CLIENT LOGIN HOURS OF OPERATION

- Debt Consolidation

- Debt Management

- Debt Settlement

- Credit Card Debt Forgiveness

- Debt Consolidation Programs

- Military & Veteran Debt Relief

- Credit Counseling

- Online Bankruptcy Classes

- Housing Counseling

- Foreclosure Prevention Counseling

- Eviction Prevention Help

- Credit Card Debt

- Student Loan Debt Relief

- Family Finances

- Credit Scores & Credit Reports

- Getting Out of Debt with Bad Credit

- Financial Literacy

- Financial Help

- Tools & Resources

- Budgeting Tips

- Military Money

- Hours of Operation

- Client Success Stories

- Partner With Us

Advantages and Disadvantages of Owning a Home

Home » Housing » Homebuyer Education » InCharge Guide to Homeownership » Advantages and Disadvantages of Owning a Home

Buying a home is the biggest financial decision many people make. As with any major decision, a key question to answer before proceeding: Why?

Perhaps your why is a larger home to raise children, have a yard, move into a better school district or get your new home office for remote work. There is no right or wrong answer, merely the best one that fits each individual circumstance.

“There is an emotional side to home ownership, particularly in the United States – it’s often baked into people’s vision of the future or part of the American dream,” said Tom Figgatt, president of Portolan Financial in New Orleans. “And it does feel good to own your own house; you can feel like it is a home and not just a temporary dwelling.”

The benefits of home ownership come with costs and limitations. For some, renting may be a better option. Consider the pros and cons of buying a house as you think through the process and before you make a decision. You can also read our homeownership guide to help you through your process.

The average sales price of a house in the United States hit a high mark in 2022 ($547,800), according to the Federal Reserve Bank of St. Louis, which tracks housing costs. The market was a boon for sellers, but rising interest rates slowed demand and lowered prices. Anyone who wants to buy a home will find lower prices but also higher borrowing costs.

» Learn more: First-Time Homebuying Course

Pros and Cons of Owning a House

Before you make the major financial investment of buying a house, make sure you’re the type of person that is right for ownership. Are you someone who likes to take care of the yard and can provide some do-it-yourself maintenance? Do you relish the idea of re-shaping a house to your idea of an ideal home?

Or are you someone who likes the idea of someone else (a landlord) paying for any upgrades and being responsible for any major expenses, such as paying for a new roof, upgrading the plumbing and putting in new floors?

Here is a summary of pros and cons to consider as you ponder buying a house.

Pros & Cons of Owning a House

What Are the Advantages of Owning a Home?

Historically, the biggest advantage of owning a home is long-term financial security. For decades, home ownership in America represented stability because the housing market almost always went up in value, rewarding homeowners with equity and also a way to borrow money, should the need arise.

But there are intrinsic advantages as well, such as control. If your family grows, you have the power to add a bedroom or bathroom to your house. Or expand the kitchen. Or widen your driveway to accommodate more cars as your family grows. There are also tax benefits and other financial benefits to home ownership.

A Good Long-Term Investment

According to the Federal Reserve Bank of St. Louis, the average U.S. home price grew a staggering 80% from 2012 to 2022. For many homeowners who opted to sell during the past decade, the market growth provided remarkable equity. History shows a constant fluctuation of overall home prices and even periods of decline or flatness. Homes can lose value, but it doesn’t happen often. Long-term, housing is an investment sector that rarely disappoints.

Low-ish Interest Rates

No longer are interest rates at rock bottom. In a move to stave off inflation, the Federal Reserve consistently hiked the prime interest rate to nearly 8%, a level not seen since 2007. But it’s a long way from the highs of the 1980s (12-13%). Besides, rates for borrowers vary depending on credit score and where you are buying.

Building Equity

Your equity is the difference between what you can sell the home for and what you owe. Equity grows as you pay down your mortgage. Over time, more of what you pay each month goes to the balance on the loan rather than the interest, building more equity.

Federal Tax Benefits

Mortgage interest is deductible on the first $750,000 of the purchase price of the home, as is interest on home equity loans, property taxes up to $10,000 if married ($5,000 if married filing separately) and some closing costs at purchase time. However, the increase in the standard deduction to $27,700 for married couples ($13.850 if single) makes it a little tougher to itemize those interest deductions. Calculating all these numbers prior to purchase will help show what tax benefits you can gain.

Greater Privacy

You own the property, which means you can renovate it to your liking, a benefit that renters don’t enjoy.

Home Office

The work-at-home phenomenon may not vanish after the pandemic fades, which means more of us will need a home office. The right setup makes a difference in comfort and productivity. Those needing that work-at-home space can find it on the market – if they act quickly.

Stable Monthly Payments

A fixed-rate mortgage means you’ll pay the same monthly amount for principal and interest until the mortgage is paid off. Rents can increase at every annual lease renewal. Fluctuating property taxes or homeowner’s insurance can change monthly payments, but that typically doesn’t happen as often as rent increases.

People tend to stay longer in a home they buy, if only because buying, selling and moving is difficult. Buying a home requires confidence that you plan to stay there for several years.

What Are the Disadvantages of Owning a Home?

The disadvantages of owning a home mostly fall into the category of permanence, with a dash of financial uncertainty. Buying a new house costs money, and a lot of that money comes out of your pocket at the time of the purchase. Later, there are no guarantees that home prices will rise. And without a large down payment, it can take years for your home equity to accumulate.

Besides money, owning a home can be an anchor. If the housing market is down, you might not be able to sell or move when you want — or at the price you desire. If you are just starting out in your career and you’re not certain you live in a place where you want to be for a long time, home ownership can be an obstacle to finding a new job elsewhere.

Let’s look at some specifics.

High Upfront Costs

Closing costs on a mortgage can run from 2%-5% of the purchase price, including numerous fees, property taxes, mortgage insurance, home inspection, first-year homeowner’s insurance premium, title search, title insurance, and points, which are prepaid interest on the mortgage. It can take about five years to recover those costs.

Less Mobility

If one of the advantages of homeownership is stability, that means it may take more thought to accept an attractive job offer requiring you to pick up and move to another city. The offset to this concern is the speed with which homes are selling.

Maintenance Costs

Contorting yourself to fit under the kitchen sink to fix a leak is a joy (not) for those who try it the first time. But when you own a home, you are the first line of repair – especially if you want to save money by doing it yourself, Bob Vila style. Some items do need professional attention. If the air conditioner goes out, you’re not only going to sweat until it’s fixed, you’ll also be writing a check to get the cool air flowing again. Some folks enjoy mowing the lawn; others don’t. That, and putting a new coat of paint on the house, trimming the bushes, cleaning the gutters, and shoveling the snow are all part of home ownership.

Equity Doesn’t Grow Immediately

Most of the payments go toward interest in the early years of a mortgage, so you don’t gain equity quickly unless property values in your area skyrocket – and that has happened in many areas in the post-pandemic market. Those who want to build equity faster could apply a small extra amount to their principal each month, provided it fits the budget. Even $20-to-$50 extra every month specifically applied to the loan principal can help.

Property Values Can Fall

That happened during the 2008 nationwide housing crisis, and more local conditions can cause this, too. Your building will depreciate over time, especially if you don’t maintain it.

Continuing Costs

As you try to sell your home, you still have to keep making mortgage payments and maintain it. If you’ve bought another house before selling yours, that means paying for two homes. The post-COVID sales fervor did help sellers unload their property faster, though.

Advantages and Disadvantages of Renting a Home

Home ownership isn’t for everybody, at least not in every stage of life. Before you buy, consider whether it’s right for you now.

