- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Get College Application Fee Waivers

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Learn more about how much college could cost — and, how to afford it:

The total price tag: Cost of attendance

What’s in your budget: Find an affordable college choice

Funding options: Federal vs. private student loans

What you’ll pay after graduation: Calculate monthly student loan payments

The price of applying to colleges can add up fast, but getting a college application fee waiver can help.

Students and their families should expect to pay an application fee ranging from $35 to $60 for each college they apply to. Registering for the SAT test costs $60, and the ACT costs up to $93.

» MORE: How to make an affordable college choice

And that’s just the bare minimum. Many students go on campus visits, enroll in pricey college admissions test prep services and take the ACT and SAT multiple times in pursuit of stellar scores, adding even more costs to applying to college.

In many cases, you have to front these costs in order to apply to colleges. But if you can prove that you have a financial need, there are ways to get around some of them. Here’s how.

» MORE: How many colleges should I apply to, by application fee?

Student loans from our partners

on Sallie Mae

4.5% - 15.49%

Mid-600's

on College Ave

College Ave

4.07% - 15.48%

4.09% - 15.66%

Low-Mid 600s

12.9% - 14.89%

13.74% - 15.01%

5.24% - 9.99%

5.49% - 12.18%

on Splash Financial

Splash Financial

6.64% - 8.95%

4.07% - 14.49%

5.09% - 14.76%

4.11% - 14.3%

6.5% - 14.83%

1. Ask for ACT and SAT fee waivers

Costs related to college applications start with standardized testing fees.

You can get up to two SAT fee waivers and four ACT waivers, allowing you to take each test multiple times for free. To get either, talk to your high school college or guidance counselor. Each test company allocates only a certain number of waivers to each high school, and it’s up to the school’s counselors to distribute them based on need.

There are several ways to qualify. You may be eligible if you:

Live in a foster home or public housing or are homeless.

Are in a free or reduced-price lunch program or qualify for one based on your family’s income.

Receive public assistance, including Medicaid or food stamps, or are in a government program for low-income families, such as Upward Bound.

» MORE: How to pay for college

2. Request college application fee waivers

The SAT fee waiver is a gift that keeps on giving: In addition to letting you take the test for free, it also lets you skip the application costs for as many colleges as you need. If you get an SAT waiver, the College Board will send you application waivers in the fall of your senior year or when you get your SAT test scores.

» MORE: 3 reasons to choose a college based on price

If you didn’t get an SAT waiver, there are other ways to potentially get those application fees waived. You can request some application fee waivers directly through the college application, or apply for a fee waiver from the National Association for College Admissions Counseling (NACAC).

Many college applications have a field where you can indicate that you want to be considered for a fee waiver. If a school’s application doesn’t have a fee waiver option, try the NACAC fee waiver request form. In both cases, you need to qualify based on your financial situation — the requirements are similar to the ACT and SAT waiver requirements. Your high school counselor may also need to verify that you have financial need, either electronically or with a signature.

However, there’s no guarantee that you’ll be able to get a fee waiver or that a college will honor it if you do; each campus can use its own discretion.

» MORE: Is college worth it? Here's how to do the math

3. Find colleges with no application fee

Not all hope is lost if you can’t get a fee waiver. Some colleges give out codes for a free application to students who attend certain college fairs or visit the school’s campus. And many colleges simply don’t charge application fees at all. For example, it’s free to apply to Carleton College in Northfield, Minnesota; Kenyon College in Gambier, Ohio; and Reed College in Portland, Oregon. The College Board has a list of colleges with no application fee and colleges that accept fee waivers.

Many schools accept the Common App , a standard application which can be used to apply to more than 1,000 colleges. About half of all schools that accept the Common App don’t require an application fee, according to a 2023 NerdWallet analysis. The Common App also allows you to be considered for a fee waiver.

4. Ask the college to waive the fee

If all else fails, it doesn’t hurt to directly ask the college to waive an application fee. Call the admissions office yourself or ask your high school counselor to help advocate in your favor.

In your request, explain that paying the application fee would create a financial hardship for you or your family.

As you’re thinking about your college applications, start thinking about financial aid too. Fill out the Free Application for Federal Student Aid, known as the FAFSA , to open the door to grants, scholarships, work-study opportunities and federal student loans.

On a similar note...

Choose Your Test

Sat / act prep online guides and tips, how to get a college application fee waiver: 3 approaches.

College Admissions

Most college application fees fall in the $40 to $50 range, with some costing as much as $90 (ahem, Stanford). For many students and their families, these fees present a serious obstacle along the already pricey path to college. If application fees are burdensome to you, you might qualify for college application fee waivers.

Just like SAT and ACT fee waivers, these college fee waivers allow you to send off your applications for free. This guide will go over how you can qualify for and use college application fee waivers; it'll also review how much college apps usually cost and how much you can save with fee waivers.

Here's the information we're going to be covering:

How Much Do College Applications Cost?

How to qualify for college application fee waivers.

- Common Application

- Coalition Application

- Alternative Fee Waiver Forms

How Do You Use College Application Fee Waivers?

This article is pretty hefty, so you might want to read through a few sections at a time and keep it bookmarked to use a reference, rather than trying to plow all the way through!

College applications cost, on average, around $50. Especially selective schools, such as NYU, Boston University, Harvard, Yale, and of course the pricey Stanford, ask for $75 or more. If you apply to just five of these expensive private schools, then you're already looking at application fees of more than $375!

Some public schools are less expensive; University of Arkansas and Michigan State University both have application fees of $40. Other schools are even cheaper with application fees of just $25 or $30. There's also a good number of schools to which you can apply for free !

But unless you're applying to primarily fee-free schools, the costs of applying can seriously add up, especially if you're looking at eight or more colleges.

Fee waivers can be a huge help, but they aren't available to everyone. Generally, fee waivers are only given to students and families who qualify. This can include international students as well. Read on to learn whether you're eligible!

First off, it merits saying that your fee waivers are actually fee waiver requests . Ultimately, each of your colleges must approve your request. For the most part, colleges will approve them if you have your school counselor's or another designated official's signature.

If your colleges have any doubts or questions, they might ask you to send along extra information demonstrating that you qualify—but this is rare. Mostly, this fee waiver process is done on the honor system. It's up to you and your counselor to determine whether you're eligible, so be sure to take a look at the criteria below.

There are a few criteria that must apply for you to be eligible for fee waivers. They're actually the same guidelines that apply to getting an SAT or ACT fee waiver . If you already got an SAT or ACT fee waiver, you should automatically be eligible for college application fee waivers. If you're using the Common Application and/or the Coalition Application , or your admission test of choice was the SAT, then the process should be especially easy.

Let's go over the qualifying guidelines . If any one of the following is true for you, then you qualify for an application fee waiver:

- You're enrolled in or eligible for the Federal Free or Reduced Price Lunch program

- Your family income meets the Income Eligibility Guidelines set by the USDA Food and Nutrition Service*

- You're enrolled in a program that aids students from low-income families, such as Upward Bound

- Your family receives public assistance

- You live in federally subsidized public housing or a foster home, or you are homeless

- You're a ward of the state or an orphan

*For most states, the Income Eligibility Guidelines are as follows:

Note that international students may be eligible for college application fee waivers as well, usually as long as they meet at least one of the criteria above.

