02, named UChicago’s 2024 Class Day speaker

UChicago Medicine

“I saw an opportunity to leverage the intellectual firepower of a world-class university for advancing cancer research and care.”

Announcement

- Search Search Please fill out this field.

What Is Behavioral Economics?

Understanding behavioral economics, factors that influence behavior, principals of behavioral economics.

- Appications

- Behavioral Economics FAQs

The Bottom Line

- Behavioral Economics

What Is Behavioral Economics? Theories, Goals, and Applications

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Behavioral Economics is the study of psychology as it relates to the economic decision-making processes of individuals and institutions. Behavioral economics is often related with normative economics . It draws on psychology and economics to explore why people sometimes make irrational decisions, and why and how their behavior does not follow the predictions of economic models.

Key Takeaways

- Behavioral economics is the study of psychology that analyzes the decisions people make and why irrational choses are chosen.

- Behavior economics is influenced by bounded rationality, an architecture of choices, cognitive biases, and herd mentality.

- Behavior economics is crafted around many principles including framing, heuristics, loss aversion, and the sunk-cost fallacy.

- Companies use information from behavioral economics to price their goods, craft their commercials, and package their products.

- Starbucks' limited season drinks, Amazon's Lightning Deals, or "buy one, get one" promotions are all tied to behavioral economics.

Investopedia / Mira Norian

In an ideal world, people would always make optimal decisions that provide them with the greatest benefit and satisfaction. In economics, rational choice theory states that when humans are presented with various options under the conditions of scarcity , they would choose the option that maximizes their individual satisfaction.

This theory assumes that people, given their preferences and constraints, are capable of making rational decisions by effectively weighing the costs and benefits of each option available to them. The final decision made will be the best choice for the individual. The rational person has self-control and is unmoved by emotions and external factors and, hence, knows what is best for himself. Alas, behavioral economics explains that humans are not rational and are incapable of making good decisions.

Because humans are emotional and easily distracted beings, they make decisions that are not in their self-interest . For example, according to the rational choice theory, if Charles wants to lose weight and is equipped with information about the number of calories available in each edible product, he will opt only for food products with minimal calories.

Behavioral economics states that even if Charles wants to lose weight and sets his mind on eating healthy food going forward, his end behavior will be subject to cognitive bias, emotions, and social influences. If a commercial on TV advertises a brand of ice cream at an attractive price and quotes that all human beings need 2,000 calories a day to function effectively after all, the mouth-watering ice cream image, price, and seemingly valid statistics may lead Charles to fall into the sweet temptation and fall off of the weight loss bandwagon , showing his lack of self-control.

Behavioral economics and behavioral finance are often driven by many of the same factors, though behavior finance is often more related to financial markets.

History of Behavioral Economics

Notable individuals in the study of behavioral economics are Nobel laureates Gary Becker (motives, consumer mistakes; 1992), Herbert Simon (bounded rationality; 1978), Daniel Kahneman (illusion of validity, anchoring bias; 2002), George Akerlof (procrastination; 2001), and Richard H. Thaler (nudging, 2017).

In the 18th century, Adam Smith noted that people are often overconfident with their own abilities, noting "the chance of gain is by every man more or less over-valued, and the chance of loss is by most men under-valued, and by scarce any man, who is in tolerable health and spirits, valued more than it is worth.” In this sense, Smith believed individuals are not rational with their own limitations.

More recently, behavioral economics took shape as early as the 1960's when several economists identified key biases when recalling information. This idea called availability heuristic was explained by Amos Tversky and Daniel Kahneman, and it leads individuals to irrationally interpret data. For example, shark attacks tend to happen less than people think, but headlines may make people feel otherwise. Tversky and Kahneman are also credited with developing prospect theory, how people are potentially more adverse to losses as opposed to receiving an equal win.

Even more recently, Richard Thaler received the Sveriges Riksbank Price in Economics Science in 2017 for his work in identifying factors that guide individual' economic decision-making. Thaler's work included limited rationality, social preferences, lack of self-control, and individual decision-making.

There are often five factors that are cited when analyzing how individual behavior is influenced.

Bounded Rationality

Bounded rationality is the concept in which individuals make decisions based on the knowledge they have. Unfortunately, this information is often limited, whether by the individual's lack of expertise of lack of available information. In regards to finance and investing, the same public information is available to everyone, though investors may not know true circumstances of what is happening with a company internally.

Choice Architecture

People can be easily manipulated, and this is often on display in the way promoters craft incentives or deals to make consumers buy certain products. Consider how a cracker display may be presented right next to the cheese aisle within a supermarket. This type of design is meant to steer a consumer into making a decision based on a choreographed demonstration often between complementary goods.

Cognitive Bias

Whether people realize it or not, everybody makes decisions that are influenced by cognitive bias . Consider the choice of choosing between two companies to invest in. Behavioral economics holds the theory that the color of the logo, the name of the CEO, or the city in which each company is headquartered in may stir up an unknown bias that yields us to choose the other company.

Discrimination

In a similar light, behavioral economics is often associated with discrimination. People perceive things, events, or other people through their own lenses , potentially discriminating towards others because they simply favor a different alternative. This does not necessarily mean the alternative is a better option, though.

Herd Mentality

Many consumer decisions are influenced by what other people are doing. Whether it is the fear of missing out or whether others want to be part of a larger collective, herd mentality is the believe that individual decisions are swayed based on what other people do, not necessarily on what is the best outcome. After all, it is much easier rooting for your favorite team even if they haven't won a championship in a while as long as other fans share your pain.

The media plays a critical part in behavioral economics. Consider how a single headline can grab your attention and make you want to either pursue or avoid a product.

The field of economics is vast. Although behavioral economics is just a subset of the field, it itself has a number of guiding principles that dictate the themes within behavioral economics. Some of the primary principles and themes are listed below.

Framing is the principle of how something is presented to an individual. This behavioral economics concept presents a cognitive bias in that an outcome may be determined based on the structure of how something has been presented. Consider how someone may feel about the two following statements about Babe Ruth, both of which are describing the same thing:

- Babe Ruth failed to get a hit in nearly two-thirds of his at-bats.