Another option is to seek a rent-to-own situation in which you sign a rental agreement for a short period (12, 18 or 24 months) with an option to purchase the property at the conclusion of the lease. In some cases, in exchange for a decision to buy, landlords will agree to apply some of your previous rent payments toward a down payment on the home or give you immediate equity.

Regardless, just as there are pros and cons of home ownership, there are also plusses and minuses of renting.

Advantages of Renting a Home

- Rent payments may be lower: This certainly can be true if you’re renting an apartment, and it also may be the case when renting an identical house. If a mortgage is more than you can afford, renting makes more sense than being stretched too thin financially.

- Repairs aren’t your responsibility: The property owner has to pay for that leaky faucet and anything else that breaks or wears out. So, you don’t have to factor those unplanned expenses into your budget .

- Flexibility: Your obligation to a place you rent can’t exceed the length of the lease, and if the property owner can quickly find a new tenant, that can get you off the hook if you leave before the lease expires.

- Low upfront costs: There is no down payment. Except for a security deposit – often the cost of a month’s rent – you don’t have to write a big check or finance the costs required to get a mortgage.

- No HOA dues: Some homes are in developments with homeowner’s associations that require monthly dues on top of all the other expenses, and they aren’t optional. Not so with renting.

Financial Disadvantages of Renting

- It can be difficult to change the property: Would you like a deck for entertaining? Would you prefer a fenced yard? Want to paint the bedroom a grayish blue? Often there’s little you can do about these issues with a rental. Unless significant changes to the property are explicitly outlined in the lease, you must get the permission from the landlord to address your desires. Landlords sometimes don’t trust tenants to make “improvements.” But sometimes they do.

- You aren’t building value: When you leave your rental, all you take with you is yourself and the furniture and dishes that belong to you. It’s the property owner’s equity that grows, not yours.

- Rent may increase: You may be comfortable with what you’re paying each month, but that could change when your lease comes up for renewal, typically in six months or a year.

- No credit score improvement: While paying a mortgage on time improves your creditworthiness, you don’t get the same benefit from rent.

- No cosmetic improvements: If the home you are renting looks dated, you may just have to get used to it.

Owning vs. Renting

In assessing the pros and cons, Figgatt suggests asking yourself three questions.

- Can you afford it?

“The down payment, closing costs and risk of sudden, very large expenses popping up combine to make it a very expensive proposition,” he said. “You need to save above and beyond your mortgage payment for infrequent yet major household expenses so that you keep it up properly. And making a smaller down payment and paying private mortgage insurance (which protects a lender in case you default on your mortgage) only increases the total cost of ownership.”

- How long do you expect to stay in the house?

“It can be difficult to break even on a house if you stay in it for three years or less; the closing costs and commissions are significant, and expecting the house to appreciate in value enough within three years to make up for those costs may be setting your expectations too high,” Figgatt said. “And remember that your entire mortgage payment does not go towards the home’s equity. During the first year of your mortgage, depending on the terms, perhaps only about 30% of the payments will actually go towards the principal of the home.”

- Why are you looking to buy?

“If you’re looking at the purchase as an investment, it could work out very well, but high fixed costs mean the shorter the amount of time you hold the property for, the less likely you are to come out ahead relative to other investment opportunities out there,” he said. “Constantly buying and selling houses if you move frequently may be eating up wealth, not increasing it. And if you plan to rent the place out after you move, make sure you have a plan for managing the property – be ready to pay for that, too.”

Additional Resources for Deciding to Buy a Home

Big financial decisions can be scary, and you don’t want to be paralyzed into inaction. InCharge Debt Solutions can help you think through the variables so you can decide if this is a smart decision right now.

If credit issues stand in your way, InCharge can help you become a better candidate for a mortgage and save money on your payments. Take the first step by looking into getting credit card debt relief to free up your finances for a home purchase.

A mortgage calculator can help sort through costs and budgets to figure out how much house you can afford . If you’re a renter, check out the rent or buy calculator for similar budgeting calculations.

Online homebuyer education courses can also be a stepping stone for those looking into homeownership. You’ll learn how to prepare for owning a home and get a better understanding of the home purchase process, including how to finance and afford a home for the long term.

Talk to a Professional About Reaching Your Financial Goals

For many people, owning a home is a cornerstone to a life-long financial puzzle. It’s a major life purchase because of the large amount of money needed for the investment.

But buying a house, as with buying a vehicle, investing in a 401(k) and putting money into a college fund, deserves thoughtful consideration before action. It also can require a clean bill of financial health, which requires minimal debt and solid credit.

If you have too much debt to qualify for a home purchase, consider talking to a qualified credit counselor about how to shrink your obligations to make homeownership a reality. A credit counselor can present options to get you to financial freedom — and into a new home.

14 MINUTE READ

Homeownership Guide Menu

- InCharge Guide to Homeownership

- 1. Advantages and Disadvantages of Owning a Home

- 2. Reviewing Your Credit Report

- 3. Make a Budget and Start Savings

- 4. How Much Home Can You Afford?

- 5. What Kind of Help Is Available for a New Homebuyer?

- 6. Home Selection: How Do You Select a Home?

- 7. Who’s Involved in the Buying and Selling of a Home?

- 8. What Kind of Mortgage Should I Get?

- 9. Home Loan Closing: How to Prepare

- 10. Responsibilities of a New Homeowner

- 11. What Happens If I Pay My Mortgage Late?

- Resource Links

- Glossary of Terms

A First Time Guide to Buying a House

Kyle Gill, Software Engineer, Particl

My wife and I wanted to buy a house shortly after we got married in 2021. We told ourselves, “the market is too crazy now” and sat on the sideline until about a month ago when we said “the market is too crazy now” and decided to go buy a house anyway.

The Kyle of yester-year knew about this much 🤏 about buying a home:

- there’s a thing called a pre-approval

- high interest rates are bad

- real estate agents get 6% of the sale price

- and he thought escrow was a style of deli sandwich

I was the village idiot of home buying whenever friends or family were talking about “this crazy COVID housing market”.

I looked up a lot of stuff and talked to a lot of different people, most of them tried to sell me something and I only bought some of those things. I wanted to write up every stupid little detail I could remember that I felt was important as I went through the process for other first time home buyers like me, and perhaps for a future me when the time comes to buy a second home and I’ve forgotten everything.

I was concerned about making the biggest purchase of my life and being played a fool. To make myself an educated buyer, I relied on a lot of ChatGPT and a lot of questions. Here’s my attempt to distill what I learned in one place .

Note: some of this information is only relevant to Utah home buyers, but many other principles and applications remain relevant.

The TL:DR of it all

When it comes to buying a house there are a couple main steps I’d categorize things into:

- Budgeting and saving for a house

- Finding a house

- Paying for a house

- Due diligence

To set some context, here is a big list of definitions of terms put in my own words. Feel free to skip or scan over this, or refer back to it as you read through:

To start with perhaps the most controversial thing in the post COVID era: finances.

1. Budgeting and saving for a house

Before anything else, it’s wise to get oriented on what you can afford.

Because virtually no one has the cash on hand to buy a house outright, you’re almost certainly going to need to get a loan or a rich relative. I didn’t have a rich relative, so I figured I needed to get a loan.

Some common advice I saw to live within your means suggested that your eventual monthly payment should be somewhere in the range of 25-30% of your monthly income. That means if you make $10,000 a month, you should be looking for a scenario where you could expect to pay about $2,500-$3,000 a month.

However , some unexpected advice from a financial advisor I talked to was that a loan on a house lasts 30 years, and during that time, your income will likely go up. So, if you’re making $10,000 a month now, you might be making $15,000 a month in 10 years. Looking through that lens, you may be able to bat a little higher than your league.