So if you already got an SAT or ACT fee waiver or are eligible based on the criteria listed above, how do you go about obtaining your college fee waiver?

First, you'll need a shovel, some gloves, and a sturdy pair of shoes ...

How Do You Get College Application Fee Waivers?

The easiest ways to get your hands on application fee waivers don't involve archaeological adventures, unfortunately. Instead, you'll find it fairly simple to get an application fee waiver if:

#1: You're applying to colleges with the Common Application, and/or #2: You're applying to colleges with the Coalition Application, and/or #3: You took the SAT with a fee waiver

If none of these scenarios applies to you, then you might be able to get an alternative fee waiver form. (For instance, students who took the ACT and are applying to a non-Common App and non-Coalition App school might need to find these other forms.) If you have trouble obtaining any form at all, you can simply fax, mail, or email your college a letter of request.

Since there are a few different options, we'll break it down with instructions for each scenario, starting with students who apply through the Common Application.

Scenario 1: You're Using the Common Application

The Common App streamlines the application process in a number of ways, one of which is asking for fee waivers. You can request fee waivers from any of your Common App schools!

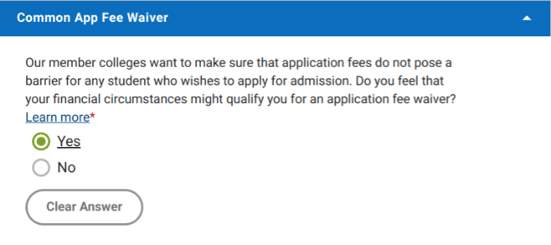

To obtain a Common App fee waiver, you have to meet the same requirements as those described above. In your Profile section , you'll indicate whether or not you qualify for a fee waiver, and then you'll select your reason why. The screen will look like this:

If you select yes, you'll be prompted to select an indicator of economic need:

You'll electronically sign this section and receive the above reminder that your counselor will need to confirm your answer. If you already got an SAT or ACT fee waiver, then your counselor should be able to sign off on this automatically. If not, you might have to provide proof to your counselor that you qualify.

International students follow the same steps listed above. Be aware, however, that it's ultimately up to the school to decide whether they will accept your request for a waiver.

As previously mentioned, many schools use the honor system. As long as your counselor approves, you should be all set. If, for some reason, your school wants to see proof or has decided to deny your fee waiver request (this is rare!), they will contact you. If you don't hear from them, then everything should be good to go.

If your schools request a hard copy, they might accept a number of forms. The easiest would be a College Board fee waiver form , which you'll get automatically if you already took the SAT with a fee waiver. If you didn't, you can access other similar forms. I'll describe the different options below, starting with the College Board's application fee waivers.

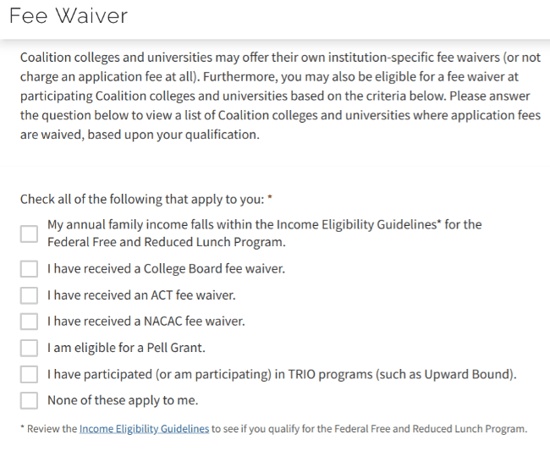

Scenario 2: You're Using the Coalition Application

Like the Common Application, the Coalition Application streamlines the college fee waiver process to make it easier for you to get one each time you apply to a school.

To qualify for a fee waiver, you need to answer "yes" to at least one of the "Fee Waiver" questions, which are located in the "Profile" section of your MyCoalition account (and should be filled out as you make your account) .

Here's the page and questions you'll see:

After you check off the boxes that apply to you, you will be shown a list of Coalition App schools that will waive their application fees based on the answer(s) you selected. Here is what this list looks like, for example, when you check off "I am eligible for a Pell Grant" (note that you can scroll through this list of schools):

Once it's been determined that you're eligible for college application fee waivers, nothing more is required of you. Your counselor will receive your request for a fee waiver , and their approval will then be sent to the colleges you apply to through the Coalition App.

After your fee waiver request has been approved, you will just bypass the payment screen each time you apply to a college.

Scenario 3: You Took the SAT With a Fee Waiver

Maybe you need to send proof of your Common App fee waiver eligibility to a college. Or maybe you're applying to a college that doesn't use the Common App or Coalition App. For whatever reason, you need a separate college fee waiver form.

If you took the SAT with a fee waiver, you'll automatically get unlimited college fee waivers from the College Board (as long as the schools allow fee waivers to be used). These college app fee waivers will be available in your College Board account, where you can view them and—should your college request it—print out and send them to your schools.

If you took the SAT as a senior, you'll be able to access these waivers when your scores become available. If you took the SAT as a junior, however, you'll have to wait until the fall of your senior year.

You can also search for schools that accept application fee waivers or download this PDF of all the colleges that accept fee waivers to see whether your schools of interest allow you to use a waiver.

You also might need to use alternative forms if you didn't take the SAT and therefore didn't get any College Board waivers. Let's take a look at what these alternative fee waiver forms are.

Scenario 4: You Need Alternative Fee Waiver Forms

Fortunately, there are a few other forms you can use if you're applying to a school not on the Common App or Coalition App and you didn't get an SAT fee waiver.

You can always call admissions offices and ask for their advice on getting a fee waiver (always recommended, as colleges like to set unique policies). Your first stop, though, should be your high school counselor's office. Your counselor will have these forms so you don't have to go tracking them down yourself. Plus, you'll have to get his or her signature of approval anyway.

There are two main forms your counselor may distribute: the ACT waiver or the NACAC waiver. There used to also be a less common form that was sent directly to qualifying students called the " Realize Your College Potential" waiver. These forms are all pretty similar, but let's break each of them down so you can see where to find them and how to use them.

The ACT, Inc. Fee Waiver

Unlike the College Board, ACT, Inc. doesn't automatically grant its test fee-waiving students application fee waivers. However, it does have a fee waiver program! You can learn about the ACT fee waiver program on the ACT, Inc. website and find a copy of the fee waiver form on page 79 of this ACT User Handbook for Educators .

This form is like most of the others: it asks for your basic information, such as your name, address, and high school, as well as your and your school official's (likely your counselor) signatures. You'll also indicate the college to which you're applying.

While the form doesn't clearly specify, it's probably safe to assume that you should only use this form if you took the ACT and, of course, qualified for an ACT fee waiver. However, you're not limited to this ACT waiver. You should use whichever form your counselor offers or your college requires.

The NACAC Fee Waiver

NACAC provides a useful fee waiver request form and a page of FAQs to help students. It's similar to the Common App page and the ACT waiver: it requires your basic information and asks you to specify an indicator of economic need. Y ou'll also need your counselor or designated school official to sign it. Any student can use this form, regardless of the admission test they took. Just remember that NACAC recommends limiting your use of its fee waiver requests to four colleges.