- Babe Ruth, one of the greatest baseball players of all time, hit .342 in his lifetime.

Heuristics is a complicated field, but it simply means that humans tend to make decisions using mental shortcuts as opposed to using long, rational, optimal reasoning. Most often, people latch onto something is true that may no longer be the case. In this situation, it's easier for the consumer to continue what they've been doing as opposed to realize a more beneficial situation exists.

Loss Aversion

Behavioral economics is rooted in the notion that people do not like losses. In fact, people are loss averse to the point that an economic outcome of one financial value that is negative outweighs the emotional toll of the same financial value but positive. For example, some people feel there is much stronger negative emotions associated with losing a $20 bill compared to finding a $20 bill on the ground.

Market Inefficiencies

For lack of a better phrase, the market can take advantage of behavior economics. For this reason, market inefficiencies play a crucial part in behavior economics. Consider how overpriced stocks may still lure in investors due to drops in P/E ratios . Though the trading multiple may still be abnormally high, investors may think something in the market is more reasonable simply because it is lower. For example, a stock worth $20 may be trading at $50. Should the price to $40, investors may feel this is a great opportunity.

Mental Accounting

Consumers and investors may change their spending and trading tendencies based on circumstances. Though this is fair, often times it is illogical and shapes many aspects of behavioral economics. For example, after receiving one's annual bonus, an investor may choose to invest in riskier stocks. This mental accounting exercise led an investor to make a decision based on their circumstances, not their long-term strategy.

Sunk-Cost Fallacy

The sunk-cost fallacy is the emotional attachment to costs that have been incurred in the past. Consumers and investors tend to have a harder time "letting go" of failed investments or committed capital. Consider a failed stock that was purchased at $100/share that is now worth $15/share. An investor may not feel compelled to buy in at $15/share because they think the company is not worth that. However, they are unwilling to sell their shares bought at $100/share due to an emotional attachment to that committed capital.

When performing a cost/benefit analysis, sunk costs are ignored entirely. That is because the price has already been paid and, if it can not be recovered, it has no financial bearing on the future outcome of a decision.

Applications of Behavioral Economics

Financial markets.

One field in which behavioral economics can be applied to is behavioral finance, which seeks to explain why investors make rash decisions when trading in the capital markets . Much like how poker professionals not only study the mathematics and odds of poker, they also attempt to capitalize on the irrational nature of other players. The same can be said of financial markets.

Game Theory

When a decision made leads to error, heuristics can lead to cognitive bias. Behavioral game theory , an emergent class of game theory, can also be applied to behavioral economics as game theory runs experiments and analyzes people’s decisions to make irrational choices. This concept attempts to override illogical behavior to predict consumption outcomes.

Pricing Strategies

Companies are increasingly incorporating behavioral economics to increase sales of their products. In 2007, the price of the 8GB iPhone was introduced for $600 and quickly reduced to $400. By introducing the phone at a higher price and bringing it down to $400, consumers believed they were getting a pretty good deal, even if the true value of the product was only $400.

Product Packaging and Distribution

Consider a soap manufacturer who produces the same soap but markets them in two different packages to appeal to multiple target groups. One package advertises the soap for all soap users, the other for consumers with sensitive skin. The latter target would not have purchased the product if the package did not specify that the soap was for sensitive skin. They opt for the soap with the sensitive skin label even though it’s the exact same product in the general package.

Examples of Behavioral Economics

Payless shoes may be most known for their "buy one, get one" deals. If a consumer purchases one pair of shoes, the second pair is often discounted. Though a consumer may not need two pairs of shoes, the consumer may be unwilling to part ways with a discount.

One form of loss aversion and scarcity is Amazon's Lightning Deals. A consumer may not be willing to part ways with a product they don't even known. Because these Amazon deals are for a limited time only, a consumer faces the behavioral economics dilemma of buying the product or "losing" it. The seasonality of Starbucks' drinks is another example of a product consumers must buy now or miss out.

Last, turn on your television and almost every commercial contains framing. Note how car advertisements or splash pages like Tesla's website for its Model Y only point out the strengths of the vehicle.

What Do Behavioral Economists Do?

Behavioral economists work to understand what consumers do , why they make the choices they do and assist markets in helping consumers make those decisions. Behavioral economists may work for the government to shape public policy to protect consumers. Other times, they may work for private companies and assist in fostering sales growth.

What Is the Goal of Behavioral Economics?

The goal of behavioral economics is to understand why humans make the decisions they do . There are usually outcomes that are the best for people and many times, people do not choose that outcome. Behavioral economics is an incredibly complex and sometimes inexplainable science of why people do things and why they choose to not be rational.

What Is the Difference Between Behavioral Economics and Psycology?

Both behavioral economics and psychology refer to the dispositions, emotions, and decision-making of individuals. Behavior economics is a much more niche field that studies the financial decision-making of an individual, while psychology may cover any aspect of human rationality.

What Is the Downside to Behavioral Economics?

One downside to behavioral economics is that it can be used to deceive or manipulate people and their decision-making. Though people are often not rational, this irrationality may be predictable. Companies can choose to exploit this by packaging their products in a certain way, pricing their goods at specific levels, or customizing their marketing to attract certain markets.

Behavioral economics is the field of understanding why people do things financially that may be irrational. Blended between cognitive bias, heuristics, bounded rationalities and herd mentality, people tend to do things that may not always be in their best interest. This information can be used to price goods, package products, craft commercials, and generate promotional deals.

Journal of Economic Perspectives. " Adam Smith, Behavioral Economist ."

Science Magazine. " The Framing of Decisions and the Psychology of Choice ."

Nobel Prize. " Integrating Economics with Psychology ."

Baseball Reference. " Babe Ruth ."

Payless. " BOGO ."

Amazon. " Lightning Deals ."

Tesla. " Model Y ."