In addition, to qualify for a loan, you can get better terms if the following things are you have a stable income, good credit, and save some money for a down payment.

If a house costs $500,000, and you make a down payment of $100,000, you’ll need to get a loan for $400,000. From the day you close on the house (more on that later), you’ll own $100,000 of the house and the bank will own the other $400,000. Over time, that’s what you’re paying off.

In summary:

- save up money to prepare to make a sizeable down payment

- pay off your debts and keep your credit score up

- stable employment will in the process to eventually get a loan

- income goes up over time so you might be able to afford a little more than you think

2. Finding a house

When you feel like you’ve got ample funds and a stable financial situation, it’s time to start looking for a house. There are two main ways to do this: with a realtor or through a builder.

- With a realtor : who can help you find houses to tour in the area and connect with the realtor of normal plain Jane citizens trying to sell their own home

- Through a builder : who can build a brand new house for you, or sell you one they’ve already built which skips some steps

- (bonus) For sale by owner : where you find a house that’s not listed on the MLS and you work directly with the seller

With a realtor

- you can get access to homes that might not be on the market yet because realtors have access to the MLS (sites like Zillow and Realtor.com try to scrape info off the MLS too though)

- they’ll take 3% of the gross sale price on the house you buy (not the net, so if you buy a house for $500,000, they’ll take $15,000), in a weird sort of way, this incentivizes them to encourage you to buy a more expensive house, not necessarily help you get the best deal

- they can help you negotiate with the seller in ways you might not be aware of, like asking for the seller to pay for closing costs, or asking for the seller to pay for repairs

Through a builder

- you’ll have to buy a new house, which means no one else will have lived in it

- you could have to wait for a house to be built, which could take a long time, and during that time the builder is probably going to do what’s best for them financially and not you (time is against you)

- (sometimes) you can customize some things about the house to get what you want, in our case the builders we talked to weren’t willing to do this since they were trying to build houses as fast as possible to meet Utah’s demand

- everything will have to be built to city code, so you won’t have to worry about old house problems and as much stuff breaking

For sale by owner

- I didn’t really look into this cuz it seemed hard, but is an option if you are an educated buyer and know what you’re doing and don’t want to fork over 6% to realtors

Stuff like Homie in Utah is pretty close to this. They’ll help you with the paperwork and things, but you’ll have to do a lot of the legwork yourself.

Used vs New

New homes through a builder sounded nice to us, since we figured it’d probaby mean less stuff like a furnace going out soon. There are some pros to buying a used house like the previous owner having already put in many thousands of dollars of ugrades like cabinets, curtains, and especially landscaping. A new house could be part of an HOA that requires you to put in a lawn yourself.

Where to find homes

If you go through a realtor they’ll probably find and send you homes. Either way you should probably use Zillow, Realtor.com, or Redfin as well. When you find a used home you can reach out to the seller through those sites to tour and visit them, or a realtor can help you with it.

Walking through houses is kind of like a sniff test of “do we like this enough to buy it”? If you really do like it, that’s when you advance into the stage of making an offer and actually paying for it.

Note : At some point during this step, you’ll also need to find a Mortgage Lender, this could be a bank, a mortgage broker (who sends your info a lot of places to find the best rates), or some other institution like a credit union. This is where you get pre-qualified and eventually pre-approved for a loan, which basically means the lender says “we’ll loan you money if you want it”. This will tell you a very high bar for what you could afford, but you should probably still not exceded the 25-30% rule from the previous section.

- you can find a house through a realtor, a builder, or for sale by owner

- you can find houses on Zillow, Realtor.com, or Redfin yourself as well

- you’ll need to find a mortgage lender to get pre-qualified and pre-approved for a loan sometime around this step too

3. Paying for a house

When it finally comes time to pay for a house things get hairy. You can pay with cash or get a loan, since we paid with a loan that’s what I’m going into.

Financing and Refinancing

The term refinancing is thrown around a lot in home buying contexts. Financing and refinancing are basically synonymous, it’s when you get a loan to pay for a house. Refinancing is just when you get a new loan to pay off the first one, in an attempt to get better terms on your loan.

Different types of loans

There are 3 main types of mortgage loans you can get: conventional, FHA, and VA. FHA loans are to help those with less income be able to get a loan, and VA loans are for veterans. Conventional loans tend to be the “default”, and what we got. The typical loan term is 30 years, meaning you’ll be paying off the loan for 30 years.

There are also some other fancy types of loans like Balloon loans, which are 7-8 years, and you then are forced to refinance. Since most people don’t stay in their house more than 7 to 8 years, might be worth looking into these in some cases, but you risk having to refinance at a worse rate.

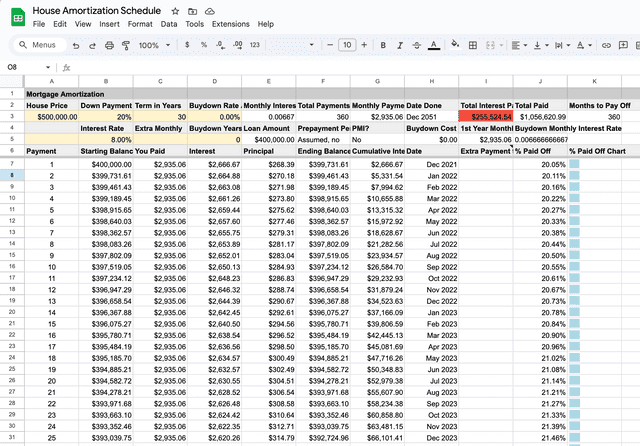

Interest rates and Amortization schedules

Interest rates are the amount of money you pay to the lender for the privilege of borrowing money. The interest rate you get is based on a lot of factors, but the main one is your credit score. The higher your credit score, the lower your interest rate.

People harp and harp about interest rates because they affect how much you pay monthly, and how much you pay in total for your house a lot . Your friend down the road that got a 2% interest rate is bragging about it all the time because well, they got a screaming deal and they probably should brag about it.

Here’s a couple examples for the exact same $500k house. Assuming a 30 year loan, and a 20% down payment, here’s how much you’d pay in total for the house at different interest rates (with numbers rounded):

Note: these monthly payments here are just the mortgage payment, not including other costs like insurance, PMI, HOA, etc.

Look back up at those numbers again and let that sink in. The difference between a 2% interest rate (virtually unheard of) and an 8% interest rate is the difference in paying half a million extra dollars, FOR THE SAME HOUSE .

This is one of the most key things to understand about buying a house. The interest rate you get is a big deal.

You can play out different scenarios if you model payments in an amortization schedule. I found a lot of really crappy, overwhelming ones online, and realized to really understand this stuff I should probably just calculate it myself. So naturally I made a spreadsheet that you too can be overwhelmed by and make your own copy .

Of all the things I did and learned I think learning about these financial scenarios affects the future me the most . Being able to see that if me and my wife pay an extra $300 a month for just the first year , we could save $18,000 in interest over the life of the loan! That’s a lot of money! Definitely, definitely, play around with some tool like this to get an idea of what you’d be paying monthly and where you could save.

The Subtle Benefits of Interest and Principal

One caveat to the above section, is that money paid towards interest can reduce your taxable income. This isn’t helpful to everyone if the standard tax deduction already covers your income (and you don’t itemize your deductions on your taxes).

In that sense, interest expense isn’t all bad.

There’s also the obvious pro that the money that pays down your principal comes back to you when you sell the house.