International students who can justify their economic need can also use the NACAC fee waiver form. To fill out the form correctly, international students should check the “Other Request” box in the Economic Need section of the form and write an explanation of their financial barriers to paying the application fee in the space provided. NACAC provides more information about fee waivers for international students on their FAQ page .

Individual College Fee Waivers

For most students in most scenarios, these forms, or a combination of them, should work to get their application fees waived. However, there are always unique circumstances that stand outside the typical process.

If you still have questions, contact the admissions offices of your prospective colleges. Find out whether they accept fee waivers and whether they prefer a specific form or simply a letter.

Some schools might suggest that you write and then mail, fax, or email a letter of request. Harvard , for instance, accepts Common App waivers, Coalition App waivers, and other waiver forms but also welcomes a personal letter if you can't obtain those forms for some reason:

"We are committed to making the application process accessible for all students. If the admissions application fee presents a hardship for you or your family, the fee will be waived. You can request a fee waiver directly through the Common Application or the Coalition application if you meet their respective indicators of economic need. If you do not meet these indicators, please fill out our Admissions Application Fee Waiver Request Form . This form is only open during the admission application period (August through March 1)."

Regardless of the form you use, the requirements are essentially the same: each form represents a request and usually asks for your basic info, signature, counselor's signature, and an indicator of economic need. Rarely do you have to provide supporting documentation, but you should have it on hand just in case.

Now that you have a sense of which fee waivers to use and how to get them, is there anything else you need to know about how to use them?

Don't worry, many colleges don't even ask to see your fee waiver!

We touched on this briefly, but let's review how to submit application fee waivers whether you're using the Common App, the Coalition App, a College Board waiver, or a different form.

How to Use Common App Fee Waivers

If you're applying through the Common App , all you have to do is indicate that you'll be using a fee waiver on your profile page , as pictured above, and give your reason. Your counselor will then be prompted to approve your request.

Both domestic and international students may apply for fee waivers this way.

If you already got an SAT or ACT fee waiver, you shouldn't have to do anything else since your counselor will have already double-checked your eligibility. If you didn't, then you might need to provide them with some supporting documentation , such as proof of income eligibility.

All Common App schools should accept fee waiver requests. For instance, here's what Cornell says:

"The Common Application will automatically send your fee waiver request to your high school counselor for confirmation. No additional documentation is needed after your counselor has approved your request."

Many colleges share this stance, though they reserve the right to ask for more info if they deem it necessary (more likely to happen if you're an international student).

If your college asks for more information, then you might have to fax or send your fee waiver form or whatever else they ask for.

How to Use Coalition App Fee Waivers

Coalition App fee waivers are pretty easy to use. All you need to do is make a MyCoalition account , go to your "Profile" section, and click "Fee Waiver" (pictured above) to check the boxes that apply to your situation and to determine which Coalition App colleges you can get a fee waiver from.

You don't need to submit documentation or proof of your eligibility, unless on the off chance your counselor won't approve your request without specific documents. If you've already gotten a fee waiver from the College Board or ACT, Inc., you shouldn't need to send in any other forms.

Most, if not all, Coalition App schools should accept fee waiver requests. For example, here's what Notre Dame says about fee waivers on its website:

"Your school counselor will receive notice of your intent to use the Fee Waiver, and will then need to verify that you meet the eligibility criteria outlined by the Common Application or Coalition Application. Once eligibility is confirmed, the Common Application or Coalition Application process will bypass the payment step."

The majority of colleges share this view, but they still have the right to ask for further info or documentation if they feel it's necessary.

How to Use College Board Waivers

Your College Board fee waivers will have a personalized code for you. If you're applying to a school that's not on the Common App or Coalition App, then it will likely ask you to enter this code or upload a scanned copy of your waiver in its online application.

If you used an SAT fee waiver, you should be familiar with this process. SAT registration also involves entering your personalized fee waiver code.

If you're applying by mail or if the college asks for an original hard copy, you'll want to send this signed form along with your application.

How to Use Other Fee Waiver Forms

If you're using an NACAC or ACT, Inc. form for non-Common App and non-Coalition App schools, you won't get a personalized code. In most cases, you'll be asked to upload a scanned copy of the signed form to your application. Again, if you're applying by mail or the school wants an original hard copy, you should mail this form.

If the school needs any more information, it will contact you and let you know. To prepare for this possibility, you should give them a call and ask about the process. A few colleges, like many in the California State system , only accept requests from in-state residents.

There are more than 2,000 colleges that approve fee waiver requests—you just have to figure out how your prospective colleges want you to submit your request.

Everyone's path to college is different. Similarly, there are several different options for requesting application fee waivers, some straightforward and others a little more complicated. To make sure you've got your bases covered, let's summarize the most important things to remember for students who want to waive the fees for applying to college.

What to Remember About College Application Fee Waivers

If and only if you're eligible, you can get your college application fees waived. All these college fee waiver forms constitute requests— ultimately, it's up to your colleges to approve your request.

For most schools, you shouldn't run into any roadblocks. It's probably safe to say most colleges welcome as many applications as they can get. The more applications they receive, the more selective they can appear to be!

The eligibility guidelines are much the same as they are for SAT and ACT fee waivers, with the most common being a certain yearly family income and/or being part of the Federal Free or Reduced Lunch program. If you already got a testing fee waiver, then your counselor can approve your college app request without any further input from you. If not, then you might have to show your counselor documentation that proves your eligibility.

Common Application and Coalition Application schools offer the easiest processes. For schools not on the Common App or Coalition App, you might need to enter your code and/or upload, fax, or mail your College Board, ACT, or NACAC fee waiver forms. A handful of schools only approve in-state residents' requests, so be sure to do the research on your prospective colleges.

If all else fails, simply send a request, signed by yourself and your counselor, to your college. Mail or fax this letter, and if you don't hear back from your college, give them a call and ask whether it was accepted. You might also be able to just email your request if the school allows it.

Hopefully, fee waivers remove any financial hardship standing in the way of your applications to your favorite colleges. Of course, all the colleges to which you apply should be ones you'd really like to attend !

What's Next?

Another huge step in college financial planning has to do with financial aid. Check out this guide that breaks down all the steps you need to take to apply for various kinds of financial aid. You can also learn in-depth about preparing your FAFSA application.

If you're still picking out your colleges, you might be considering tuition cost as a factor. Check out these colleges that offer the best financial aid .

Remember to apply for scholarships as well! Our list of the easiest scholarships to apply for is a great place to start.

Rebecca graduated with her Master's in Adolescent Counseling from the Harvard Graduate School of Education. She has years of teaching and college counseling experience and is passionate about helping students achieve their goals and improve their well-being. She graduated magna cum laude from Tufts University and scored in the 99th percentile on the SAT.

Student and Parent Forum

Our new student and parent forum, at ExpertHub.PrepScholar.com , allow you to interact with your peers and the PrepScholar staff. See how other students and parents are navigating high school, college, and the college admissions process. Ask questions; get answers.

Ask a Question Below

Have any questions about this article or other topics? Ask below and we'll reply!

Improve With Our Famous Guides

- For All Students

The 5 Strategies You Must Be Using to Improve 160+ SAT Points

How to Get a Perfect 1600, by a Perfect Scorer

Series: How to Get 800 on Each SAT Section:

Score 800 on SAT Math

Score 800 on SAT Reading

Score 800 on SAT Writing

Series: How to Get to 600 on Each SAT Section:

Score 600 on SAT Math

Score 600 on SAT Reading

Score 600 on SAT Writing

Free Complete Official SAT Practice Tests

What SAT Target Score Should You Be Aiming For?