:max_bytes(150000):strip_icc():format(webp)/AdobeStock_267027141_Editorial_Use_Only-78fa38259c574676b40748b7f7a5c597.jpeg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Behavioral Economics

Behavioral Economics is the combination of psychology and economics that investigates what happens in markets in which some of the agents display human limitations and complications. We begin with a preliminary question about relevance. Does some combination of market forces, learning and evolution render these human qualities irrelevant? No. Because of limits of arbitrage less than perfect agents survive and influence market outcomes. We then discuss three important ways in which humans deviate from the standard economic model. Bounded rationality reflects the limited cognitive abilities that constrain human problem solving. Bounded willpower captures the fact that people sometimes make choices that are not in their long-run interest. Bounded self-interest incorporates the comforting fact that humans are often willing to sacrifice their own interests to help others. We then illustrate how these concepts can be applied in two settings: finance and savings. Financial markets have greater arbitrage opportunities than other markets, so behavioral factors might be thought to be less important here, but we show that even here the limits of arbitrage create anomalies that the psychology of decision making helps explain. Since saving for retirement requires both complex calculations and willpower, behavioral factors are essential elements of any complete descriptive theory.

- Acknowledgements and Disclosures

MARC RIS BibTeΧ

Download Citation Data

Published Versions

International Encyclopedia of SocialSciences, Pergamon Press, 1st edition, October 1, 2001: 1094-1100.

More from NBER

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

- Youth Program

- Wharton Online

- Business Journal Articles

- Student Essays

- The World Economy

An Intern’s Deep Dive into Behavioral Economics

Share Article:

Google Classroom:

Stephanie Cook is a rising high school senior at Fort Worth Country Day in Fort Worth, Texas, U.S. We first met Stephanie last summer when she won Round 3 of the Wharton Global Youth Comment & Win contest for her personal story about Taekwondo on the article Advice from New York Stock Exchange President Stacey Cunningham .

More recently, Stephanie reached out to us to pitch a personal essay about her growing fascination with behavioral economics . This type of economic analysis applies psychology to human behavior as a way of explaining economic decision-making.

In another Wharton Global Youth student essay that is yet unpublished, Rachit Surana, a high school senior at La Martiniere for Boys in Kolkata, India, explains behavioral economics like this: “ I’ve made an interesting observation when I go shopping with my grandmother. The available products are always changing. But I realize that we stop more often in the shops that offer wider selections of things to buy. That is expected, right? But here’s where it gets curious. We actually buy more often from the shops that provide fewer choices. This theory is called decision paralysis. Whenever our brain is faced with a complex decision, it either tries to take a shortcut or to avoid the decision entirely — so, when shopping we might buy less. In contrast, the shop with fewer options presents a simpler decision and thus better conversion.”

Stephanie has taken her economic interests a step further by immersing herself in field research through a remote internship at the University of Southern California’s Los Angeles Behavioral Economics Lab. She writes about her experiences in this personal essay.

On a daily basis, we are all confronted with one basic behavior – decision making. Have you ever thought about why you make certain decisions and if they are rational? I had never given much thought to the impact of my decision making until I started my remote internship in behavioral economics with Professor Brocas from the University of Southern California.

Let me back up a minute and explain how I even got interested in behavioral economics, which merges economics and psychology. Simply put, it studies and tries to understand decision making, in an attempt to make economic models more accurate.

We Are ‘Predictably Irrational’

Last summer, I attended a program called “ Economics for Leaders,” run by the Foundation for Teaching Economics. I fell in love with economics and using economic analysis to tackle public policy issues.

Soon after, I began my college tours. During my first visit to Duke University in North Carolina, I learned that Professor Dan Ariely was a highly regarded behavioral economist . Through my research, I bought and read his book, Predictably Irrational. It highlighted how humans make decisions without rationalizing their outcomes. A simple example is how we react to the promise of free products or services. We may jump at the chance to take advantage of a free day at the museum, but we don’t think about the long lines and hour-long wait to see one exhibit.

My research then led me to discover that a Nobel Prize in Economics was presented to Professor Thaler of Chicago University for developing “nudge theory”. This behavioral economic theory suggests that positive reinforcement and indirect suggestion can influence decisions and actions without people realizing what is happening to them. A practical example is of a grocery store placing arrows on the ground leading to the produce department. Research showed that this simple nudge resulted in nine out of 10 people following the arrows, and produce sales increasing significantly.

The more I learned about behavioral economics last summer, the more determined I became to finding an internship in the field. I explored whether or not any universities would take on a rising high school junior, rather than just graduate students who already had a college degree. I then stumbled across University of Southern California’s website for their Los Angeles Behavioral Economics Lab (LABEL). As I dug deeper into the website, I found that the school accepted visitors and on occasion, remote interns. So, I reached out to the director, Professor Isabelle Brocas, sent a résumé, and wrote an essay about my interest in this field and why I wanted to be involved.

It worked! For the past year, I have been working remotely from my home in Texas as an intern for LABEL. As a behavioral economics intern, my role is to summarize scientific literature reviews for Professor Brocas. A scientific literature review provides an overview and analysis of what has been published on a certain topic by accredited researchers. I usually prepare two-to-four literature reviews a month. I have spent my junior year researching how bilingualism affects decision making. My reviews help Professor Brocas conduct experiments, develop new experiment paradigms, plus support her findings.

“Condensing a scientific article from 20 pages to one page involves understanding how completeness, accuracy and editing work together. It takes time and practice!” — Stephanie Cook

The research I have read and summarized has allowed me to learn how monolinguals (people who speak one language) and bilinguals (people who speak two languages) differ in their decision-making process. The various methods of scientific testing have been incredibly enlightening in understanding how children, teens and adults inhibit, switch and suppress information.

Many experiments have shown that since bilinguals monitor and practice two languages, they are more successful in inhibitory control and switching control. These are scientific terms that refer to the thought processes that permit someone to regulate their impulses. Effectively, being bilingual enhances decision-making. Studies consistently reveal that if you speak two languages, you have better problem-solving abilities and it challenges certain parts of your brain that focus on memory and reasoning. Speaking in another language shapes the way individuals think.

Embracing Statistics

How does this fit into economics? The big picture of studying the impact of bilingualism is to develop programs that increase cognitive skills in schools, so public finance and government spending are more effective. Studies in Canada have shown a positive impact between bilingualism and Gross Domestic Product , a key indicator used to gauge the health of a country’s economy.