The Surprisingly Bad Investment of Real Estate

There are plenty of cons to paying for a house and interest though. Everyone who tells you as a renter that you are “just burning money” and “paying for someone else’s mortgage” exclude the fact that you’re rent is more likely only paying down a teeny tiny fraction of your landlord’s principal. 🤷

Under a scrutinizing eye, real estate isn’t always the most amazing investment. TikTok real estate bros will shout “cash flows” from the rooftops, but the reality is that real estate just doesn’t grow as fast as the S&P 500.

You can check out online calculators like this one to see how much money you’d have if you invested in the S&P 500 vs. real estate.

The housing market is weird and volatile these days like the stock market, so gaming or timing it is probably a fool’s errand. If you’re looking for a good investment, real estate is a fine one to help diversify, but it’s not everything others make it seem like.

Earnest money

When you’re serious about a house and you make an offer, you’ll need to put down some earnest money. This is a deposit you make to show the seller you’re serious about buying a house. If you back out of the deal, you’ll lose this money. If you go through with the deal, this money will go towards your down payment. This could range from $1,000 to $10,000 depending on the house and the market.

If you are working with a builder your earnest money will probably just mean you will get the house unless something goes wrong getting a loan. If you’re working with a realtor, the person selling the house needs to accept the offer you’ve made. If they don’t, you’ll get the earnest money back.

Getting a loan

At this point you’ll probably have been pre-approved, and a lender will have given you a letter saying they’ll loan you money. You’ll need to get a loan for the amount of money you need to pay for the house, minus the down payment you’re making.

The lender is going to ask you about a billion questions and require proof you make what you do and you aren’t sending kickback money to a gang of pirates in Somalia. They’ll want bank statements, pay stubs, identification, you name it.

Those documents go to an underwriter, who will look at them and decide if you’re a good candidate for a loan. This process as I understand it has only gotten harder since the 2008 financial crisis when too many people got loans they couldn’t afford.

There are a couple ways you can negotiate with the seller when making an offer. Offering to sign sooner, making an all cash offer, or offering a pagan sacrafice to the real estate gods could all win some favor and award you chances to waive fees or get a better deal.

Typical things that could be offered by the seller are help towards paying closing costs or paying closing costs entirely.

Random Additional Costs

Now a big laundry list of other costs you could have to pay for:

- Washer/Dryer

- New home blinds/curtains

- Closing costs

- Putting in a lawn

- Home insurance

- interest rates are a big deal

- you can play around with amortization schedules to see how much you’d pay monthly and where you could save

- getting a house is a great investment in some lights, but not in others (but at least you get to use the investment! you can’t raise kids in a stock portfolio)

4. Due Diligence

Once you’ve made an offer and it’s been accepted, you’ll need to do some due diligence to make sure you’re not buying a lemon.

Inspections

You don’t have to, but it’s a good idea to get a home inspection. This is a third party that will come and look at the house and tell you what’s wrong with it. They’ll look at the roof, the foundation, the furnace, the water heater, the plumbing, the electrical, and everything else. They’ll give you a report of what they find, and you can use that to negotiate with the seller to fix things or lower the price.

We paid a little under $500 for an inspection, so hopefully we save that money in the long run from the stuff we found.

Even if you don’t get an inspection, you should still take some time to look over everything you can find in the house and point out any problems before you close. This is the only time you’ll have leverage to get the seller to fix things.

5. Moving In

Once you’ve closed on the house, you’ll get the keys and you can move in, then more fun of home ownership begins!

Getting Appliances + Furniture

There are a lot of appliances you need if you are buying a new home. If you are buying a used home, you may replace or need to service some of those appliances. Buying new can require some time for delivery, so be aware of that when planning when you’ll move.

Here’s some stuff we learned about the stuff we had to get:

Kitchen Appliances

- Fridge : the things that make one fridge different than the next:

We got a side by side door with ice maker and water dispenser.

- Oven + Stove : the things that make one oven different than the next:

Cooking aficionados probably prefer the gas stove in most cases.

We got a gas stove.

- Dishwasher : I can’t tell you what makes one better than the next, honestly. I’m sure there are differences but I don’t notice them.

We got some generic GE dishwasher.

- Microwave : Ditto on microwaves.

We got a GE microwave.

Laundry Appliances

- Washer : the things that make one washer different than the next:

We got an LG top load with no agitator.

- Dryer : the things that make one dryer different than the next aren’t much, it’s basically the size of the drum which determines how much clothing you can dry at once. The bigger the drum, the higher the cost.

We got a bigger sized LG dryer.

- Couches : the things that make one couch different than the next:

We got a fabric sectional couch from Ashley Furniture. They pushed back the delivery time on us a couple times, which meant we were living without a couch for a while.

- Mattress : the things that make one mattress different than the next:

We got a King Size mattress, it’s a pain to move, but it’s nice to have extra space so we wake each other up less.

- Dining Table : the things that make one dining table different than the next:

We’re planning on getting an extendable table and haven’t quite decided on the finish or style yet.

Weird Sounds and Tips

Depending on what type of systems you have for heating and cooling, you might hear some weird sounds that no one told you about. Sometimes these are indicative of actual problems, sometimes they’re just normal. You won’t really know which is which until you do a lot of searching the internet and talking to other homeowners.

In our experience, the biggest culprits of weird sounds were:

- our new refrigerator which would occasionally make chugging sounds, and would also drop ice into an ice tray that is a bit loud

- our furnace would make a bang sound that echoed through the air ducts when it kicks on, and again but not as loud when it turns back off

- draining lots of water from a bathtub or running the washing machine, which you can usually hear in the pipes that run along the sides of the house

Best of luck! And may you burn money on someone else’s mortgage no longer! 😉

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Buy a House: 15 Steps in the Homebuying Process

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners .

1. Make sure you're ready

2. get your finances in order, 3. make a plan for the down payment, 4. create a wish list, 5. find the right mortgage for you, 6. get preapproved for a mortgage, 7. find a real estate agent, 8. go shopping, 9. make an offer, 10. get a mortgage, 11. get homeowners insurance, 12. schedule a home inspection, 13. have the home appraised, 14. negotiate any repairs or credits with the seller, 15. close on your new home.

We’ve broken down the homebuying process into 15 main steps: Call it a buying-a-house checklist. Each step includes choices to make and things to do. Some are stressful, some are pretty cool and some are, well, kinda annoying. But each gets you one step closer to your goal of homeownership.

Sure, there's being financially ready to buy a house (see Step 2 for that). But are you emotionally ready ? Even if it's just going to be your starter home, you're making a big financial commitment and putting down some roots.

You'll want to think about your other goals for the next few years. Are you buying with a partner, and, if yes, are you on the same page when it comes to money? Is there any chance you'd need to relocate for work? Are you thinking of starting a family? These big-picture questions can add to the pros (or cons) of whether this is the right time to buy a house .

» MORE: What to expect when you're buying a house

Buying a house may be the biggest financial decision you'll ever make, so before you take the plunge, you want to be sure your finances are solid.

Using a home affordability calculator can help you determine your budget by taking into account your income, debts, location and down payment amount (more on down payments in a moment). You'll be able to see how your monthly mortgage payments might add up and how your finances could look as a homeowner.

This can be important for keeping your ambitions down to earth. You might be able to qualify for a sizable mortgage, but that doesn't mean you actually want to commit that much of your budget to housing.

» MORE: Calculate how much you might be able to borrow

Check your credit score, too. A higher credit score is the single most powerful way to earn a lower mortgage interest rate. Know the mortgage options for your credit score . If your credit score could use some work, it may be worthwhile to hold off on homeownership and see what you can do to build up your score .