15 Strategies to Improve Your SAT Essay

The 5 Strategies You Must Be Using to Improve 4+ ACT Points

How to Get a Perfect 36 ACT, by a Perfect Scorer

Series: How to Get 36 on Each ACT Section:

36 on ACT English

36 on ACT Math

36 on ACT Reading

36 on ACT Science

Series: How to Get to 24 on Each ACT Section:

24 on ACT English

24 on ACT Math

24 on ACT Reading

24 on ACT Science

What ACT target score should you be aiming for?

ACT Vocabulary You Must Know

ACT Writing: 15 Tips to Raise Your Essay Score

How to Get Into Harvard and the Ivy League

How to Get a Perfect 4.0 GPA

How to Write an Amazing College Essay

What Exactly Are Colleges Looking For?

Is the ACT easier than the SAT? A Comprehensive Guide

Should you retake your SAT or ACT?

When should you take the SAT or ACT?

Stay Informed

Get the latest articles and test prep tips!

Looking for Graduate School Test Prep?

Check out our top-rated graduate blogs here:

GRE Online Prep Blog

GMAT Online Prep Blog

TOEFL Online Prep Blog

Holly R. "I am absolutely overjoyed and cannot thank you enough for helping me!”

What is a Common App fee waiver?

Jul 25, 2023 • knowledge, information.

Common App and our colleges want to make sure that application fees do not pose a barrier for any student. If you meet certain qualifications, you can request a Common App fee waiver.

- You are enrolled in or eligible to participate in the federal free or reduced price lunch program (FRPL).*

- You have received or are eligible to receive an SAT or ACT fee waiver.

- Your annual family income falls within the income eligibility guidelines set by the USDA Food and Nutrition Service.

- Your family receives public assistance.

- You are enrolled in a federal, state, or local program that aids students from low-income families (e.g., GEAR UP, TRIO such as Upward Bound or others).

- You live in a federally subsidized public housing, a foster home or are homeless.

- You are a ward of the state or an orphan.

- You have received or are eligible to receive a Pell Grant.

- You can provide a supporting statement from a school official, college access counselor, financial aid officer, or community leader.

*You must enroll or be eligible for the FRPL. Students who attend schools where all students receive free lunch do not automatically qualify for a Common App fee waiver.

Some of these government programs have websites that are hard to navigate. Please reach out to a counselor or another trusted adult if you're unsure if you qualify.

How do I get a Common App fee waiver?

You can use the Common App Fee Waiver section of your Profile to request a fee waiver. If you select that you are eligible for the Common App fee waiver, you will not be charged any application fees when you submit through Common App.

Can international students use a Common App fee waiver?

International students may be eligible for a Common App fee waiver.

Each college has varying policies, so it is not guaranteed that they will accept your fee waiver request as an international student. If a college does not accept your fee waiver, they may ask you to pay the application fee after you submit your application.

What can I do if I don't meet the Common App fee waiver criteria?

Almost half of all Common App colleges do not charge an application fee. You can use the application fee search filters in the College Search tab to find those schools.

Many colleges also offer a college-specific fee waiver. You can contact colleges directly or look for a fee waiver question on their application in the My Colleges tab.

Does it look bad on my application if I apply for a fee waiver?

Definitely not! Colleges don't want application fees to prevent you from applying to your desired school.

How to Get a College Application Fee Waiver

ASO Staff Writers

Contributing Writer

Learn about our editorial process .

ASO Rankings Team

Updated September 6, 2023

AccreditedSchoolsOnline.org is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

Turn Your Dreams Into Reality

Take our quiz and we'll do the homework for you! Compare your school matches and apply to your top choice today.

The cost of a college education gets a lot of attention these days, and for good reason: Simply applying to college can be an expensive undertaking. There's the cost of standardized tests, the application fee and travel costs for campus visits. Before you know it, you may have to spend $100 or more for each school you apply to. One way to reduce this financial burden is to obtain an application fee waiver.

What is a Fee Waiver?

Most college applications require a fee. The exact amount depends on the school, but the fees commonly hover around $50 to $60. The purpose of the application fee is to help the college or university you are applying to pay for the cost of reviewing your application and making an admissions decision.

The Cost of Applying to College

According to US News & World Report, the average college application fee in 2022 was $45, while $50 was the most common application fee amount. The most expensive schools have fees around $80 to $100, including Stanford University, Duke University and Arkansas Baptist College.

There are colleges that charge no application fee, such as Averett University, Kenyon College and Carleton College. Of the colleges that do charge a small application fee, such as Wofford College, you can expect to pay around $35.

The number of colleges students apply to depends on a variety of factors, such as financial ability and type of decision status a student is applying to. For instance, if you apply during the early decision process and get accepted, you may only apply to one school. But those who strive to get into their preferred schools but want a backup should apply to at least three schools. One school will be their “safety” school, one school will be their “probable” school and one will be their “reach” school. For students who obtain a fee waiver or can afford to apply to more schools, applying to six or 10 schools isn't uncommon. A student who applies to 10 schools (two safety schools, two probable schools and six reach schools) can easily spend over $500 on application fees, assuming no fee waivers were used.

Other Costs of Applying to College

At a minimum, students will need to spend around $55 for the SAT or ACT and another $12 to have their standardized test score sent to the college they are applying to. If the student intends to mail in a paper application, there will also be postage fees.

Students who want to go “all out” can expect to pay a few hundred to a few thousand dollars in test preparation, then there's the cost of an on-campus visit; depending upon how far you live from the school, this might be the cost of driving across town or the cost of a round-trip plane ticket and hotel room.

Which Students Qualify for Fee Waivers?

Fee waivers are generally given to students who demonstrate financial need. However, some schools will allow any student to avoid paying the application fee if they meet certain requirements, such as making an official on-campus visit.

For students who request a fee waiver based on financial need, the exact requirements to qualify will depend on the waiver process the student is using. For example, some schools have their own fee waiver application process. However, students can expect a fee waiver if they receive government assistance based on their participation in programs for low-income families.

Popular Online Programs

Learn about start dates, transferring credits, availability of financial aid, and more by contacting the universities below.

How to Get a Fee Waiver

There are several methods by which students can obtain college application fee waivers. Many of these will require students to complete a separate application process for each waiver.

The College Board's SAT fee waiver

Students eligible for the College Board's SAT testing fee waiver will automatically be eligible for four college application fee waivers. Students are eligible for SAT testing fee waivers if they are enrolled in the National School Lunch Program, have a family income that falls within the Income Eligibility Guidelines , are enrolled in a government program for low-income students, are a member of family that receives public assistance, are living in federally subsidized public housing or living in a foster home, or are homeless, a ward of the state, or an orphan.

Apply online

Many colleges will waive the application fee if you apply online. Examples include:

- College of Southern Idaho

- Wesleyan College

- Manchester University

- Washington and Jefferson College

If students prefer not to apply online, they can mail in a paper application, although the regular application fee will apply.

Request one directly from the school based on financial need

Most schools with application fees will allow students to apply for an application fee waiver. The process will differ for each school, but often includes completing a separate form outlining the student's financial situation.