Here are a few other valuable takeaways from my internship:

- Writing clearly and simply is critical to delivering a research article summary that a professor can rely on. Condensing a scientific article from 20 pages to one page involves understanding how completeness, accuracy and editing work together. It takes time and practice!

- Nearly every research paper I worked on displayed results tables with such mathematical concepts as mean scores, standard deviations and regression analysis. People assume that Statistics is the “easy math” in high school compared to Calculus. Professor Brocas has encouraged me to add Statistics to my senior schedule, and I now see the value of its application.

My research over the past year has opened my eyes to the area of decision-making. I am so intrigued by the “why” of decision-making and now want to understand the “what”. This summer I’m going to explore data science to understand what numbers tell us about the decisions we make.

I am excited to pursue economics in college, and I also want an interdisciplinary nature of study where economics can be studied with mathematics and then applied to business. My internship at USC’s Los Angeles Behavioral Economics Lab has helped me to make better decisions about my own interests and my future.

Related Links

- Foundation for Teaching Economics

- Los Angeles Behavioral Economics Laboratory

- Prof. Richard Thaler Wins Nobel Prize in Economics

Conversation Starters

What is behavioral economics?

How did Stephanie Cook build on the summer program she attended? How is she truly acting on her interests and not just checking a box?

10 comments on “ An Intern’s Deep Dive into Behavioral Economics ”

I think Behavioral Economics as a school of thought has much more to offer than the general economic theories which assume consumers to be rational, since it’s no doubt that the smartest creatures on earth are not so smart while making decisions, being influenced by forces like brand value, social acceptance, etc. than the actual utility.

But then again, if people were rational, then ‘Advertising’ as a discipline would not even exist as no influence would be able to change their decisions based on achievement of utility.

Already being in the process of opening a start up, I can easily say that it would have been impossible to create a strong marketing front without knowing anything about consumers and their reactions.

And it’s not only business, the economics of behaviour has endless possibilities. Say, being a part of the KWHS Investment Competition, creating and developing a good strategy was one thing, but I personally believe that a bit of study and knowledge about how to present the real deal and what all could convince the judges and the audience of the essence of the strategy is what actually helped me and my team ‘ Filter Coffee Investments’ to bag the global round one in the 2019 edition of the same competition.

All I mean is that behaviour economics is the key to humans. It can tell you everything about a person, his decisions and reactions. And that one strong key that one needs to crack the lock of successful marketing.

I agree with Dipit G. that Behavioral Economics is special because we need to consider consumers’ thoughts in a way that directly involves the influence of emotions and feelings. I also agree that we, as human beings, are the smartest creatures. Moreover, based on Stephanie’s experience, Dipit G. thinks of his own experience of taking part in KWHS, which is really encouraging.

But what I disagree with his comment is that we are not always smart enough to make rational decisions because we are constantly influenced by factors such as brand value, social acceptance, etc. than actual utilities. I do not think there is anything shameful about being influenced though. First, influence is not always a bad thing. Also, emotions and ethics from ethic and preference do not mean that the decision is irrational. For instance, according to data released by IDC, Chinese people prefer to buy HUAWEI phones instead of iPhone these days because of their preference for the Android System, rising patriotism, and price considerations. Is that irrational? Is iPhone better than HUAWEI? This kind of questions are hard to answer. Also, why we will pay more for “brand value”? Because in a long history of the brand, it always had high quality and confirmed by customers, so brand value is the proof of good quality. Moreover, these things can always improve the actual utility. For instance, clothes are always similar and the uses of them are covering, keeping warm and decorating. However, the price of T-shirts ranges from 15 dollars to 500 dollars, because of brands or design. Design and brand value do not offer actual utility. Yet, sometimes people are benefited from them. With our experience, we know that formal and fancy suit can improve the chance to trade successfully because it is fit to your social class and wealth level. Another thing that I need to mention is the use of advertising. It is so narrow to declare that “if people were rational, then ‘Advertising’ as a discipline would not even exist as no influence would be able to change their decisions based on achievement of utility”. We need to understand the use of advertising: help people to know better about products. It is not always irrational to believe advertisement. In the end, I disagree this sentence“It can tell you everything about a person, his decisions and reactions”, because it is too absolute.

Hereinbefore, these are my ideas about the comment of “Dipit G”. Furthermore, I have my own thoughts about this article.

Stephanie Cook’s experience to learn and pursue the knowledge she wanted is really impressive and inspiring. At the same time, the explanation of Rachit Surana with the example of shopping is easy to understand. Through the article, I knew the existence of LABEL. Also, I knew the work of Stephanie and have a glance at “nudge theory” with a vivid example. Moreover, I can feel the strong and firm determination of her to study this area and how hard she worked. In the end, I understand the importance of math and statistics of economics and how data worked to help analyze.

In short, I learned a lot from the article. If a person really wants to study something, no matter how difficult, he will always hold on to it. The experience is super inspiring and I knew some new way to study economics and get the chance to pursue knowledge. I am from Xinjiang, which is the northwest corner of China. Sometimes, it is difficult for me to get this kind of chance to study economics and finance in high school. Fortunately, I have kept pursuing my dream for many years and have never given up. Finally, with the help of internet, I can get the chance to study this knowledge and know about KWHS. Behavioral Economics is a big but meticulous area in our daily life. From “nudge theory” to make decisions, they are all about Behavioral Economics. I do not agree that the final purpose of Behavioral Economics or other economics areas is only to maximize benefits. Instead, I believe the final goal is to help people, no matter sellers or buyers, find the balance in economics life. I do not want people to ignore emotions and feelings when they considered economics because money and feelings are all valuable. Behavioral Economics can help sellers make more suitable tactics to fit the market and help buyers do the decision that they won’t regret. All in all, after I opened the door of economics and finance world, I am pretty sure this is my future major and career choice. I will hold on my dream and endeavor to pursue it like what Stephanie do.

You raise several intriguing points, Xiangxin! I’ve also noticed that “brand value” chiefly affects a consumer’s perceived value of the product. I remember reading a Time article, which mentioned the heaps of zany, pricey fashions that high-end designers are able to sell. From an emblazoned dry cleaning bag to a $290 paper bag, it’s clear that neither the designer’s nor the consumer’s choices are completely transparent. I also reckon that Cook demonstrated a stellar initiative to pursue her passion, and to seek such a fascinating opportunity. This article has also raised my interest in the field of Behavioral Economics, and I think that your own enthusiasm is quite admirable!