When you've determined what you can afford, you can figure out how much you want to save for a down payment . You don’t need to put down 20% to buy a house; many homeowners opt to put down less. A smaller down payment requires less money upfront, but it means you'll have to pay mortgage insurance , which typically increases your monthly payment. The type of home loan you use also helps to determine the minimum down payment required.

If this is your first home or if you haven't owned a house in a while, you may also want to look into state first-time home buyer programs . Many offer financial help, including down payment assistance. And if you have a friend or family member who can afford it, you may also use gift money to increase your down payment. Rules about gift money vary by loan program.

You'll want to set aside money for more than just the down payment. Closing costs generally run from 2% to 5% of the total cost of the loan. It's also a good idea to have some emergency funds in case the home needs unexpected repairs.

» MORE: Use our mortgage calculator to estimate your payments

at Next Door Lending LLC

See, told you there'd be some fun steps! And coming up with a list of must-haves and nice-to-haves for your house is definitely one of them. Whether you’re looking for a starter home or somewhere you can imagine living for years to come, there are lots of little details, but here are some of the bigger decisions you might make when drawing up your list:

Detached house or attached unit? If you're all about having a backyard, a traditional single-family home is for you. But if you're in a more heavily populated area or you don't want to deal with all that maintenance, buying a condo or townhouse might be your best bet. In some cities, co-ops are also an option. They can be less expensive than a condo but a bit harder to finance.

» MORE: Pros and cons of buying a condo vs. a house

What's your ideal location? Assuming you're staying in state and know the general area where you want to live, now it's time to choose a neighborhood. Think about factors such as safety, amenities (like walkability, green spaces or coffee shops) and costs, which can include property taxes and, if it's part of a homeowners association , HOA fees. It's also smart to consider the school district. Even if you don't plan to have children, school quality can affect the home's value — and help or hurt your resale price if and when you choose to sell.

» MORE: What to look for when you're buying a house

Move-in ready or fixer-upper? It doesn't get easier than purchasing a house where all you need to do is move in. But if you're in a pricey or otherwise competitive market, taking on a property that needs TLC may help you afford a larger house or get into a costlier neighborhood. With a fixer-upper , you will need to put in the work — and the cash — to make it livable, so make sure you're up to the challenge.

» MORE: Buy, build or fix? What to consider

The type of mortgage you use to buy a house affects what you'll need to qualify for the loan, including the required down payment amount, and how you'll pay it back. Choosing the right home loan can boost your chances of approval and may save you thousands in the long run.

Before you decide which type of mortgage to pursue, it’s important to learn the advantages and drawbacks of each one. Here are some of the main types of mortgages :

Conventional loans are mortgages not guaranteed by the federal government. They offer low minimum down payments but have more stringent qualifications.

FHA loans are mortgages backed by the Federal Housing Administration. These are generally easier to qualify for than conventional loans but have stricter requirements for mortgage insurance.

VA loans from the Department of Veterans Affairs are for active or former service members and eligible spouses. VA purchase loans allow you to make no down payment.

Jumbo loans are mortgages for houses that are more expensive than standard lending limits. These usually require larger down payments and higher credit scores.

Renovation loans let you wrap the costs of home improvements into the total amount of the home loan. Especially when mortgage rates are low, this can be a way to borrow more money for repairs while paying less interest than you would with another type of home improvement loan, like a personal loan.

NBKC: NMLS#409631

» MORE: Learn how to choose the best mortgage

With each of these loan types, you may have the opportunity to choose between a fixed-rate or an adjustable-rate mortgage, also called an ARM. As you probably guessed from the names, fixed rates are static; adjustable rates can move up or down. An ARM loan can start at a lower interest rate than a fixed-rate loan, enabling you to buy more home for the same monthly payment, but rates can increase — or decrease — over time.

You'll also need to choose the mortgage term. Thirty-year mortgages are the most common, but 10-, 15- or 20-year terms may be available at lower interest rates.

You know your homebuying budget, and you've decided what type of home loan will work for you. Now it's time to start shopping for a mortgage lender . There are lots of lenders out there, including big brick-and-mortar banks with familiar names, online-only nonbank lenders and smaller, local banks and credit unions that may offer more personalized service.

When you look at lenders, determining that they offer the type of loan you want is the first step. (If you've decided on an FHA loan and they aren't an FHA-approved lender, move on to the next one.) But beyond that basic hurdle, you'll want to look at how their sample rates compare with today's mortgage rates , find out what closing costs you’ll be responsible for and compare mortgage origination fees . You'll likely find some of this info right on their websites; to get some numbers, you'll have to speak with a loan officer.

Working with a lender to get preapproved for a mortgage is an important step in accurately determining your budget. A mortgage preapproval will give you real numbers, since the lender will have detailed info about your finances. That includes a hard inquiry , which will show up on your credit report. The good news: If you apply with multiple lenders around the same time, it'll only count as one hard pull — and shopping around may help you find a lower rate.

» MORE: What you'll need for a mortgage preapproval

Pulling together all the documents for a preapproval can be time-consuming. But once you have the documents for one lender, it's easier to apply with others, and what you'll get will be worth it. Along with the preapproval letter stating how much the lender is willing to lend you, you can also get a Loan Estimate form. This form isn't final, but it lets you easily compare lenders' rates, fees and other costs since they all use the same form. A preapproval letter is typically valid for up to 90 days, after which it will need to be updated.

A preapproval letter also shows sellers and real estate agents that you're a serious buyer who can get financing, which can give you a crucial edge over competing home shoppers. You may also have heard of pre-qualification , which traditionally gives you a rough estimate of what the lender might let you borrow based on self-reported data. The terms are sometimes used interchangeably, but a preapproval letter carries more weight, though neither preapproval nor pre-qualification is a guarantee that you'll close the loan.

» MORE: Tips for finding the best mortgage lenders

You've got your preapproval in hand and know what kind of house you're looking for, so let's find someone to help you look. The right real estate agent can make a huge difference throughout the process of buying a house, from knowing the ins and outs of the local market to providing moral support when the search feels endless to helping you negotiate with a seller.

It's a good idea to interview at least three agents. Ask people you know who've recently bought a home whether they'd recommend their agent. However, avoid using the real estate agent who's selling the home you're hoping to buy. You want your own agent who will advocate and negotiate on your behalf.

The buyer's agent is generally paid a commission by the seller, but there are different ways to structure and negotiate compensation. Read the agreement carefully to verify who'll pay in your case.

» MORE: How to track down the right real estate agent

Yes, this step merits an exclamation point. It's time to take scrolling through online real estate listings to the next level and actually see some homes in person. Make the most of your walk-through , since you might only see a home once in person before you make an offer, especially in a hot market . Try not to be thrown off by other home shoppers or by the seller's agent, who may or may not be in attendance.

Take photos with your phone to help jog your memory when you're deciding whether to make an offer. It might be easy to recall that charming breakfast nook or the extra bedroom that would make a perfect home office, but the aging appliances or decking that needs replacement could be out of sight, out of mind. Potential issues can affect the amount you offer or be things to bring up with a home inspector.

» MORE: The case for the 'good enough' home

Found a home that's right for you? Now's the time to make an offer . Your real estate agent can be a tremendous resource here, providing you with comparable sales information and any intel about the sellers they might have gleaned from the sellers' agent, like if they've already found a new place and are extra motivated to sell. You may also want help from a real estate attorney . In some states, a lawyer is required to be part of any real estate transaction.

If the seller rejects your offer, you might make a counteroffer or walk away; it depends on why they turned you down. If the seller counters, talk it out with your agent to decide whether to accept or make your own counteroffer. It's during these negotiations that a buyer's agent really earns their keep.