Legacy applicants

A few schools will grant a fee waiver for students who have parents or grandparents that attended and graduated from a particular school. One such school with this policy is Western New England University .

Visit the school

Many schools, such as the University of Pittsburgh , will provide an application fee waiver if you visit the school. The granting of this waiver does not require showing financial need. The exact process will depend on the school. For instance, the University of Pittsburgh application fee waiver requires a campus visit between June15 and August 31. Other schools do not advertise this type of fee waiver, so you may have to contact the admissions office directly and ask for details.

If you are eligible for the ACT test fee waiver , you may also be eligible for the Request for Waiver or Deferral of College Admission Application Fee. The requirements for the ACT test fee waiver are very similar to the SAT test fee waiver.

Simply ask for one

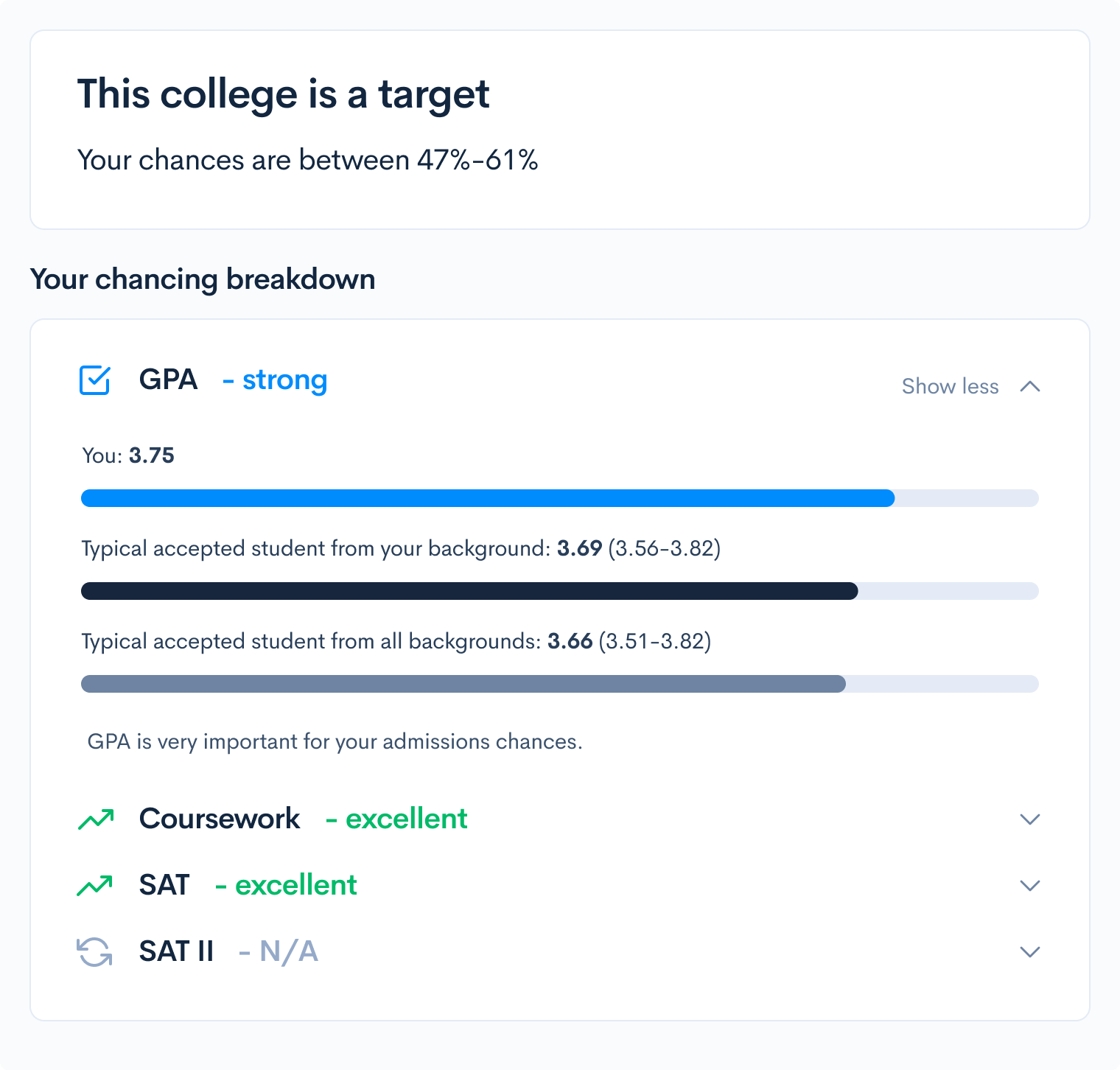

If you are a prized candidate with great test scores and a stellar high school GPA, ask for a fee waiver and you just might receive. This strategy will usually work best when you have numbers well above the average for accepted students.

Apply as an international student

If you're applying as an international student, some schools will waive the application fee. Ithaca College is an example of a college with this benefit.

National Association for College Admission Counseling (NACAC) fee waiver

The NACAC allows students to apply to up to four colleges without having to pay the application fee. A student will be eligible for a NACAC college application fee waiver if they meet the requirements for an SAT or ACT testing fee waiver. While most colleges and universities will accept a NACAC college application fee waiver, not all of them will.

Realize Your College Potential program

High school students in the top 10-15% of their class but bottom third in family income may be eligible to participate in the Realize Your College Potential program, sponsored by the College Board. Eligible students will receive special packets with information about choosing, applying and attending college, as well as application fee waivers.

Special invitation

Students who express interest in a school, such as by providing contact information at a college recruitment fair or considering playing a sport at the school, may receive a special invitation to apply for free. In other instances, the invitation to apply with a waived application fee can be unsolicited.

Avoid the application fee

One way to reduce the costs of applying is to choose schools that don't have an application fee. Some of these schools include:

- Grinnell College

- Centre College

- United States Naval Academy

- Oberlin College & Conservatory

An Expert Discusses Fee Waivers

Dr. michele scott taylor.

Dr. Michele Scott Taylor is the Chief Program Officer at College Now Greater Cleveland, the nation's oldest college access organization. She is an expert in college access and higher education policy and programming.

Some students fall into the unfortunate position of having too much family income to qualify for a waiver, but still being unable to afford it. What's the best way to ask the admissions office for an exception?

Students should write a special circumstances letter to the admissions representative at the school who is assigned to them. In the letter, the student should explain their personal situation and the difference between how things look on paper versus how they actually are in real life. Better yet, if the school is local, the student should go for an in-person interview with their admissions representative to make his or her case. It doesn't work 100 percent of the time, but the majority of the time, talking to someone works. And if the student is a strong applicant, a school usually does try to come through.

If the school itself doesn't offer a fee waiver, what can a student do to get help from other sources?

If a school doesn't offer a fee waiver, a student or family should reach out to the local college access organization (like College Now). There are many college access organizations across the country that work to guide students and families through the college application and financial aid process. Here is a list of college access organizations that are members of the National College Access Network (NCAN): NCAN Membership List .

Another resource is The College Board, which offers up to four free college application waivers to students who are income-eligible to receive an SAT fee waiver.