Stephanie, this was a great article to read! Seeing how your interest in behavioral economics has led you to pursue amazing opportunities is absolutely inspiring.

What I loved most about your article was learning about behavioral economics. I’ve never heard of the subject before, but was thrilled to realize that I am familiar with its concept. While reading, I was reminded of an interview I read about in the PennToday newsletter featuring Patti Williams, Wharton Professor of Marketing, and felt like it offers an interesting perspective on behavioral economics. It’s titled, “How shopping became a version of social impact” and discusses how shoppers increasingly want meaning from their purchases. Factors such as brand sustainability have increasingly begun to affect purchasing decisions made by millennials, demonstrating how young consumers purchase things that are consistent with and help expand upon their own values and beliefs, rather than solely for the physical attributes of products and services. Though this phenomenon is more intentional than nudge theory and your research in monolingual vs. bilingual decision-making in the sense that consumers are making a more proactive decision to shop from sustainable brands, I believe it is a valuable example of behavioral economics in a different lens. It is valuable because it outlines two human behaviors which I think play a key role in the study of behavioral economics.

The first behavior is self-actualization from Maslow’s hierarchy of needs. As Dr. Williams states, “This notion of self-actualization… means to find my place in the world in even very mundane, everyday activities. And I think it’s part of economic development, part of a changing cultural ethos about what matters to us.” To an extent I agree with Dr. Williams’ perspective, because I indeed feel as though consumers have increasingly become concerned with sustainability, especially with the media projecting immense concerns about climate change and environmental degradation. However, the second behavior I would like to point out is the self brand connection (SBC) construct, in which brand associations are used to construct one’s self or to communicate one’s self to others; I believe it is essential to acknowledge the SBC construct in response to Dr. William’s point, because it highlights a deeper desire to enhance one’s identity, rather than one of pure altruism. Sustainability has become a trend, especially due to stigmas surrounding fast-fashion and its pollution-prone business model, causing consumers to feel the need to shop at sustainable brands in order to construct a with-the-times identity. Arguably, this is not true of all consumers, however, it is an important aspect of today’s fashion industry and provides a different perspective to behavioral economics.

I am incredibly interested in other perspectives, so what is your take on behavioral economics? What examples have you seen in your day-to-day lives?

Wow! What fantastic comments you have all made to my article. I thank you for taking the time to read my essay and adding your views and thoughts.

Let me comment on what seems to be a common thread – behavioral economics and consumer spending/investing. Dipit G discussed his investing strategy while John M kindly provided a link to behavioral finance. Xiangxin and Serene further elaborated on brand value, and Rachel highlighted shopping and social impact.

I recently read an article in Behavioral Public Policy and McKinsey Quarterly about how our personal biases along with factors such as music, temperature and physical markers impact how consumers make decisions. From sustainable consumption to investment decisions to food choice, understanding consumer behavior helps businesses nudge people to make smarter, better and sustainable choices. I agree with Dipit in that understanding human behavior guides successful marketing. However, it is important to understand that consumer behavior is shaped by irrational decision making.

Let us look at the example of behavioral investing. One behavior that is irrational and causes many investors to get into trouble is known as “herding”. If there is buzz about a particular stock and everyone is focusing on the price rising, your decision is more about following the crowd rather than logically looking at your financial goals and risk tolerance. Think about market “bubbles” – there is nothing rational about them. Conversely when everyone is selling, you may choose to do the same for fear of losses. Are you thinking long term or short term? Positive and negative feelings plus emotional attachment to stocks can trigger irrational decision making in the stock market. What strategies can a financial advisor or investment firm put in place to mitigate an investors irrationality? John’s link to Charles Schwab client advising strategy using biagnostics is fascinating because the organization takes into account emotional bias.

Rachel discusses sustainability and the millennials wanting to purchase such products that represent their values. How does a corporation or business nudge millennials or Generation Z to purchase their product, given millennials value their time and collaboration? There is a term called “nano marketing” which is a subtle nudge by using influencers to talk about credible brands. Think about Instagram and what products appeal to your emotions plus what social proof you value.

Remember, economic choices are shaped by emotions. I wonder what will appeal to you and me who are Generation Z!

Hi Stephanie, thank you for the continued insight! I find it very interesting that you mention the impact of influencers, because I just read an article from Harvard Business Review that states, “In 2018, 19% of all U.S. consumers — including 36% of those aged under 25 — purchased a product or service because a social media influencer recommended it.” In this day and age, this form of “nano marketing” definitely seems to be working. Thinking about how exactly influencers succeed in driving brand sales, I would agree that the economic choices that we make are shaped by emotions. The influencer value proposition is based on the premise of promoting a lifestyle, seamlessly wearing or using a product as if it has always been a staple element in their life, rather than simply selling it. I see this most with Curology, the personalized skincare provider, who has been one of the first skincare brands to disrupt the digital market using influencers such as YouTuber Emma Chamberlain. By having these influencers attest to both the physical and emotional impact Curology’s skincare product has made on their lives, they create a connection with their viewers and followers. Being able to relate to their problems with acne, for example, and the emotional baggage that comes with it, even I have felt incredibly moved, causing me to purchase my own Curology shipment. The brand’s mission in and of itself -providing affordable personalized skincare products- is a testament to the power of emotion in economics, because personalized products hit closer to the heart than generic ones. If a brand can make you feel something, whether that be through an influencer or simply through the product that they offer, they are a step ahead than those that don’t, demonstrating the driving force of emotions in decision-making.

I’d love it if this discussion would continue, because I find this subject to be incredibly interesting; so here are some questions: what are some of the negative emotions that play into the way we shop? When an Instagram post is deemed as an #ad, do you feel positively or negatively about the brand or influencer?

Hi Stephanie! After reading the article and your active comment section, I have really come to admire your research efforts and your passion in economics, which you have obviously incorporated into your everyday life. Thanks to you guys, I have learned a lot of valuable information and want to contribute to the discussion by providing my own experience and perspective of behavioral economics.