Offer accepted? Congrats! Now you've got just a few more steps to go. You'll also likely write your first check at this point. Earnest money is a deposit you'll make toward the purchase of the house. It usually goes into an escrow account, and when the sale goes through, most buyers use it as part of their cash to close.

» MORE: Working with your real estate agent to make an offer

You know the property you want to buy and how much you'll have to pay for it. Now you'll choose a lender to get a mortgage from. You can go with a lender that preapproved you, or start fresh with a different one. Even with an online-first lender, you'll often work closely with a loan officer to complete the actual application.

This is a paperwork-heavy process, so get ready to do a lot of uploading. Here's what you're likely to need:

W-2 forms from the past two years (possibly more, if you've changed employers).

Pay stubs from the past 30 to 60 days.

Proof of other sources of income, including documentation of any gift money.

Federal income tax returns from the past two years.

Recent bank statements, usually for the past couple of months.

Details on long-term debts like car or student loans.

ID and Social Security number.

Once your mortgage application is complete, you'll go into underwriting . During this process, the lender makes a final decision on whether to give you the loan; it's basically making sure there's not anything about the deal that's too risky.

Underwriting includes digging deep into your finances, so you may need to come up with even more documents. The lender will also look at the home you've chosen via an appraisal (see Step 13 below) and request a title search .

» MORE: What not to do while you're waiting for mortgage approval

It might feel a little strange to take out an insurance policy on a home you don't actually own yet, but most lenders make securing homeowners insurance a condition of giving you a mortgage. You'll want enough coverage to fully replace the home, which might not be the same as your purchase price or the appraised value, and typically the policy should become effective on your closing date.

» MORE: See our picks for the best homeowners insurance companies

A basic home inspection can raise issues you might face down the road and point out any necessary repairs. This visual assessment covers all aspects of the house and its systems, from the foundation to the roof. If you have a particular concern, like mold or radon, you may want to get one of the more specialized types of home inspections in addition to a standard inspection. And if the home has features such as a pool, septic system or retaining walls, you may want to have these inspected as well.

You should choose the home inspector and pay for the home inspection. If it uncovers problems that weren't included in the seller's disclosures, you may be able to negotiate with the seller (see Step 14).

» MORE: Is it OK to waive the home inspection?

The home appraisal is separate from the home inspection. While the home inspection is for your peace of mind, the appraisal is really for the lender, which doesn’t want to lend you more money than the home is actually worth. An appraisal looks closely at the home you're buying and at comparable recently sold homes to determine the market value of the property.

Your lender will choose the appraiser, but you'll pay for the appraisal. Even if you're buying a house with cash , you may want to consider hiring an appraiser yourself to be sure about your investment.

Though some items, like prorating property taxes or HOA fees, will have been addressed in your offer letter, you may have some items to negotiate before closing.

Your ability to negotiate can hinge on what kind of market you're facing. In a strong seller's market, it can be difficult to get concessions, since the seller can simply go to their next offer. But if it's an issue that will come up with any buyer — for example, a necessary repair that will get flagged by any home inspector — you may have leverage. And in a buyer's market, almost any aspect of the transaction can be negotiated, including having the seller pay some of your closing costs or loan points.

Asking for a credit at closing rather than for the seller to complete needed repairs can help keep the transaction moving. The seller simply rebates you an agreed-upon amount for specific improvements. That can save you a bit of cash at closing, plus handling the repairs yourself (whether DIY or with a pro) ensures the work will be done to your satisfaction.

» MORE: Ways to lower your closing costs

You've finally made it to the last step! Getting familiar with the standard closing documents ahead of time can make the closing process less nerve-wracking.

Your lender must provide you with the closing disclosure at least three days before the actual closing. You can compare it with your Loan Estimate to see whether and how any closing costs have changed. This will let you know how much total cash you’ll need to close.

On or near closing day, you'll do a final walk-through with your real estate agent. You'll probably be buzzing with excitement, but make sure to check that everything’s as agreed upon — for example, that all the appliances that are supposed to be included in the sale are still there.

It's been a whirlwind of emotion and seemingly endless paperwork, not to mention that you may have just written the biggest check of your life, but now you're getting the keys to your new home. Congratulations, you did it!

» MORE FOR CANADIAN READERS: Steps to take before buying a house

On a similar note...

- Search Search Please fill out this field.

- Renting vs. Owning: An Overview

Renting a Home

Owning a home, key differences.

- Renting vs. Owning FAQs

- Home Ownership

Renting vs. Owning a Home: What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/ChristinaMajaski-5c9433ea46e0fb0001d880b1.jpeg)

Renting a Home vs. Owning a Home: An Overview

Buying a home is a huge part of the American Dream . Choosing to buy or rent, though, is a major decision that affects your financial health, lifestyle, and personal goals. Whichever option you choose depends entirely on your lifestyle and financial situation. Both require a regular income (so you can afford the payments and associated costs) and may also require a certain degree of effort to maintain.

But there are several differences that make renting and owning property distinctly different. Renting a property doesn't come with all the responsibilities associated with homeownership and you have more flexibility, as you aren't necessarily tied down to your property. Owning your home gives you a sizeable investment , but it does come at a big cost—both upfront and over the long run.

Owning a home isn’t always better than renting, and renting is not always as simple as it seems. Here, we highlight some of the key differences between renting and buying.

Key Takeaways

- Whether you choose to rent or buy your home depends on your financial situation, lifestyle, and personal goals.

- Both provide you with a place to live and require regular income in order to make the payments.

- Renting offers flexibility, predictable monthly expenses, and someone to handle repairs.

- Homeownership brings intangible benefits, such as a sense of stability and pride of ownership, along with the tangible ones of tax deductions and equity.

- Renting doesn't mean you’re throwing away money every month, and owning doesn't always help you build wealth in the long run.

Investopedia / Alex Dos Diaz

The biggest myth about renting is that you're throwing away money every month. This is not true. After all, you need a place to live, and that always costs money in one way or another. While it's true that you aren't building equity with monthly rent payments, not all of the costs of homeownership always go toward building equity.

When you rent, you know exactly your housing costs each month. This amount is indicated on your lease so you can plan accordingly. In some cases, your landlord may also include other costs within that amount, such as utilities, storage, and homeowner association (HOA) fees if you live in a condominium.

As a renter, you may face rent increases each time your lease is up for renewal. These rent increases can be even steeper if you live in certain parts of town. This may not be the case if you live in an area with rent ceilings and rent control, which limit how much a landlord can increase the rent, if at all.

Renting means you're able to move whenever your lease ends. However, it also means you could have to move suddenly if your landlord decides to sell the property or turn your apartment complex into condos. Less dramatically, they could just bump up the rent to more than you can afford.

Although not as universal as homeowners' insurance, renters' insurance is often recommended (and sometimes required by landlords) for those leasing homes or apartments.

Homeownership brings both tangible and intangible benefits. Not only do you have your own home, but you can make decisions about the look and design of the space, and you also get a sense of stability and pride of ownership.

Keep in mind, though, that changing your mind about where you're living can be very expensive since real estate is an illiquid asset. You may not be able to sell when you want. And even if you do, you may not get it at the price you want, especially if the housing market is down. Even if it’s up, there are significant transaction costs associated with selling your property.