Popular Resources

Whether you’re looking to earn your online degree or you’re a parent looking for answers, you can find all of your questions covered here. Explore these resources to help you make informed decisions and prepare for whatever is thrown your way.

Shape your future with an online degree

Connect with a community of peers, and find a program that will allow you to continue your education in a fast and flexible way.

- Search All Scholarships

- Exclusive Scholarships

- Easy Scholarships to Apply For

- No Essay Scholarships

- Scholarships for HS Juniors

- Scholarships for HS Seniors

- Scholarships for College Students

- Scholarships for Grad Students

- Scholarships for Women

- Scholarships for Black Students

- Scholarships

- Student Loans

- College Admissions

- Financial Aid

- Scholarship Winners

- Scholarship Providers

Apply to vetted scholarship programs in one click

Student-centric advice and objective recommendations.

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here .

How to Get a College Application Fee Waiver

Lisa Freedland is a Scholarships360 writer with personal experience in psychological research and content writing. She has written content for an online fact-checking organization and has conducted research at the University of Southern California as well as the University of California, Irvine. Lisa graduated from the University of Southern California in Fall 2021 with a degree in Psychology.

Learn about our editorial policies

Bill Jack has over a decade of experience in college admissions and financial aid. Since 2008, he has worked at Colby College, Wesleyan University, University of Maine at Farmington, and Bates College.

Maria Geiger is Director of Content at Scholarships360. She is a former online educational technology instructor and adjunct writing instructor. In addition to education reform, Maria’s interests include viewpoint diversity, blended/flipped learning, digital communication, and integrating media/web tools into the curriculum to better facilitate student engagement. Maria earned both a B.A. and an M.A. in English Literature from Monmouth University, an M. Ed. in Education from Monmouth University, and a Virtual Online Teaching Certificate (VOLT) from the University of Pennsylvania.

College applications looking pricey? Luckily for you, if you meet just a few general eligibility criteria and demonstrate financial need, you may qualify for a college application fee waiver at the colleges you apply to! Keep on reading to find out what college application fee waivers are, how you can get them, and how to use them!

What is a college application fee waiver?

Great question! Simply, college application fee waivers allow you to apply to colleges without having to pay the usual fee. These are very beneficial as applying to colleges can be expensive and serve as a barrier to applying for some students. Before we get into common eligibility requirements for college application fee waivers, let’s go over the cost of college applications.

How much do college applications cost?

College applications vary in price by school. On the higher end if the $100 and over application fees for elite schools. On the lower-end, some applications are in the $30 range, and some are even free. Thus, applying to many (or even a few) colleges can be quite costly. This is where college application fee waivers come in. If you sense that applying to colleges will be a burden for you or your family, consider college application fee waivers. So, let’s get into it!

Do I qualify for a college application fee waiver?

Good question! First, knowing whether you qualify for fee waivers is of utmost importance. So, don’t waste any time applying in case you don’t meet the eligibility requirements.

So, what are the criteria to qualify? Well, they’re actually the same as those needed to get a fee waiver for the SAT or ACT. In fact, if you’ve already gotten a fee waiver for one of those exams, you’re automatically eligible for college application fee waivers! However, for those who haven’t received a fee waiver for one of those exams yet, let’s review the criteria.

If any of the following are true for you, you qualify for a college application fee waiver:

- You’re eligible or enrolled in a Federal Free/Reduced Price Lunch Program

- Your family meets the USDA’s Food and Nutrition Service Income Eligibility Guidelines , which are as follows (for most states):

- You’re enrolled in a program which helps students from low-income families (e.g. Upward Bound)

- Your family gets public assistance

- You live in federally subsidized public housing, live in a foster home, or are homeless

- You’re an orphan or a ward of the state

Once again, you only need to meet a single one of those criteria, and you qualify! International students are also eligible for these fee waivers, typically so long as they meet at least one of the criteria.

Now, let’s go over how you go about getting your fee waivers. Even for those of you who’ve already qualified for fee waivers when taking the SAT or ACT still have to go through the process of obtaining the college application fee waivers, so, let’s get into how you would do that.

How can I get college application fee waivers?

There’s a number of ways you can get college application fee waivers, as universities are unique and have different fee waiver processes. However, some of the easiest ways to get college application fee waivers are:

- If you’re applying to schools on the Common Application

- Whether you’re applying to schools on the Coalition Application

If you took the SAT with a fee waiver

Keep in mind, if none of these apply to you, don’t worry! These are not the only ways to obtain college application fee waivers, as you can also request alternate fee waiver forms. Or, if you have trouble getting access to these forms online, you can also directly contact your prospective schools by email and ask for one.

Now, let’s get into the specifics! Keep on reading to find out how to get fee waivers on the common app, coalition app, and other common ways of requesting fee waiver forms.

While filling out college applications

On both the Common and Coalition Applications, there are questions which will ask you to select which college application requirements (yes, the ones we went over earlier!) apply to you. The processes are slightly different for each application, though, so we’ll go over the steps now.

Common Application: Steps to obtain a fee waiver

- In your “Profile” section, indicate whether or not you qualify for a fee waiver (click “Yes” or “No”)

- If you click “Yes”, you will be prompted to answer why you qualify (this is where you select which eligibility requirement(s) applies to you!) and will be asked to enter your signature

And that’s it (just don’t forget to hit “continue” or “submit”)! Keep in mind, though, that your counselor may also have to confirm your answer. If you have already received a fee waiver for the SAT or ACT, your counselor should be able to sign automatically. However, if this is not the case, you may need to provide additional proof to your counselor that you qualify for a fee waiver.

After your counselor approves, you should be all good to go! In the very rare case that your school wants additional proof or denies your request, they will contact you directly.

International students: all the above steps should be the same for you as well!

Coalition Application: Steps to obtain a fee waiver

- When making your Coalition Application account , you will be prompted to select which of the fee waiver eligibility requirements apply to you once you reach the “Profile” section

- Once you select which requirements apply to you, you will be shown a list of Coalition Application schools that will waive their application fees according to the answer(s) you selected

Then, you’re done! Your counselor will receive a request for your fee waiver, and if they approve, it will be sent to the colleges you’re applying to through the Coalition Application.

Once this is done, whenever you apply to a college on the Coalition Application, you will be able to skip the payment screen.

If you’ve already taken the SAT with a fee waiver, you’re in luck! Doing so makes you automatically eligible to receive unlimited college application fee waivers from College Board, so long as the schools you’re applying to allow the use of fee waivers. These fee waivers are available in your College Board account, where they can be viewed and printed (if you need to send them out to colleges).

If you took the SAT with a fee waiver yet are unable to find the fee waivers in your College Board account yet, it may be because you’re in the wrong grade. These fee waivers only become available in your senior year. So, if you’re currently a junior, just wait until the Fall of your senior year, and you should be good to go!

Didn’t take the SAT? Don’t worry – There are alternate fee waiver forms available!

Getting alternative fee waiver forms

In the case that you’re not applying to colleges through the Common or Coalition Application and haven’t taken the SAT, there are other ways of getting fee waiver forms.

If you’re in this situation, we recommend you first head to your counselor’s office. They likely have the forms themselves or can print them for you, and you’ll end up needing their signature anyway.

The two forms they’re most likely to hand to you are the ACT, Inc. and NACAC (National Association for College Admission Counseling) fee waiver form.