Believe it or not, I also participated in the summer program Economics For Leaders. The different activities we took part in really made me look at economics differently. I realized that not all theories I learned from AP Econ the previous year were applicable to solving real business and financial dilemmas. However, by observing and experimenting with other students, I began to see decision making as a play on the human mind. The influence from others, the values we believe in, our cultural, socioeconomic, and family background… There are millions of factors that influence our choices and behavioral economics helps us understand how these choices play a role in altering conventional economic theories and models.

Interested and excited about my new interest in behavioral economics, I tried to incorporate this subject area outside the summer program. Last summer, I had the honor to assist Professor Jin Xin from the University of South Florida with a unique and intriguing research – Terrorist Attacks and the Labor Market Outcomes of Immigrants. My work involved collecting statistical data on terrorist attacks for analysis of the labor market outcomes of immigrants. Noting a general trend of growing unemployment for non-white immigrants three months following any such attack, I stared at the numbers and pondered the psychology behind them. Based on the rational thinking model favored by economics theorists, low-paid immigrant employees should be in higher demand in the labor market. So how then should we take into account human behaviors and irrational decision-making when assessing economic conditions? It can be assumed that, to many employers, rising threats of terrorism and their safety have offset the benefits of lower costs for their businesses.

Instead of basing every theory on the assumption of rational customers and controlled environments, behavioral economics takes a closer look at actual human behaviors. It is a more complex and advanced method of examining our society for it takes into account both empirical analysis of psychological behaviors and its impacts on economic models. Behavioral economics is an ever-changing subject as it always sparks new observations and theories as the world progresses. Therefore I believe that although it is a relatively new area of study, it has great potential for development.

Splendid work, I couldn’t say much, because of enough viewpoint on your post. Your work on behaviour economy helps me a ample to understand Behaviour economy in another method.

Hi Stephanie! I actually relate to you a lot while reading this essay, from taking action on your interests to your excitement about behavioural economics. As one of the first students to learn the new IB Economics syllabus, behavioural economics was my favourite section out of all the latest knowledge added. I totally agree with your concept about “we are ‘predictably irrational'”, and it’s exactly how I often fell for pushy salespeople in cosmetic stores. For example, adding up to your point, the bounded self-control I have, which is one of the characteristics of irrational consumers. Rationally, we know how much and what to buy. However, with the pricing strategies and the salesperson keep telling you that “after you buy one more product, then you can have another discount off”, or “this product really suits you”, I just can’t control myself to buy one more product. This discount reward just goes on forever, making you buy more than you need, acting predictably irrational, as Stephanie mentioned. After learning Behavioural Economics, I suddenly realized how the nudge theories and analyzing consumer behaviours are essential for business. But this also leads us to our branches in interest. Rather than being triggered on “why” and “what” of decision making, I focus on the “what’s next” and “how to apply” part of decision making, which is the marketing and strategic part of the business. Following about marketing, this brings us to our second similarity: striving for opportunities to take action on our interest. “I explored whether or not any universities would take on a rising high school junior, rather than just graduate students who already had a college degree.” This just strikes me as it reminds me of my experience recently. Getting marketing internships has been on my bucket list since I’ve discovered my target to work in this industry. Still, I’ve pushed this target to my uni life list. I’ve realized how firms only hire undergraduate students for summer internships due to legal protection and knowledge level issues. But, an opportunity suddenly showed up. During the school’s career festival, a CEO from a digital marketing company was invited to give a share. During the Q&A section, I actually raised my hand and asked if they would accept a high school student for internships. Then, guess what? After several rounds of communication, the CEO asked for my resume regardless of all the issues and challenges about hiring a high school intern. Reading about your internship experience excites me more for mine happening in the coming summer, and I totally support your interest in pursuing your interest. Also, it’s so motivating after knowing that you will be studying related subjects in college. Hopefully, I can also study marketing with the consumer psychology minor in my dream school (whispering, Wharton). Anyways, this is not the main point of the comment, but your comment is just driving me to pursue what I want to be with the experiences you are sharing. Your fascination with behavioural economics and your steps of digging into your passion shows that you are definitely someone I wanted to know. So, after two years of your essay, I’m curious about how you are doing recently and where you are reaching your goal of doing the interdisciplinary study?

Thank you for your commentary. I am so excited to hear about your marketing internship. The greatest saying in my house (the Cook mantra) is “if you don’t ask, you don’t get”. I’m glad you raised your hand and didn’t just accept the status quo about internships. The summer before my senior year I completed another internship with a financial advisor and came to nearly winning a nine month investment competition. It changed my trajectory of study and made me reassess my interdisciplinary thinking.

As I began the college search process, I decided that I wanted to do an undergraduate business degree rather than an economics degree. Business to me was more broader and suited my mathematical strengths and problem solving skills. While behavioral science was fascinating, I was beginning to take more interest in the complexity of how markets operate, the role of data, and even supply chain management.

Since writing the article, I achieved my goal of being accepted into USC and many other prestigious business schools. I am now a rising sophomore in the business honors program at McCombs Business School at UT Austin – which I love!! I have learned that there is so much to explore at college and you can start with one idea/passion (interdisciplinary studies) and find yourself enjoying something else completely (finance).

My advice to you is take your time to explore the many facets of business and if you are interested in marketing think about complimentary majors such as strategic communication as well as psychology. A great resource I recommend is the website ama.org (American Marketing Association).

I wish you all the best in your internship and future studies!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Articles

Educator toolkit: the entrepreneurial mindset, that crazy cryptocurrency.

behavioural economics Recently Published Documents

Total documents.

- Latest Documents

- Most Cited Documents

- Contributed Authors

- Related Sources

- Related Keywords

Hobo Economicus

Abstract The central implication of maximising behaviour amid competition is that rates of return tend toward equality. We test that implication in a market whose participants have the traits that behavioural economics suggests should make it hardest to find evidence of maximisation: the market for panhandling at Metrorail stations in Washington, DC. We find that stations with more panhandling opportunities attract more panhandlers and that cross-station differences in hourly panhandling receipts are statistically indistinguishable from zero. Panhandling rates of return thus tend toward equality. Extreme ‘behavioural’ traits do not prevent maximisation in this market.