The overall cost of homeownership tends to be higher than renting even if your mortgage payment is lower than the rent. Here are some expenses you’ll be spending money on as a homeowner that you generally do not have to pay as a renter:

- Property taxes

- Trash pickup (some landlords require renters to pay this)

- Water and sewer service (some landlords require renters to pay this)

- Pest control

- Tree trimming

- Homeowners insurance

- Pool cleaning (if you have one)

- Lender-required flood insurance (in some areas)

- Earthquake insurance (in some areas)

Mortgage interest can make up nearly all of your monthly payments in the early years of a long-term mortgage. It can take as many as 13 years before more of your payment goes toward the principal balance in a 30-year home loan. You'll spend about $72,000 in interest for a $100,000 loan at 4% for 30-years. Admittedly, you'll recoup some of that in tax deductions if you can itemize.

And let's not forget repairs and maintenance, which can be very costly. You may find yourself with an unexpected leak in the roof. Replacing your roof could cost an additional $12,000, which may not be covered under your home insurance policy.

Mortgage lending discrimination is illegal. If you think you've been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development (HUD).

Property Values

As noted above, homeownership is often touted as a way to build wealth. But like any other investment, certain factors can positively or negatively affect the value of your home, including:

- Economic issues

- Maintenance

- Environmental concerns, such as nearby landfills and hazardous waste sites

- Outdated interiors

- Exterior conditions (your unruly neighbor's front yard littered with pink flamingos can impact your home value, too)

- Housing surpluses

These factors can, of course, affect you as a renter, too. For instance, negative factors may help lower your rental costs. After all, the landlord may be desperate for income and may end up slashing the monthly price.

Tax Benefits

Homeowners may benefit from certain tax benefits. The home mortgage interest deduction reduces any out-of-pocket expenses during the early life of the loan, as long as deductions are itemized.

Of course, if you rent, you get no mortgage tax deduction at all. Keep in mind, that you can still take the standard deduction that's available to all taxpayers. The same is true for homeowners who don't have enough deductions to itemize individually

Repairs and Maintenance

As noted above, being a homeowner means you're responsible for maintenance and regular upkeep. This can be very costly. And renovation projects don't often increase your home's value by more than what you spend on them. According to Remodeling magazine, project costs continue to outweigh values, with an estimated 60 cents recouped for every dollar spent on repairs and renovations.

If you live in a community with an HOA, it may take some homeownership chores off your plate. That will usually cost a few hundred dollars a month. But beware of the headaches that association membership can entail. If you rent, your landlord will take care of all the repairs and maintenance, though of course they may not be done as quickly or as well as you would like.

The projects that recoup the most are not glamorous things you’ll be excited about doing. The best return (and the only one on Remodeling's list that comes close to recouping its entire cost) comes from replacing a garage door.

Time Commitment

If you like having your evenings and weekends to use as you please, if you work long hours, or if you travel frequently, then the time commitment that comes with homeownership may be more than you want to take on. There are always projects that you will need or want to take care of, from finding a plumber to replacing a rusted-out pipe and repainting the bedroom to mowing the lawn.

After factoring in the costs of homeownership, you may find that renting may make more financial sense, allowing you to invest the money you would have put into a home into a retirement account.

Special Considerations

The decision to rent or own depends on your financial situation. But it's also about your comfort and vision for your future. Ignore people who tell you that owning always makes more sense in the long run or that renting is throwing away money. Disregard anyone who says that buying makes more sense if your monthly mortgage payment is more cost-efficient than your monthly rent payment. Housing markets and life circumstances are too varied to make blanket statements like these.

People were often prevented from owning land because of their race, ethnic background, beliefs, or marital status in the past. This is illegal. Although practices like redlining (where people are denied services because of their race or ethnicity) continue to deter members of minority groups from seeking to own a home, they shouldn't. The borrower's ability to make payments is the only factor that mortgage lenders should consider.

Before you do anything, be sure to weigh the risks involved, especially with buying a home. Getting a mortgage often requires using a large amount of financial leverage . If housing prices go up, people with mortgages can make extraordinary gains. But you also stand to lose if prices plummet. During the subprime meltdown , an unprecedented number of Americans ended up with underwater mortgages . The key is to pay attention to housing prices by looking at the Case-Shiller Index . If prices seem too high, renting for a few years may make more sense.

Still, despite the risk , added expense, and extra chores associated with owning a home, many people choose it over renting. It provides a more permanent place to raise children. It is also frequently the only way to have, or create, the sort of residence people want. Ultimately, the decision to rent or to own is not just financial. It is also emotional.

Is It Better to Rent or Own a Home?

There is no definitive answer about whether renting or owning a home is better. The answer depends on your own personal situation—your finances, lifestyle, and personal goals. You need to weigh out the benefits and the costs of each based on your income , savings, and how you live.

Is Renting Cheaper Than Owning a Home?

Renting can be a very predictable expense. You know what your costs are upfront and can plan accordingly. On the other hand, if you enjoy a lavish lifestyle, you may find renting to be more expensive than owning a home, even if there are repairs and regular maintenance you have to make with purchasing real estate.

Is Homeownership a Good Investment?

Buying a home can be a very good investment. You may be able to build equity. But as with any investment, just how well your investment performs depends on a number of factors. When it comes to real estate, factors like location, the economy, maintenance, and environmental concerns can affect the overall value. And keep in mind, that it's never static, so things can change.

Internal Revenue Service. " Publication 936 (2021), Home Mortgage Interest Deduction ."

Consumer Financial Protection Bureau. " Submit a Complaint ."

U.S. Department of Housing and Urban Development. " Complaints ."

Internal Revenue Service. " Publication 936 (2019), Home Mortgage Interest Deduction ."

Remodeling. " Key Trends in the 2021 Cost vs. Value Report ."

Remodeling. " 2021 Cost Vs Value Report ."

Federal Reserve Bank of St. Louis. " S&P/Case-Shiller 20-City Composite Home Price Index ."

- The Complete Homebuying Guide 1 of 40

- Are You Ready to Buy a House? 2 of 40

- Top 12 House-Hunting Mistakes 3 of 40

- How to Choose the Right Real Estate Broker 4 of 40

- The Differences Between a Real Estate Agent, a Broker, and a Realtor 5 of 40

- Do You Need a Lawyer to Buy a House? 6 of 40

- First-Time Homebuyer’s Guide 7 of 40

- How Millennials Are Changing the Housing Market 8 of 40

- How to Set a Budget for Buying Your First Home 9 of 40

- Financial Tips After Buying Your First Home 10 of 40

- The Hidden Costs of Owning a Home 11 of 40

- Hidden Costs of New Homes That Can Burn Buyers 12 of 40

- Renting vs. Owning a Home: What's the Difference? 13 of 40

- Homeownership as an Investment 14 of 40

- Are There Credits for First-Time Homebuyers? 15 of 40

- Loans for First-Time Homebuyers: How to Finance 16 of 40

- How to Find and Buy Off-Market Homes 17 of 40

- 15 Top Alternatives to Zillow and Trulia 18 of 40

- The Factors of a "Good" Location 19 of 40

- Buying a Foreclosed House: Top 5 Pitfalls 20 of 40

- What To Look for in a Starter Home 21 of 40

- 8 Things to Consider Before Buying a Two-Family House 22 of 40

- Moving Up: Dream House or Money Pit? 23 of 40

- What Is a Home Appraisal? 24 of 40

- Home Appraisal: What it is, How it Works, FAQ 25 of 40

- Buying a Home: 8 Important Seller Disclosures 26 of 40

- Clear Title: Definition and Importance in Real Estate 27 of 40

- Home Warranty: Meaning, Qualifications, Costs 28 of 40

- How to Choose the Best Mortgage for You 29 of 40

- How to Get Pre-approved for a Mortgage 30 of 40

- Pre-Qualified vs. Pre-Approved: What’s the Difference? 31 of 40

- How Construction Loans Work 32 of 40

- Top 6 Mortgage Mistakes 33 of 40

- Best Mortgage Lenders of April 2024 34 of 40

- Down Payment: What It Is and How Much Is Required 35 of 40

- Conditional Offer: Definition, How It Works, and Types 36 of 40

- Bidding War: What it Means, Example, FAQs 37 of 40

- Transfer of Physical Assets (TPA): What It is, How it Works 38 of 40

- 12 Steps of a Real Estate Closing 39 of 40

- 10 Hurdles to Closing on a New Home 40 of 40

:max_bytes(150000):strip_icc():format(webp)/GettyImages-930003386-8477a40f71d2453e86d70b247e43d9d5.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- IELTS Scores