ACT, Inc. Fee Waiver

ACT, Inc., unlike College Board, does not automatically give application fee waivers to its students who received a test fee waiver.

Although somewhat buried on the site, page 85 of this ACT User Handbook for Educators provides a fee waiver form for students who qualified for an ACT fee waiver. It asks you to fill out some information about yourself, including your name, address, high school, as well as your own and your counselor’s (or school official’s) signature. You will also need to note which university you’re applying to.

Note: Qualifying for a fee waiver on the ACT does not mean that this is the only fee waiver form you can use! Feel free to use whichever your counselor has on hand or whichever your prospective college(s) will allow.

NACAC Fee Waiver Form

Like the Common Application page and the ACT fee waiver request form, the NACAC fee waiver form also requests some basic information and asks you to specify which indicator(s) of economic need applies to you. After filling this in, you will need your counselor or a school official to sign off on these forms (in non-COVID times).

The NACAC form can be used by any applicant, no matter what standardized test they took. However, NACAC recommends that students only use their form for a maximum of four colleges. It is unclear whether or not international students can use this form.

If you need help filling out the NACAC fee waiver form or run into any issues, NACAC provides its own helpful FAQ for any questions you may have while filling it out.

Individual college fee waivers

If, by chance, your prospective college(s) do not allow any of the fee waivers we’ve listed out so far, there are other ways you can go about getting your application fees waived.

If this happens to you, you should first contact the colleges directly (through email, calling, etc.) and ask (1) if they accept application fee waivers and (2) what type or form of fee waiver they would prefer.

Although uncommon, some universities allow applicants to write a letter of request for a fee waiver instead of filling out a form. In your letter, you should include: why you want to attend that university, your future goals, your financial situation (the hardships that would qualify you for a fee waiver), your family’s annual income, how many people live in your household, and contact information for both yourself and your counselor.

How can I use my college application fee waivers?

Now, for the most important part – putting your fee waivers to use! The processes differ depending on what platform you’re using, so we’ll go over each individually.

However, first, it is important to note that fee waivers are fee waiver requests – and that it is up to each school to approve of your request. Luckily, colleges will typically approve of these so long as you have the signature of a counselor or another designated official.

Colleges may sometimes ask you for more information or proof that you qualify, but this is uncommon. The fee waiver process is largely based on an honor system, in which schools will take your word for it if you and your counselor deem that you’re eligible for a fee waiver.

Common Application fee waivers

The process is SUPER simple on the Common App! All that you need to do is go to your “Profile” page and indicate that you’ll be using a fee waiver. Then, you simply need to give your reason why, submit, and your counselor will be reminded to approve of your request.

Yes, this is the same process we mentioned earlier (under “How Can I get College Application Fee Waivers”), so you may have already done it at this point.

If your counselor approves, you’re good to go (for both domestic and international students)!

Similarly, if you’re already eligible for fee waivers as you qualified for an SAT fee waiver, you shouldn’t have to do anything else (your counselor has probably already checked your eligibility for that waiver).

All schools on the Common App should accept fee waiver requests, and typically don’t request any additional information after your counselor has approved. If they do, however, want more information, they will contact you directly (this is more common for international students).

Now, on to the Coalition App!

Coalition Application fee waivers

Just like the Common Application, these steps are the same as the ones we went over earlier (under “How Can I get College Application Fee Waivers?”)! If you need a refresher, simply set up your MyCoalition account, head to your “Profile” section, and check the boxes of the eligibility requirements that apply to you.

You likely won’t have to submit additional proof of your eligibility unless your counselor happens to request something. If you’ve already qualified for a fee waiver for the SAT or ACT, you also shouldn’t need to send in any additional forms.

Most colleges on the Coalition Application accept fee waiver forms, so you should be set once your counselor approves of your request.

College Board fee waivers

College Board fee waivers are unlike any of those previously mentioned, and give students a personalized code. If you’re applying to any schools that aren’t on the Common or Coalition Application, you will likely be asked to either (1) enter this code or (2) upload a scanned copy of your fee waiver form on your application.

When your college(s) require you to apply by mail or ask for a hard copy, send the signed fee waiver form with your application.

Have questions about the College Board fee waiver or are unsure if your college(s) accept them? Check out these helpful tools from the College Board itself:

- College Application Fee Waiver FAQ

- Search for Colleges that Accept (any) Application Fee Waivers – this also tells you which colleges you can apply to for free and if a college has any special instructions for accepting fee waivers!

- Directory of Colleges that accept the College Board fee waiver

Other fee waivers

If using a NACAC, Act, Inc., or any other alternate fee waiver form, you will likely be instructed to upload a signed copy of the form to your application (if your school(s) don’t request a hard copy).

If you have any questions about the fee waiver process at a particular school, we recommend giving them a call. Alternatively, if they have any more questions for you, they will likely contact you.

We should also note that some schools, though not many, only accept fee waivers from certain students. For example, many of the universities in the California State system only allow fee waivers for in-state students.

That just about covers it! Now, you should know everything you need to know about getting college application fee waivers. We wish you luck on your college application process, and more specifically, your college application fee waiver process. Have fun at college!

Keep reading:

- When should I apply for college?

- Scholarships360’s scholarship directory

- Top scholarships for high school seniors

- How to choose a college

- Finding a financial safety school

Frequently asked questions

Can i get a fee waiver for graduate school, are fee waivers guaranteed once i apply for them, can i get a fee waiver for multiple colleges, scholarships360 recommended.

10 Tips for Successful College Applications

Coalition vs. Common App: What is the difference?

College Application Deadlines 2023-2024: What You Need to Know

Trending now.

How to Convert Your GPA to a 4.0 Scale

PSAT to SAT Score Conversion: Predict Your Score

What Are Public Ivy League Schools?

3 reasons to join scholarships360.

- Automatic entry to our $10,000 No-Essay Scholarship

- Personalized matching to thousands of vetted scholarships

- Quick apply for scholarships exclusive to our platform

By the way...Scholarships360 is 100% free!

How to get college application fee waivers

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Personal loans

- • Debt relief

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Students experiencing economic hardship often find it difficult to cover the cost of college application fees. The College Board recommends that students apply to five to eight colleges and universities to guarantee acceptance, but this can add up to $250 to $400, since most application fees are close to $50 each.

Costly application fees may initially deter students from applying to certain institutions, but college application fee waivers allow qualifying students to apply to college for free.

How to get a fee waiver for college applications

There are a few different ways to find fee waivers for college applications.

SAT and ACT fee waivers

Qualifying for SAT and ACT fee waivers automatically qualifies you for unlimited college application fee waivers through the College Board and on the Coalition, Common and Universal Applications.

Low-income high school juniors and seniors are eligible for the SAT fee waiver if one or more of the following conditions applies:

- Student participates in or is eligible for participation in the federal National School Lunch Program (NSLP).

- Student’s family’s annual income is within the United States Department of Agriculture (USDA) Food and Nutrition Service Income Eligibility Guidelines .

- Student is enrolled in a federal, state, or local program providing aid to students from low-income families.

- Student’s family receives public assistance.

- Student is homeless or lives in a foster home or federally subsidized public housing.

- Student is an orphan or ward of the state.

Most of the time, you don’t need to complete any extra information to get an SAT or ACT fee waiver; your school counselor will identify eligible students and distribute waivers from there. If you haven’t gotten a waiver and you need one, talk to your guidance counselor.