Political Economy Inside the Strategy of Line Game

In today's world, the concept of the game and game theory is turned into new methods of knowing and understanding some of the human behaviours followed by society. In the 21st century, behavioural economics plays a major role in understanding the concept of the `line' game and hence the strategies followed by it. It is a country game played in many parts of India. It is a two-person game with very simple rules and moves. It can be played indoors. Students play the game during the break-outs. The game keenly and minutely determines the objectivity of the game and the behaviour of the players involved inside the game and the way one starts moving helps the other players to understand what one is trying to portray through the game whether it is winning or losing. The strategies involved can be put forth and looked upon from different perspectives. Referring to one such perspective, it can be looked at from a concept of Pareto efficiency, a microeconomic concept. It helps develop logical skills and learn winning strategies.

HOW BEHAVIOURAL ECONOMICS CAN SUPPORT SCHOOLS IN THEIR FUNCTION OF BUILDING CHILDREN’S SOCIAL CAPITAL – PROBLEMS OF IMPLEMENTATION

This text describes the difficulties in implementing those activities of the model which are directly aimed at children. Most of them are carried out at school, but require the cooperation of many institutions at the same time: a social welfare centre, school, library or museum. This is one of the challenges of implementation. Another difficulty is the development of mechanisms at school through which teachers will be able to recognise that a pupil's problems in learning or in his/her relations with peers are due to certain negative patterns at home, and as a result he/she cannot count on the kind of support that children of parents who are higher in the social structure receive. In other words, the measures designed are intended to support the school to the extent that it provides social capital to children from disadvantaged families. The very specific circumstances of testing the above-mentioned actions were not without significance. This coincided with the period of the Sars-Cov-2 pandemic, which challenged the school's discharge of its basic duties towards its pupils. It is worth noting here that the school of the time of the pandemic has even fewer tools for equalising opportunities for children than in normal times.

Experimentální laboratoř PLESS

The PLESS laboratory was established in 2013 at the Faculty of Arts of Charles University. It provides both physical and online space for the implementation of research, a database of contacts for the recruitment of participants, and know-how for the technical support of studies. The created facilities are used by the members of the laboratory for their researches, in particular in the fields of experimental social psychology, psychology of decision-making, and behavioural economics. About all the studies carried out so far, the members of our team, and the studies currently under investigation topics we are working on, you can find out more at www.pless.cz.

The Dutch “Digi Commissioner” (2014-2018)

The Dutch governmental digital infrastructure (Generic Digital Infrastructure; GDI) is a vital element of state functioning. This article investigates the governance of the GDI as exemplified by the activities of the Digi Commissioner (officially the ‘National Coordinator Digital Government’). In 2014 the Digi Commissioner was made responsible for coordinating and re-structuring GDI-governance. Early 2018 his tasks were transferred to the Ministry of Interior Affairs. Some progress was made, but according to the Digi Commissioner himself the GDI still leaves much to be desired and is far from future proof. The article will discuss the Dutch digital infrastructure by adopting several perspectives. First, by defining and describing the development of the GDI. Second, by analysing the activities and achievements of the Digi Commissioner. Third, by applying behavioural economics and securitization concepts offering relevant insights with regard to the (lack of) GDI-progress.

Conceptual Framework of Behavioural Economics

The main purpose of this paper is to systematize the characteristics of behavioural economics, and, on this basis, to highlight the differences between behavioural economics and neoclassical economics. Special emphasis is placed on the differences between the real and the rational economic man. Attention is focused on economic choice modelling under the influence of behavioural economics and the emergence of the so-called limited rationality. The paper also presents the methodological tools of behavioural economics, as well as the principles on which it is built as a modern branch of economic theory.

Good ethics and bad choices: The relevance of behavioural economics for medical ethics. Jennifer S.Blumenthal‐BarbyMIT Press: Cambridge, MA, 2021. 251 pp. ISBN 978‐0‐262‐54248‐7. US $45.00 (Soft cover).

Lecture 10: rhetoric and behavioral economics.

Although behavioural economists are not rhetoricians, and rhetoricians are not behavioural economists, they are both interested in persuasion, even as they come at it from different points of view. Lecture 10 argues that behavioural economics examines our choice-making practices and considers how a range of influences works in concert with conventional economic interests to shape the procedures by which we come to decisions. These influences use rhetoric to nudge people to adopt particular beliefs, engage in specific behaviour, and endorse ideas believed to be in the public interest. Les économistes comportementaux ne sont pas rhétoriciens, et les rhétoriciens ne sont pas économistes comportementaux, mais ils s’intéressent tous les deux à la persuasion, même si leurs points de vue diffèrent. Le cours 10 soutient que l’économie comportementale examine notre manière de faire des choix et il considère comment un éventail d’influences, de concert avec des intérêts économiques conventionnels, façonne les procédures par lesquelles on prend des décisions. Ces influences utilisent la rhétorique afin d’inciter les gens à adopter des croyances particulières, adopter des comportements spécifiques, et appuyer des idées censées être dans l’intérêt public.

Sport as a behavioural economics lab

Discussion of citizen behavioural change using the nudge effect: a perspective based on social policy interventions.