- Life Skills Test

- Find a Test Centre

- Alternatives to IELTS

- Find Student Housing

- General Training

- Academic Word List

- Topic Vocabulary

- Collocation

- Phrasal Verbs

- Writing eBooks

- Reading eBook

- All eBooks & Courses

Housing Essays

by Tam Nguyen

In some countries, most people prefer to rent their homes rather than buying them. What are the advantages and disadvantages of renting a home? Purchasing a house is getting more expensive as it is a part of human needs. While some people prefer to rent their homes rather than owning them, there are some drawbacks to consider. This essay will discuss some advantages and disadvantages of renting a house. One of the best benefits of just renting a property would be, in my view, job requirements in which you occasionally need to move to a whole another city to keep working at a certain position. When it comes to looking for a place to live, renting a house for a reasonable price should definitely be considered as your company may change your department again. Another reason for not buying a house is the high prices which a huge number of individuals are not able to afford. Unless you worked and saved half of your salary for about 15 years, it is nearly impossible to buy a home. However, homeowners are not always predictable. When someone rents a house it will be inevitable to be kicked out of the house, because your homeowner decided to sell the house instead of renting it. Moreover, they might not always be comfortable, when you have some relatives or friends over. For instance, I recently rented a home, and the homeowner warned me that he would not allow me to invite my girlfriend to the house, as he thought it was inappropriate. To sum up, In my opinion, considering advantages outcome disadvantages in terms of renting a home, when left with a choice, it is a better option to not squander one's money on buying a house.

Building Homes in the Countryside Essay

by Yami (Saudi Arabia)

In many places, new homes are needed, but the only space available for building them is in the countryside. Some people believe it is more important to protect the countryside and so new homes should not be built there. What is your opinion about this? these days, with the great expansion of cities and population, many people are considering building houses in places outside cities, like the rural areas. While many people are saying it is a bad idea, I believe it is a great thing for people to do so with many merits that I will elaborate more about. first of all, constructing new houses in the countryside has a crucial benefit in regard to the financial aspects. with this said, the expansion of the population will force many individuals with low economic status to go and live in the rural areas due to the low prices of owning a home there. to give an example for this, if owning a single room in city costs around fifty thousand dollars, with the same price tag you can buy a four bedroom apartment. thus, it is a better option for those who wants to save money. going to my second point, I would like to say that it is better for individuals to build houses there to enjoy the beautiful wonders of mother nature. nowadays, many individuals tend to choose to go out and have a great time while they are enjoying the natural beauty of the countryside. Occasionally, people construct houses there just to live there temporarily during holidays and leisure time. finally, despite many people claiming that constructing new homes may cause damage the countryside environment, with strict laws and spreading awareness , one can easily manage to keep the environment clean. in conclusion, many people at present focus solely on the negative aspects of building a home in the countryside while ignoring many great benefits someone might harvest from such investment like the financial and enjoying a great view there.

Owning or Renting a Home Essay

by Khang Cao (Vietnam)

In some countries, owning a home rather than renting one is very important for people. Why might this be the case? Do you think this is a positive or negative situation? Everyone needs food to eat, water to drink and a shelter to settle in. In the past, owning a home was a symbol of wealth, success and stability. However, as the modern civilisation advancing, the mindset has changed a lot. Nowadays, there are some people thinking that having a house is no longer important as it was in the past. Generally speaking, renting a house is a rising trend these days, but why there are still people assuming that renting a house is nothing compared to having one? In many Asian countries, there has always been an invisible pressure put on men since they were born. Those can be academic achievements, success in career via various ways such as being in the top of a school, having a high-paying job or obviously, owning a private accommodation. Because of the conservative ideology, Asians usually consider a house is an indicator of prosperity and high-tier social status, not only for themselves but also for their families and children. Moreover, people usually want to claim ownership, and this is not new throughout human history. Take colonies, for example, people always desire something that they can have absolute control over it. While a rent house may not satisfy your demand because you have minimal rights to do anything you want with it. As mentioned above, renting a house has some certain disadvantages. Firstly, it is definitely not a long-term investment even though you can avoid mortgage deposit and other taxes, but you will be under the supervision of the landlord all the time. For example, you cannot renovate or redecorate your home at all without the landlord’s permission. Next, if you choose this type of housing, you may take risk of being moved multiple times due to limited vacancies or property sale from the landlord. Last but not least, since the proprietor is in charge, he or she might suddenly raise the rent, and that is a really big issue when you are in the condition of insufficient finance. Bottom line, possessing a house is better than renting one. Although you may have to be responsible for repairs, remodelling or pay land-related additional fees, it is yours and always be. No matter what happens to you, remember there is always a home awaiting you to come back. (380 words)

Before you go...

Check out the ielts buddy band 7+ ebooks & courses.

Would you prefer to share this page with others by linking to it?

- Click on the HTML link code below.

- Copy and paste it, adding a note of your own, into your blog, a Web page, forums, a blog comment, your Facebook account, or anywhere that someone would find this page valuable.

Band 7+ eBooks

"I think these eBooks are FANTASTIC!!! I know that's not academic language, but it's the truth!"

Linda, from Italy, Scored Band 7.5

IELTS Modules:

Other resources:.

- All Lessons

- Band Score Calculator

- Writing Feedback

- Speaking Feedback

- Teacher Resources

- Free Downloads

- Recent Essay Exam Questions

- Books for IELTS Prep

- Student Housing

- Useful Links

Recent Articles

Decreasing House Sizes Essay

Apr 06, 24 10:22 AM

Latest IELTS Writing Topics - Recent Exam Questions

Apr 04, 24 02:36 AM

IELTS Essay: English as a Global Language

Apr 03, 24 03:49 PM

Important pages

IELTS Writing IELTS Speaking IELTS Listening IELTS Reading All Lessons Vocabulary Academic Task 1 Academic Task 2 Practice Tests

Connect with us

Copyright © 2022- IELTSbuddy All Rights Reserved

IELTS is a registered trademark of University of Cambridge, the British Council, and IDP Education Australia. This site and its owners are not affiliated, approved or endorsed by the University of Cambridge ESOL, the British Council, and IDP Education Australia.

Essay on Buying A House

Students are often asked to write an essay on Buying A House in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Buying A House

What it means to buy a house.

Buying a house is when you choose a place to live and pay money to own it. It’s a big step because it’s usually very expensive and means you plan to stay there for a long time. People often save money for years to buy a house.

Choosing the Right House

When picking a house, you look at how big it is, where it is, and if it has what you need, like enough rooms. It’s important to visit many houses to find the best one for you.

Paying for the House

Most people don’t have enough cash to buy a house outright, so they get a loan called a mortgage. This means they pay back a little bit every month for many years.

Final Steps

Before you get the keys, you need to check the house carefully and agree on the price. Then you sign papers to make it officially yours. It’s exciting to finally have a place to call home.

250 Words Essay on Buying A House