NACAC fee waivers

The National Association for College Admission Counseling (NACAC) offers fee waivers to those with an economic need. You’ll need to apply for these waivers using an online form that can be either printed or saved as a PDF. Once you complete the form, it must be signed by a school counselor, postsecondary support personnel, a principal at your school or an official from a community-based organization. From there, you’ll send the form to your college’s office of admissions. Students are encouraged to limit the number of forms sent to four.

While the NACAC lists basic eligibility criteria, you may qualify by getting a specific request from a principal, guidance counselor, financial aid officer or another similar official who can vouch for your circumstances.

College financial aid office

If you don’t meet the eligibility criteria for fee waiver programs, it’s worth reaching out to the financial aid offices of the colleges you’re applying to. Some colleges are willing to waive the application fee if you reach out directly and explain your circumstances.

Who qualifies for a college application fee waiver?

Most fee waivers require demonstrated financial need. If you don’t have any financial concerns or issues paying for college applications, you probably won’t be eligible for fee waivers. In general, waivers are available to:

- Students who currently or have previously gotten free or reduced lunch.

- Students who are enrolled in a government program for low-income families.

- Foster children.

- Residents of subsidized housing or students experiencing homelessness.

- Students in families with annual incomes that qualify for the U.S. Food and Nutrition Service.

- Students who receive public assistance.

If you don’t qualify for a waiver based on need, you could have a high school or college official vouch for you, saying that the application cost would cause financial hardship.

What happens if you don’t qualify for a fee waiver?

If you don’t qualify for a college application fee waiver, you can still try to limit the amount you have to spend to apply for schools. For one, you can narrow your search to schools that don’t charge you to apply; PrepScholar maintains a list of colleges without application fees that you can reference as you begin your search.

You can also curate your list of colleges to avoid applying to more than you need to. Research approval statistics and financial requirements beforehand to limit your applications to the top schools that you’re truly invested in and likely to be admitted to. Although the College Board recommends applying to five to eight schools, you can adjust this number as needed.

Bottom line

The cost of attending college doesn’t just include tuition, books and housing. Application fees are one of the first college expenses you will have, and they can get to be expensive. Although some institutions no longer charge application fees, including the University of Wisconsin System, which eliminated application fees for all but four of its schools, many colleges and universities expect this fee to be paid before an application is reviewed. Luckily, students can rely on application fee waivers to give them the chance to attend the school of their choice.

Related Articles

10 ways to attend college for free

Tuition waivers: What to know and how to qualify

How to pay for college with scholarships

How to afford out-of-state tuition

- Meet Lynnette

- Advertiser’s Disclosure

- Money Coach University™

- Write for us

Disclosures

How To Get College or Grad School Application Fees Waived

- By: Lynnette Khalfani-Cox, The Money Coach

College application season is upon us.

That means high school students, transfer students, and would-be graduate students all across the country will be busy during the months of November and December polishing their college applications.

Many college applications cost $50 and up, meaning if you or your child applies to 10 different schools, you could quickly shell out $500 just for the chance to attend the college or university of your choice.

In another article, I described in detail how to get a college application fee waiver based on economic need .

But that’s just one strategy.

A fee waiver will let you apply at no cost to your desired college or university, saving your hard-earned money for other needs.

As I explain in College Secrets for Teens: Money-Saving Ideas for the Pre-College Years , students can get fee waivers for college applications in eight ways.

The eight college application fee waiver strategies are:

- Get a fee waiver based on economic need

- Get a fee waiver for being a great student

- Get a fee waiver for visiting campus or going to a college fair

- Get a fee waiver for applying to or attending a “Fly-In” program

- Get a fee waiver for exceptional circumstances

- Get a fee waiver for service activities

- Get a fee waiver for applying early

- Get a fee waiver for being a child of a veteran or a college employee

Here’s an overview of each one of these strategies and how they can help you save hundreds of dollars in college application costs.

Get a Fee Waiver Based on Economic Need

Suppose you need a waiver to submit a college application. In that case, you can get one from one of three sources: the National Association for College Admission Counseling (NACAC), the College Board (which administers the SAT), and the college or university where you want to apply.

Generally, you may qualify for an application fee waiver if your annual household income is about $45,000 or so, assuming a family of four. However, qualifying income levels can be more or less than that figure, depending on the number of people in your household.

You can obtain a NACAC fee waiver, called a “Request for Waiver of College Application Fee” form , from your high school counselor.

How to Prove Economic Need for a College Application Waiver

The NACAC form outlines a host of circumstances that make students economically qualified to get waivers for college application fees.

Among those circumstances:

- You are eligible to receive an SAT or ACT fee waiver

- You are enrolled in or eligible to participate in the free or reduced lunch program at school

- Your family income falls within the income Eligibility Guidelines set by the USDA Food and Nutrition Service

- You are enrolled in a federal, state, or local program that aids low-income students (i.e., TRIO programs, like Upward Bound)

- Your family receives public assistance (such as food stamps — nationwide, about 47 million Americans, roughly 15% of all citizens, receive food stamps)

- You live in federally subsidized public housing, a foster home, or are homeless

- You are a ward of the state or an orphan

- Do You face any other challenges that would make paying college application fees a financial hardship

If your school doesn’t have NACAC waiver forms, you can obtain a fee waiver form from the NACAC website .

You can find an online list of schools that accept SAT application fee waivers at the SAT Fee Waiver Directory of Colleges .

Additionally, if you plan to attend graduate school or apply to a professional degrees program — such as law school, business school, or medical school – you can also get fee waivers for your graduate school applications. For example, if you received a fee waiver to take an exam, you typically also qualify for fee waivers for graduate school applications.

Get a Fee Waiver for Being a Great Student

If you’re an academic standout, that status can also offer advantages when it comes to college admissions.

Stellar grades — like ranking in the top 10% of your class — will usually put your college application in or near the top of the pile when you’re applying to most colleges. Great test scores and academic honors get noticed, too, especially if they’re based on nationwide testing.

Fortunately, there’s one other benefit to being a scholarly student. You may find that some schools will reward you by waiving their application fees just to encourage you to apply.

For example, the University of Maryland grants fee waivers for National Merit, National Achievement, National Hispanic finalists or semi-finalists, and Maryland Distinguished Scholar finalists, semi-finalists, and honorable mention recipients.

Other campuses award application fee waivers to students with a certain minimum grade point average, such as a 3.5 GPA or higher or even a 3.0 GPA or better.

If you are an especially high-achieving student, peruse college websites or call the schools you’re interested in and ask whether fee waivers are available for select scholars.

Get a Fee Waiver for Visiting a Campus or Going to a College Fair

Simply visiting campus or attending a college fair may be enough to get you a fee waiver.

Often, college recruiters will pass out particular forms or codes you can use while applying to the school online to take advantage of the fee waiver.

So anytime you take a campus tour or participate in a college fair, don’t simply skip over the materials on the desks. Instead, see whether any of them are fee waivers for applicants.

Get a Fee Waiver for Applying to or Attending a “Fly-In” Program

Certain “Fly-In Programs” offer application fee waivers to students who attend early recruitment programs.

One example is the Future Achievers of Science and Technology, or FAST Programs, at Harvey Mudd College.