PurposeThis study aims to present a communication model for promoting value co-creation between citizens and policymakers and to draw out proposals on the rationale in implementing nudge effect as well as key policy implications. The paper also revisits the close relationship between information senders and receivers (citizens) from the perspective of “citizen behaviour change” and focuses on the nudge effect, which strengthens the communication skills of policymakers (information senders) and accelerates the behaviour change of citizens (i.e. the recipients of information). Based on the study, the authors propose a conceptual framework to explain the spontaneous incentive structure of citizens.Design/methodology/approachThis study uses a conceptual discussion based on a literature review. It examines the nudge effect on citizen behaviour based on information and communications models and theories. From critical discussions of literature, it proposes an analytical model that focuses on the nudge effect put forward in behavioural economics and takes into account the importance of measures to increase the sensitivity and empathy of the recipients of information.FindingsThe authors revisited the relationship between information senders and receivers from the perspective of citizen behavioural change and focus on the nudge effect, which strengthens the communication power of policymakers and accelerates the behavioural change of citizens (i.e. the recipients of information). According to the study, the authors propose a conceptual framework to explain citizens' spontaneous incentive structure. The dual perspective of policymakers and citizens should be central to the collaboration between citizens and policymakers to enhance the effectiveness of social policies, where the scope and type of value generated and the perspective of social value are essential.Research limitations/implicationsThis paper bridges the interdisciplinary research fields of behavioural economics and social policy. It is hoped that the model proposed in this paper will be an effective discussion framework for relevant researchers and practitioners when considering human resource training and system building related to information dissemination. In addition, it is hoped the model will be an effective tool for deepening discussions on topics that help to facilitate information transfer and communication within organisations.Practical implicationsThe realisation of policy intentions within the core elements of the social policy process, such as the definition of key objectives, policy mechanisms and legislation, are central elements of policy formation and are said to be highly similar across countries. The framework proposed in this study is a valid resource that can be applied in other countries and can be expected to act an effective guidepost for policy makers and other stakeholders engaged in social policy.Originality/valueUp to this point, in examinations of encouraging behavioural change in information recipients, attention has been focussed on the aspect of increasing the sender's ability to transmit information. Interventions, such as increasing the energy of the delivery, increasing the frequency and diversifying the media to make a strong impression on the receiver's consciousness, have been considered and implemented. However, this study suggests that, in addition to such efforts on the part of the sender, it is important to increase the sensitivity and affinity of the receiver to the message as preliminary preparation to receiving it.

Export Citation Format

Share document.

- Faculty of Arts and Sciences

- FAS Theses and Dissertations

- Communities & Collections

- By Issue Date

- FAS Department

- Quick submit

- Waiver Generator

- DASH Stories

- Accessibility

- COVID-related Research

Terms of Use

- Privacy Policy

- By Collections

- By Departments

Essays in Behavioral Economics

Citable link to this page

Collections.

- FAS Theses and Dissertations [6136]

Contact administrator regarding this item (to report mistakes or request changes)

The wisdom of microeconomics and behavioral economics for the everyday individual to the abundance seeking entrepreneur The Infinite Knowledge Podcast

- Self-Improvement

This audio essay covers how microeconomic principles, such as supply and demand, opportunity cost, comparative advantage, marginal thinking, elasticity, and the recognition of the sunk cost fallacy, are pivotal for personal financial growth and decision-making. By applying these concepts, individuals can make more calculated decisions that align with their personal and financial goals. For instance, understanding supply and demand can lead to smarter purchasing decisions, while opportunity cost can be significant in managing time and resources more efficiently. Comparative advantage encourages focusing on one's strength and delegating other tasks, and marginal thinking helps evaluate the benefits of incremental change. Elasticity aids in flexible financial planning, while acknowledging the sunk cost fallacy can lead to more rational choices about when to let go of unprofitable endeavors. Behavioral economics brings to light how biases and psychological factors affect financial decisions. Identifying and countering biases like overconfidence improves the rationality of financial planning, while strategies like automatic savings align financial habits with personal goals. This combination of microeconomic principles and behavioral insights provides a comprehensive strategy for life planning and personal development. Individuals can manage resources better, maximize their unique skill sets, and make decisions that truly enhance their prosperity. These economic principles prove to be not just abstract notions but robust tools for smart living, blending discipline and flexibility in financial and career growth. Entrepreneurs also benefit from understanding how microeconomics meshes with behavioral economics. Concepts like bounded rationality and prospect theory can deeply influence marketing and pricing strategies. Framing effect, nudge theory, heuristics and biases, loss aversion, social proof, and the sunk cost fallacy all provide insights into consumer behavior that can be leveraged to drive business success. For instance, simplifying options for consumers, employing pricing tactics that focus on potential losses, making use of social proof like testimonials, and understanding the endowment effect can all create more committed customers. Nudging tactics highlight the entrepreneurial capability to shape consumer choices, and by anticipating and guiding decisions through psychological understanding, businesses can customize their market approach to garner success. These insights are not intended for manipulation but rather for creating value and better consumer experiences, indicating a sophisticated fusion of economic principles and human psychology to influence and anticipate market demands.

- Episode Website

- More Episodes

- Copyright 2023 All rights reserved.

IMAGES

VIDEO

COMMENTS

In this way, behavioral economics augments standard economic analysis. Behavioral eco-nomics adopts and refines the three core prin-ciples of economics: optimization, equilibrium, 2015). Both traditional and behavioral econo- and empiricism (Acemoglu, Laibson, and List mists believe that people try to choose their best feasible try to choose ...

Essays In Behavioral Economics Benjamin Garry Young A Dissertation Presented to the Faculty of Princeton University in Candidacy for the Degree of Doctor of Philosophy Recommended for Acceptance by the Department of Economics Adviser: Professor Roland B enabou June 2018.

What is a "nudge" in behavioral economics? In behavioral economics, a "nudge" is a way to manipulate people's choices to lead them to make specific decisions: For example, putting fruit at eye level or near the cash register at a high school cafeteria is an example of a "nudge" to get students to choose healthier options. An ...

Advances in Behavioral Economics contains influential second-generation contribu-tions to behavioral economics. Building on the seminal work by Kahnemann, Strotz, Thaler, Tversky, and others, these contributions have established behavioral econom-ics as an important field of study in economics. In this essay, I discuss aspects of the research ...

Behavioral Economics is the study of psychology as it relates to the economic decision-making processes of individuals and institutions. The two most important questions in this field are:

In this essay I show that these arguments have been rejected, both theoretically and empirically, so it is time to move on. The new approach to economics should include two different kinds of theories: normative models that characterize the optimal solution to specific problems and descriptive models that capture how humans actually behave.

Behavioral Economics. Sendhil Mullainathan & Richard H. Thaler. Working Paper 7948. DOI 10.3386/w7948. Issue Date October 2000. Behavioral Economics is the combination of psychology and economics that investigates what happens in markets in which some of the agents display human limitations and complications.